Our team of PhDs created a data-driven and time-tested approach for carefully managing your money.

Our investment philosophy incorporates our observations, our academic research, and our real-world experience since 2006.

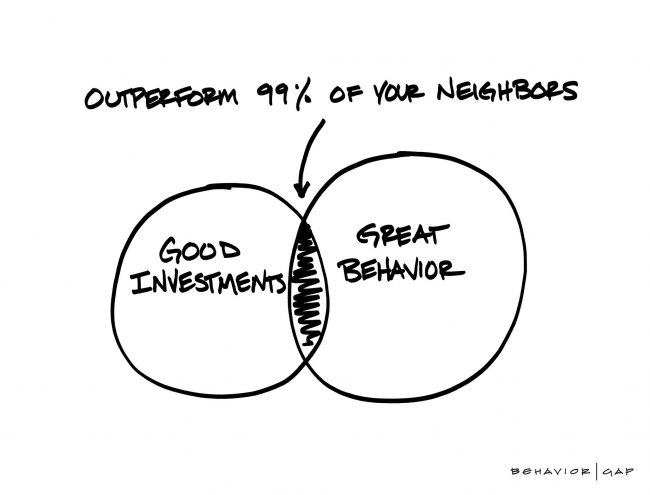

Our experience has been that successful investing is goal-focused and planning-driven, while most of the failed investing we’ve observed was market-focused and performance-driven. We mustn’t doubt that we will get more opportunities to practice the same patience and discipline in the years to come. As Warren Buffett says, successful investing is simple but never easy.

Another way of making the same point is to tell you that the really successful investors we’ve known were acting continuously on a plan — tuning out the fads and fears of the moment — while the failing investors we’ve encountered were continually (and randomly) reacting to economic and market “news.”

Most of our clients are working on multi‑decade and even multi-generational plans for such great goals as education, retirement, and legacy. Current events in the economy and the markets are in that sense distractions of one sort or another. For this reason, we make no attempt to infer an investment policy from today’s or tomorrow’s headlines, but rather align clients’ portfolios with their most cherished long-term goals.

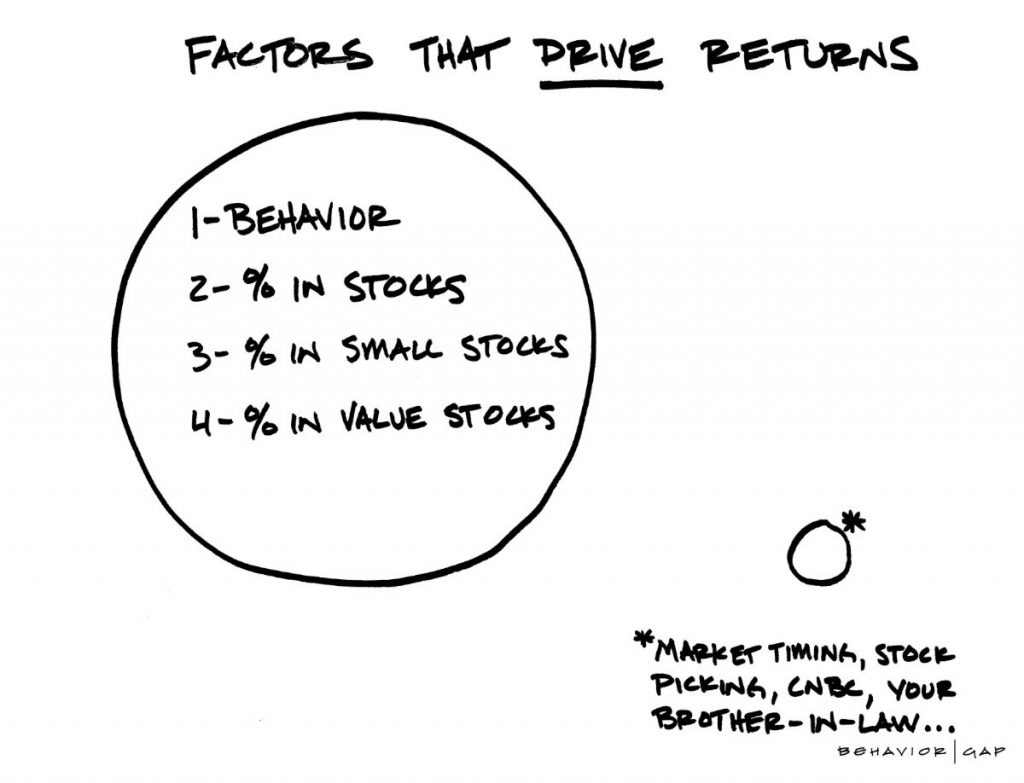

We don’t forecast the economy; we make no attempt to time markets; and we cannot — nor, we’re convinced, can anyone else — consistently project future relative performance of specific investments based on past performance. In a nutshell, we’re planners rather than prognosticators. We believe our highest value services are planning and behavioral coaching — helping clients avoid overreacting to market events both negative and positive.

Our essential principles of portfolio management in pursuit of our clients’ most important goals are fourfold:

Our essential principles of portfolio management in pursuit of our clients’ most important goals are fourfold:

(1) The performance of a portfolio relative to a benchmark is largely irrelevant to financial success.

(2) The only benchmark we should care about is the one that indicates whether you are on track to accomplish your financial goals.

(3) Risk should be measured as the probability that you won’t achieve your financial goals.

(4) Investing should have the exclusive objective of minimizing that risk to the greatest extent practicable.

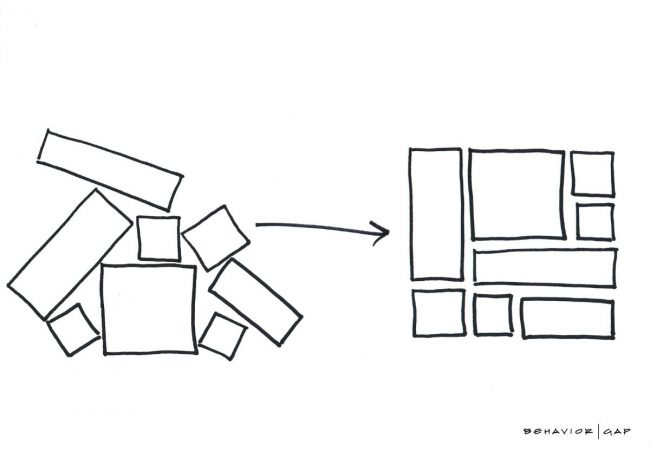

Once a client family and we have put a long-term plan in place — and funded it with the investments that seem historically best suited to its achievement — we very rarely recommend changing the portfolio beyond its systematic rebalancing. In brief, our principle is: if your goals haven’t changed, don’t change the portfolio. Our unscientific sense is that the more often people change their portfolios, the worse their results become. We agree with the Nobel Prize-winning behavioral economist Daniel Kahneman when he said, “All of us would be better investors if we just made fewer decisions.”

The nature of successful investing, as we see it, is the practice of rationality under uncertainty. We’ll never have all the information we want, in terms of what’s about to happen, because we invest in and for an essentially unknowable future. Therefore we practice the principles of long-term investing that have most reliably yielded favorable long-term results over time: planning; a rational optimism based on experience; patience and discipline.