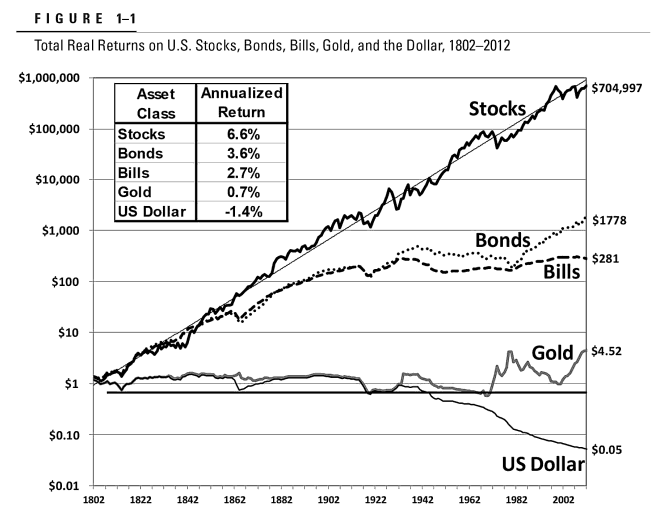

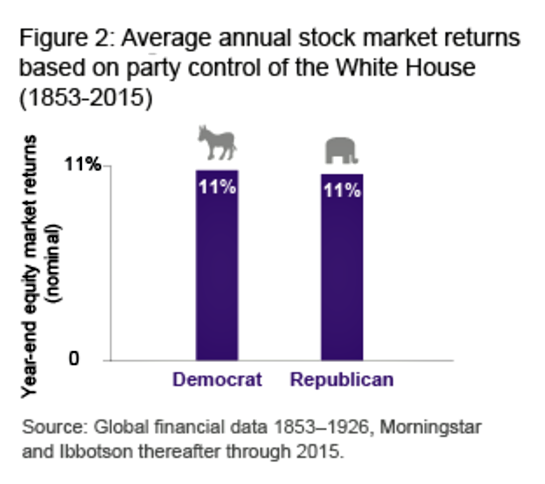

Your Investments Don’t Care Who Wins

Countless words and boundless time have been expended over the ages debating which political party is best for the investment markets. Good news! You can stop worrying and wasting your time because 160 years of history are very clear on this question.

Vanguard research going back to 1853 demonstrates that stock market returns are virtually identical regardless of which party is in the White House (see chart above). Similarly, Vanguard finds the political party of the president has little impact on the bond market as well.

Vanguard research going back to 1853 demonstrates that stock market returns are virtually identical regardless of which party is in the White House (see chart above). Similarly, Vanguard finds the political party of the president has little impact on the bond market as well.

So take a deep breath and relax because your investments* don’t care who wins on November 8th.

(* “your investments” should be a diverse portfolio of assets that serves a long-term investment discipline that is goal focused and planning driven)

Source: Vanguard