Weekly Market Review ~ Friday, 09/28/12

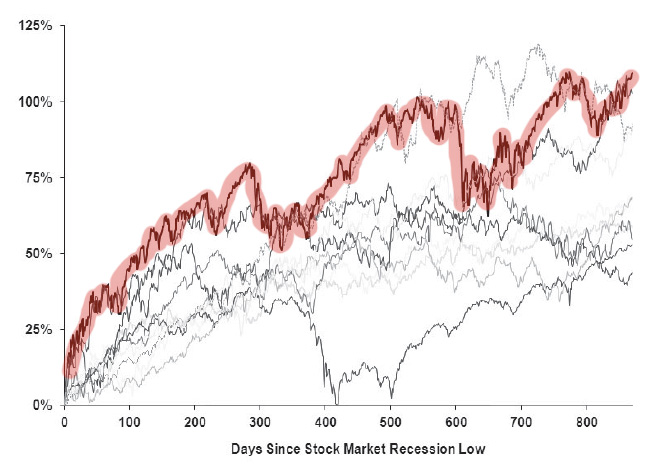

The major indexes experienced modest losses on Monday despite a positive manufacturing index report, as investors focused more on uncertainty over European banking policy. On Tuesday the S&P 500 suffered its worst daily loss in three months after a Fed official stated that the recent QE3 bond-buying program would be ineffective at stimulating the economy. Sour sentiment also resulted from Caterpillar lowering its long-term profit growth outlook. On Wednesday stocks fell once again following a report that August new home sales fell against expectation. Thursday brought a break from the recent downturn, as the market rebounded markedly as positive economic news out of Spain and China lessened this week’s negative attitude among investors. The week, month, and quarter ended on Friday unceremoniously with another loss as investors fear that Spain’s credit rating might be downgraded to junk status.

The major indexes experienced modest losses on Monday despite a positive manufacturing index report, as investors focused more on uncertainty over European banking policy. On Tuesday the S&P 500 suffered its worst daily loss in three months after a Fed official stated that the recent QE3 bond-buying program would be ineffective at stimulating the economy. Sour sentiment also resulted from Caterpillar lowering its long-term profit growth outlook. On Wednesday stocks fell once again following a report that August new home sales fell against expectation. Thursday brought a break from the recent downturn, as the market rebounded markedly as positive economic news out of Spain and China lessened this week’s negative attitude among investors. The week, month, and quarter ended on Friday unceremoniously with another loss as investors fear that Spain’s credit rating might be downgraded to junk status.

[table id=82 /]