Risks to Family Wealth

source: U.S. Trust

source: U.S. Trust

source: U.S. Trust

source: U.S. Trust

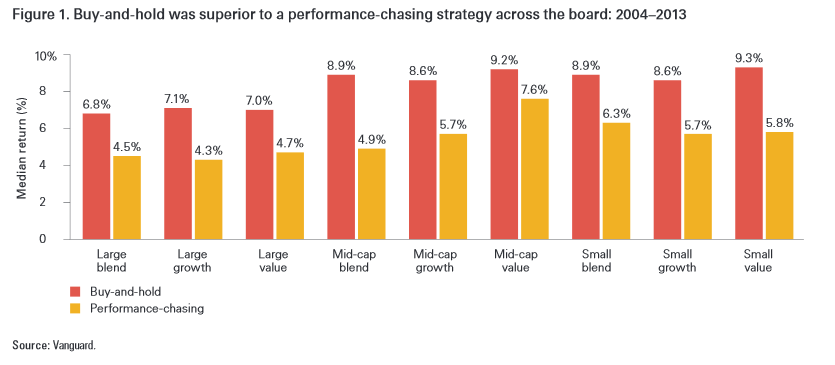

A new study demonstrates that chasing the hot mutual fund is an inferior investing strategy compared to good, old-fashioned buy and hold.

A new study demonstrates that chasing the hot mutual fund is an inferior investing strategy compared to good, old-fashioned buy and hold.

Vanguard analyzed a decade of data ending December 31, 2013 across nine asset classes. In every case the investor would have been significantly better off just sticking with the index. On average the indexes generated 50% higher returns than the performance-chasing strategy!

Buy and hold may not be perfect, but it can be a lot better than flitting from mutual fund to mutual fund.

REITs stands for Real Estate Investment Trusts. REITs sell like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate.

REITs stands for Real Estate Investment Trusts. REITs sell like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate.

Real Estate is historically a good performing asset class. Allocating approximately 10% of your stock portfolio is a generally prudent choice. However, state regulators are seeing more and more trouble with a certain type of real estate investment: non-traded REITs.

Non-Traded REITs

Unlike normal REITs, non-traded REITs do not trade on a securities exchange. They have several very significant issues:

Front-end fees can be as much as 15% (much higher than traded REITs due to the limited secondary market)

Non-traded REITs buy office buildings, stores, and other properties. They are sold directly to private investors by financial advisors and brokers.

State Securities Regulators Worried

Regulators are concerned that small investors are not fully aware nor understand the risks associated with non-trade REITs. States are on the verge of adopting new restrictions to protect “mom and pop” investors including:

The State of Massachusetts has brought enforcement actions against brokerages for improper sales of non-traded REITs including

Source: WSJ