The Biggest Threat To Your Portfolio

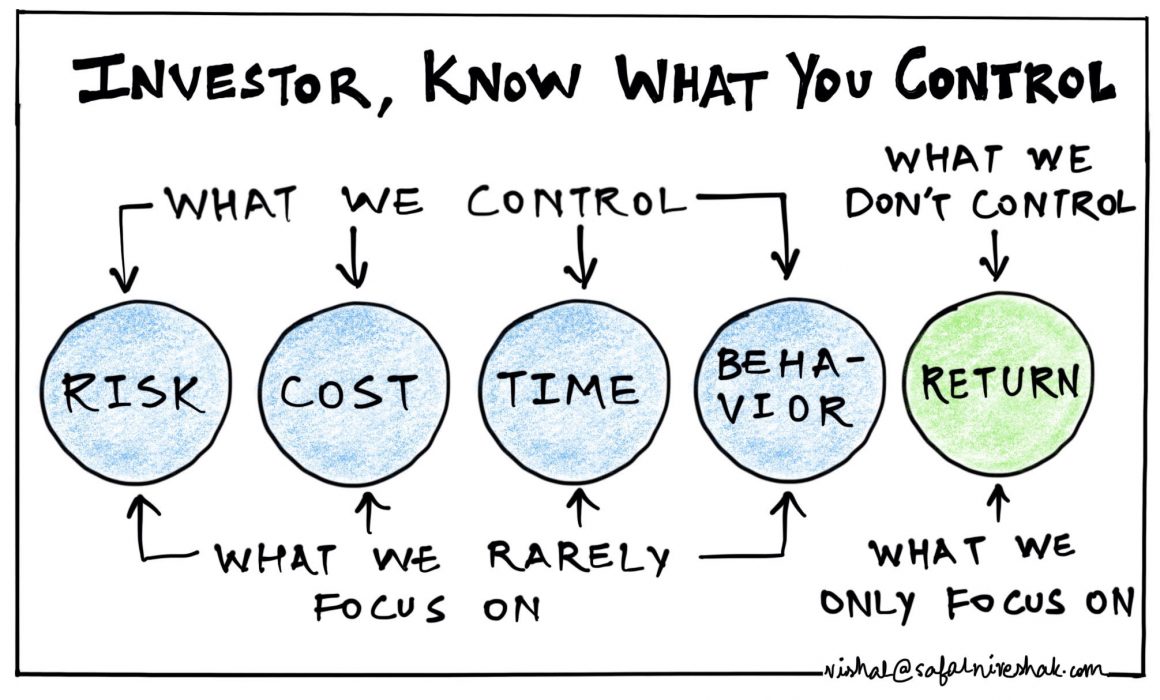

How do you react to when the stock market is down or it gets bumpy? Do any of these sound familiar?

How do you react to when the stock market is down or it gets bumpy? Do any of these sound familiar?

- Fleeing into the arms of a charlatan who purports to having predicted it

- Buying into Black Swan funds and protective products that cap all future upside and cost a fortune

- Obsessing over hedges after the fact

- Selling out with big (permanent) losses and sitting in cash

- Freezing 401(k) contributions or having retirement cash allocated to money market funds

- Excessive trading

- Planting a flag and being unwilling to publicly change our minds in the face of new evidence

- Throwing money at bizarre alternatives like coins, bars, bricks and bullion which have no proven ability to fund a retirement

- Conflating political views with investment expectations

Every one of these things is extremely detrimental to our financial health.

Nothing kills the long-term returns of a portfolio like throwing away the playbook in the heat of a market crisis.

Source: TRB