Sir Isaac Newton: Monumental Scientist, Terrible Investor

Most people recognize Sir Isaac Newton as one of the most influential scientists of all time, but did you know he was a horrible investor?

Most people recognize Sir Isaac Newton as one of the most influential scientists of all time, but did you know he was a horrible investor?

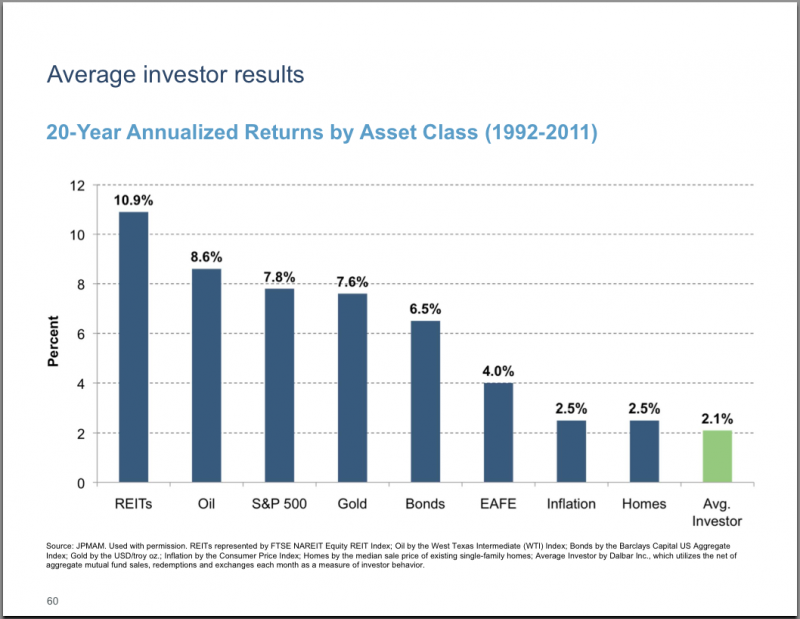

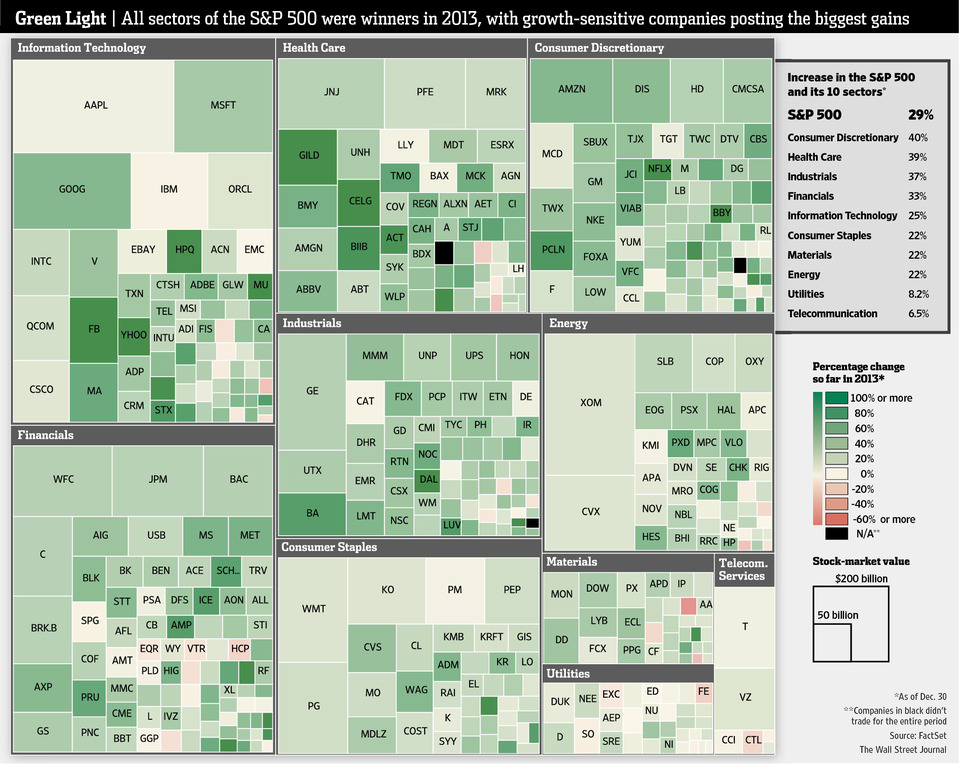

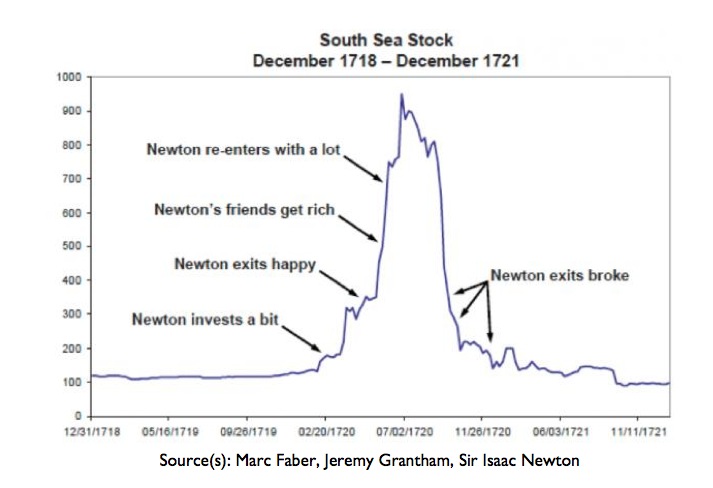

Newton’s experience with the South Sea Company vividly demonstrates the financial perils of chasing hot markets, getting caught up in investment bubbles, and not maintaining a diversified portfolio.

In the early 18th century the South Sea Company was established and given a monopoly on trade in the South Seas in return for assuming England’s war debt. Investors liked the idea of that monopoly and the company’s stock began to take off.

Newton hear the siren call of the South Sea Company, invested his cash in early 1720 and managed to turn a nice profit. But then the stock kept soaring after he had gotten out. So Newton jumped back into the stock with a lot more money than his original investment.

Newton subsequently lost 20,000 pounds, almost all of his life savings! From this terrible outcome, Newton supposedly decreed, “I can calculate the movement of the stars, but not the madness of men.”

No warning on Earth can save people determined to grow suddenly rich.

— Lord Overstone

Source: Sovereign Man

Source: Sovereign Man