Quick Check: Are Your Retirement Savings On Track?

The two greatest impacts on your retirement savings over time are starting early and saving consistently. Beyond that, how do you know if you’re on track to have enough set aside to retire comfortably? Fidelity Investments recently published convenient “rule of thumb” that provides convenient, age-based targets to help you gauge your progress.

What’s the end game look like?

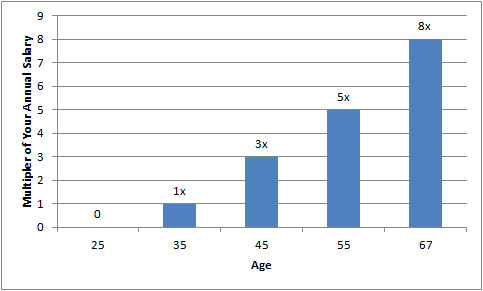

If you’ve saved eight times your annual salary by your last year of work before retiring, you should have enough money to replace 85% of your annual income for a 25-year period, including social security.

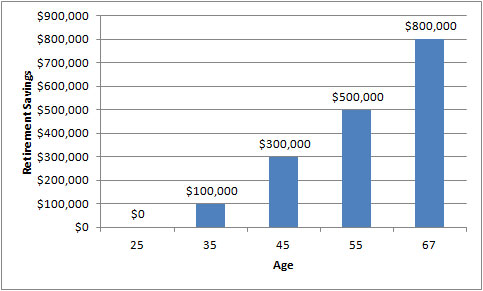

Age-based targets for retirement savings. For example, at age 35 you should have saved one times your annual salary. By age 55 you should have 5 times your salary. Ultimately retire at age 67 with eight times your annual salary set aside in retirement savings.

Here are the key milestones for getting to 8x and beyond:

- age 25: start saving for retirement beginning at 6% of annual salary and increasing this by 1% per year until it reaches 12%; employer provides a 3% matching contribution

- ages 31-67: setting aside 12% of annual income for retirement savings with an additional 3% matching contribution from the employer

- age 35: you should have saved one times your annual salary

- age 45: you should have saved three times your annual salary

- age 55: you should have saved five times your annual salary

- age 67: retire with eight times your annual salary in retirement saves

- age 67-92: live off your retirement savings

Recognize that this is a broad guide and each person’s requirements will vary by the specifics of their situation. Nonetheless, this provides a quick and easy reality check.

What if you check your actual retirement savings and you’re coming up short against these targets? Try to increase your retirement contributions to close the gap. Sit down with an investment advisor to review your investment portfolios and make sure they are optimized for success.

Source:

Fidelity Outlines Age-Based Savings Guidelines to Help Workers Stay on Track for Retirement