What if “the other guy” wins?

|

|

|

Last Saturday night, Master Eric Sbarge opened the Chinese New Year banquet celebration at The Peaceful Dragon with a moment of silence for those impacted by the coronavirus outbreak. Our hearts and thoughts go out to those dealing with this crisis.

(Incidentally, my family trains in Chinese martial arts, yoga and meditation at The Dragon. It is a uniquely special place of learning and development available to those of you in the Charlotte area.)

But I write to you from the perspective of your investments.

On Friday, January 17 — after a spectacular 40% run-up that started the day after Christmas 2018 — the S&P 500 index closed at 3,329.62.

Two weeks later to the day — last Friday, January 31 — the S&P 500 index closed a little over 3% lower, at 3,225.52. (Indeed, more than half that damage was done on Friday.)

We have therefore been invited by financial media to suspect that the blended value of 500 of the largest, best financed, most profitable businesses in America and the world has “lost” 3% — with more “losses” to come — due to the outbreak in China of a new strain of coronavirus.

Permit me to doubt this, and to suggest that you — as goal-focused long-term investors — join me in doubting it.

I do not claim to have any idea how far this outbreak will spread, nor how many lives it will claim, before it is brought under control. I’m reasonably certain that many (or perhaps most) of the world’s leading virologists and epidemiologists are working on it, and I believe that their efforts will ultimately succeed. Clearly, this is nothing more (or less) than my personal opinion.

But if the rich history of similar outbreaks in this century is any guide, this would seem to be a reasonable hypothesis.

I draw your attention to:

Without belaboring the point: the super-spreader of SARS — a fish seller — checked into a hospital in Guangzhou on January 31, 2003, basically infecting the whole staff. The epidemic exploded from there.

On that first day of the litany of epidemics cited above, the S&P 500 closed at 855.70. Seventeen years and six epidemics later (including the current one), this past Friday the S&P 500 index closed fairly close to four times higher. I’m confident that you see where I’m going with this.

As always, I welcome your inquiries around this issue. In the meantime, I think the most helpful — and certainly most heartfelt — investment advice I can offer would be that you turn off the television set.

—

Chris Mullis, Ph.D.

Financial Planner & Founding Partner

704-350-5028 | AskNorthStar.com

Better Conversations. Better Outcomes. Since 2006

According to Barry Ritholtz, the big problems that plague the financial service industry are the following:

According to Barry Ritholtz, the big problems that plague the financial service industry are the following:

• Simplicity does not pay well: Investing should be relatively simple: Buy broad asset classes, hold them over long periods of time, rebalance periodically, get off the tracks when the locomotive is bearing down on you. The problem is its easier in theory than is reality to execute. And, it is difficult to charge excessive fees for these services.

• Confusion is not a bug, its a feature: Thus, the massive choice, the nonstop noise, confusing claims, contradictory experts all work to make this much a more complex exercise than it need be. This is by design.

• Too much money attracts the wrong kinds of people: Let’s face it, the volume of cash that passes through the Financial Services Industry is enormous. Few who enters finance does so for altruistic reasons. There is a difference between normal greed (human nature) and outright criminality. This is why strong regulators and enforcement cops are required.

• Incentives are misaligned: Too many people lack the patience to get rich slowly. Hence, not only do the wrong people work in finance, and some of the right people exercise bad judgment.

• Too many people have a hand in your pocket: The list of people nicking you as an investor is enormous. Insiders (CEO/CFO/Boards of Directors) transfer wealth from shareholders to themselves, with the blessing of corrupted Compensation Consultants. 401(k)s are disastrous. NYSE and NASDAQ Exchanges have been paid to allow a HFT tax on every other investor. FASB and Accountants have done an awful job, allowing corporations to mislead investors with junk balance statements. The Media’s job is to sell advertising, not provide you with intelligent advice. The Regulators have been captured.

Source: The Big Picture

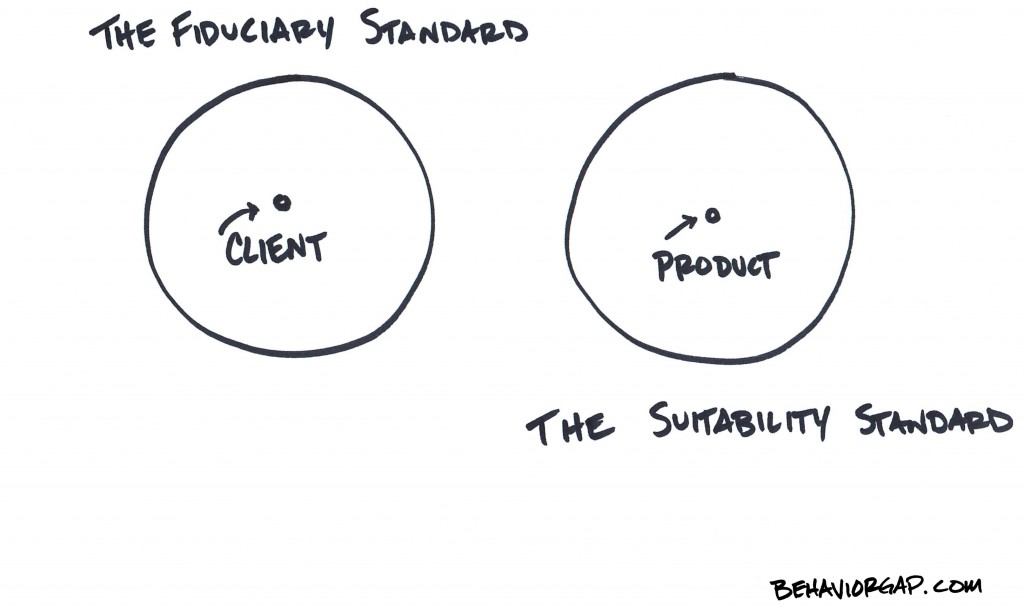

As an investor, you are faced with hundreds of decisions on where to get your investment advice. Here’s a nice breakdown between advisors and brokers that can help steer your decision making process.

As an investor, you are faced with hundreds of decisions on where to get your investment advice. Here’s a nice breakdown between advisors and brokers that can help steer your decision making process.

The infographic below refers to advisors using the acronym “RIAs” which stands for Registered Investment Advisors.

NorthStar Capital Advisors is an RIA. Note that we have no minimum investment requirements so we win Round 4 below as well! We hope this information will help you understand the role that we play in helping our clients.

(Click on the graphic to enlarge for easier reading)

Identifying what does NOT work is often a great process for narrowing your list of options of what you should do. In that spirit, here’s Ben Carlson’s list of 20 people you wouldn’t want to invest with:

Identifying what does NOT work is often a great process for narrowing your list of options of what you should do. In that spirit, here’s Ben Carlson’s list of 20 people you wouldn’t want to invest with:

1. People that are unwilling or unable to admit their limitations.

2. People that are consumed by ideological or political beliefs when making investment decisions.

3. People that are unwilling to say “I don’t know.”

4. People that don’t learn from their mistakes.

5. People that blame external forces for their failures.

6. People that are unable to effectively communicate their process.

7. People that make guarantees about the markets in the future.

8. People that are more interested in selling you a product than creating a beneficial long-lasting client relationship.

9. People that try to invest in the markets as they “should be” instead of how they actually are.

10. People that are more worried about what others are doing instead of focusing on their own process and goals.

11. People that take the markets personally and let their emotions drive their decisions.

12. People that assume “trust me, I got this” is good enough in terms of explaining their strategy.

13. People that believe in conspiracy theories and think the system is out to get them.

14. People that are more worried about sounding intelligent than actually making money.

15. People that obsess over the market’s short-term movements.

16. People that would rather take you golfing than help you solve your problems.

17. People that make you feel like they’re doing you a favor by letting you invest your money with them.

18. People that try to dazzle you with 200 page pitch books.

19. People that are more worried about gathering future clients than taking care of their current ones.

20. People that tell you what you want to hear instead of what you need to hear.

Source: AWOCS

Although the following makes reference to politicians and political decisions, it’s not meant to be political. The intent is to inform you and to help protect you and your family’s best interest.

Although the following makes reference to politicians and political decisions, it’s not meant to be political. The intent is to inform you and to help protect you and your family’s best interest.

Today the founder and former chief executive of Vanguard, John C. Bogle, penned an article in the New York Times. It starts off:

THE Trump administration recently announced that it intends to review, and presumably overturn, the Obama-era fiduciary duty rule that is scheduled to take effect in April. The administration’s case was articulated by Gary Cohn, the new director of the National Economic Council.

Mr. Cohn, most recently the president of Goldman Sachs, called it “a bad rule” and likened it to “putting only healthy food on the menu, because unhealthy food tastes good but you still shouldn’t eat it because you might die younger.” Comparing healthy and unhealthy food to healthy and unhealthy investments is an interesting analogy.

The now-endangered fiduciary rule is based on a simple — and seemingly unarguable — principle: that in giving advice to clients with retirement funds, stockbrokers, registered investment advisers and insurance agents must act in the best interests of their clients. Honestly, it seems counterproductive to go to war against such a fundamental principle. It simply doesn’t seem like a good business practice for Wall Street to tell its client-investors, “We put your interests second, after our firm’s, but it’s close.”

To learn more, see Mr. Bogle’s article and The Freedom To be Fleeced — How Donald Trump Made Financial Hustles Great Again

It’s easy to get lost in the details and let our minds glaze over, but what you should know is very simple:

When we formed our advisory practice many years ago we purposefully chose to be a fiduciary because it’s the right thing to do. Incredibly that ethos is counter-cultural in financial services. It’s bemusing to watch the delicate public-relations dance and contortions that many big institutions are making around or in avoidance of doing the right thing.

Stuck for ideas on what to give newlyweds, graduates, or new parents for Christmas or Hanukkah? Consider something nontraditional this year that will last a lifetime and never go out of style: a visit with a financial planner.

Giving someone a financial planning consultation is a unique way to show you care, and it can help set up a loved one for a successful financial future. Newlyweds, graduates, and new parents all are at the start of a new phase of their lives. A financial planning gift provides them with something that may last for decades.

Those experiencing life’s transitions will also face financial challenges. Whether it’s learning to budget as a couple, understanding retirement plan options at the first job after graduation, or starting to think about paying for college, many important financial decisions await young people today. You can help by putting financial planning front and center.

Money and finances are among the top issues that cause marital discord. A financial planner can help strategize for a happily-ever-after financial life. A good planner will spend time talking to the couple, helping them determine their mutual financial goals. There are so many topics a financial planner can help with, including: managing household expenses; reviewing assets, debts, and credit reports; creating a budget; discussing future goals and creating mutual goals such as buying a home; analyzing benefits; updating wills; and reviewing insurance coverage.

Once the diploma is hanging on the wall, it’s tempting for new grads to overspend, racking up credit card debt and a new car loan when what they really need to be worrying about is paying down student loans and planning for retirement. A gift of financial planning can help a new graduate establish short- and long-term financial goals and develop a budget to meet those goals. A financial planner may also help the grad deal with the new challenge of filing taxes and make recommendations on how to allocate investments into 401(k) or other retirement savings vehicles.

The government estimates that a middle-income family will spend more than a quarter of a million dollars to raise a child until he or she is 18. New parents will benefit by working with a financial planner to figure out how much money they’ll need to raise their child. A financial planner can help them create a savings safety net, create and stick to a budget, advise about life insurance and wills, and talk about saving for college.

Purchase a financial planning gift certificate for someone you care about and know you’ve made a lasting contribution!

Identifying what does NOT work is often a great process for narrowing your list of options of what you should do. In that spirit, here’s Ben Carlson’s list of 20 people you wouldn’t want to invest with:

Identifying what does NOT work is often a great process for narrowing your list of options of what you should do. In that spirit, here’s Ben Carlson’s list of 20 people you wouldn’t want to invest with:

1. People that are unwilling or unable to admit their limitations.

2. People that are consumed by ideological or political beliefs when making investment decisions.

3. People that are unwilling to say “I don’t know.”

4. People that don’t learn from their mistakes.

5. People that blame external forces for their failures.

6. People that are unable to effectively communicate their process.

7. People that make guarantees about the markets in the future.

8. People that are more interested in selling you a product than creating a beneficial long-lasting client relationship.

9. People that try to invest in the markets as they “should be” instead of how they actually are.

10. People that are more worried about what others are doing instead of focusing on their own process and goals.

11. People that take the markets personally and let their emotions drive their decisions.

12. People that assume “trust me, I got this” is good enough in terms of explaining their strategy.

13. People that believe in conspiracy theories and think the system is out to get them.

14. People that are more worried about sounding intelligent than actually making money.

15. People that obsess over the market’s short-term movements.

16. People that would rather take you golfing than help you solve your problems.

17. People that make you feel like they’re doing you a favor by letting you invest your money with them.

18. People that try to dazzle you with 200 page pitch books.

19. People that are more worried about gathering future clients than taking care of their current ones.

20. People that tell you what you want to hear instead of what you need to hear.

Source: AWOCS

A report released last week by the Public Investors Arbitration Bar Association (PIABA) pointed out nine big brokerages for advertising as if they are fiduciaries, but denying that standard and renouncing any requirement to avoid conflicted advice in private arbitration hearings.

Those nine brokerages are: Merrill Lynch, Fidelity Investments, Ameriprise, Wells Fargo, Morgan Stanley, Allstate, UBS, Berthel Fisher, and Charles Schwab.

Fiduciaries have a legal requirement to put client interests ahead of all others.

The report includes samples of misleading advertising from major brokerage firms AND the firms’ legal repudiations when their brokers are sued for losses caused by misconduct.

Allstate

Their advertisements say: “Your’e in good hands.”

Their lawyers say: “Allstate Financial Services owed no fiduciary duty to Claimants, and, therefore, no such duty was breached.”

UBS

Their advertisements say: “Until my client knows she comes first. Until I understand what drives her. And what slows her down. Until I know what makes her leap out of bed in the morning. And what keeps her awake at night. Until she understands that I’m always thinking about her investment. (Even if she isn’t.) Not at the office. But at the opera. At a barbecue. In a traffic jam. Until her ambitions feel like my ambitions. Until then. We will not rest. UBS.”

Their lawyers say: “[A] broker does not owe a fiduciary duty to his customer in a non-discretionary account.”

Merrill Lynch

Their advertisements say: “It’s time for a financial strategy that puts your needs and priorities front and center.”

Their lawyers say: “Respondents did not stand in a fiduciary relationship with Claimants.”

Morgan Stanley

Their advertisements say: “Having an intimate knowledge of blue chips and small caps is important. But even more important is an intimate knowledge of you and your goals. Get connected to a Morgan Stanley Financial Advisor and get a more personalized plan for achieving success.”

Their lawyers say: “Claimant’s claim seeks to impose ‘fiduciary’ obligations and duties on Respondents that only arise in very limited circumstances that do not exist here, i.e. where Respondents are given discretionary trading authority over Claimant’s accounts.”

The report succinctly summarizes this disparity:

“On one hand, the firms boast that they offer unconflicted, trustworthy advice while, on the other hand, those same firms argue they are little more than salesmen with a single duty: to execute trades in customers’ accounts.”

Sources:

MarketWatch

USN