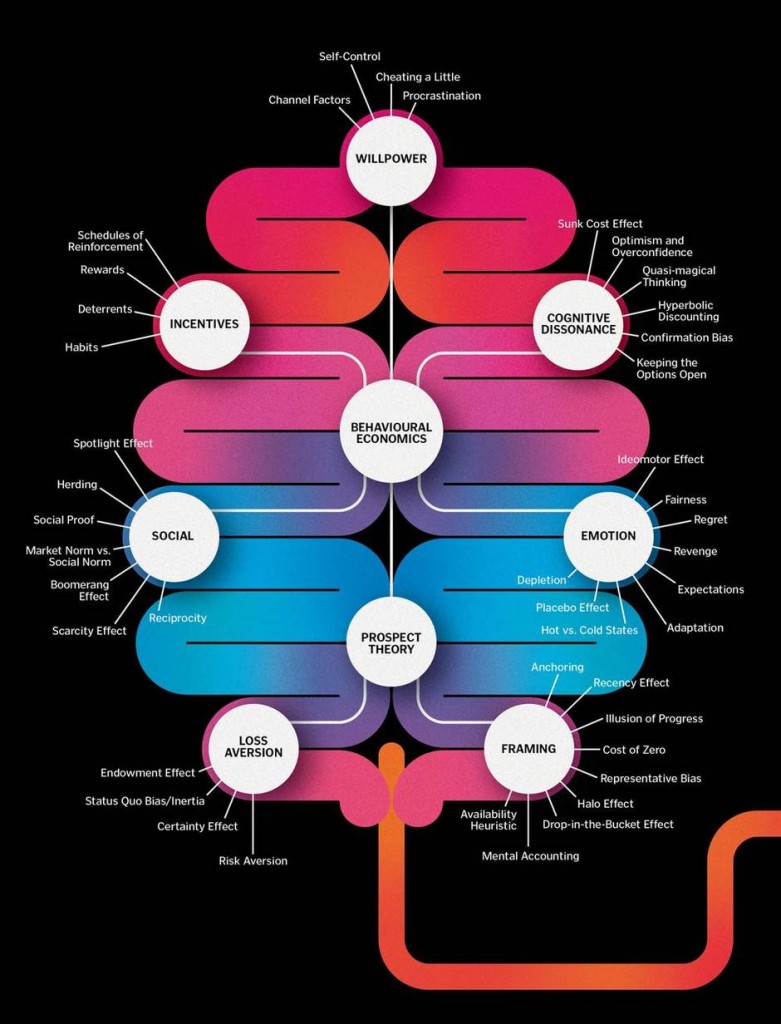

Six ways our brains make bad financial decisions

Our brains are hard-wired to choose short-term payoff over long-term gain. Duke University professor of psychology and behavior economics Dr. Dan Ariely has a great article on this subject. Here are six common mistakes investors make – and how to avoid them.

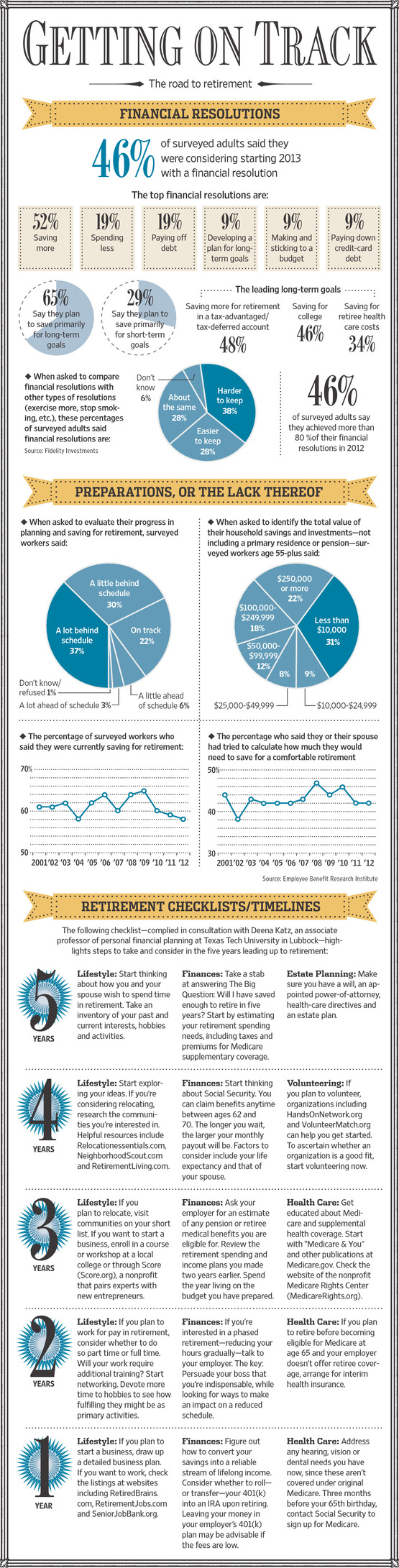

- SAVING: What’s more important: buying a new iPad nowor saving that moneyfor the future?

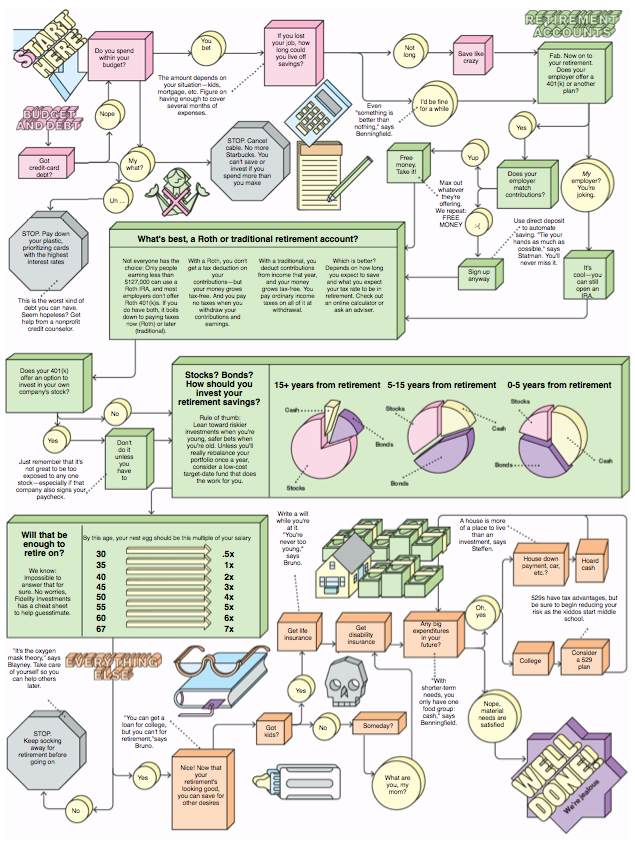

- RETIREMENT PLANNING: How much money do you think you need for your retirement, assuming you plan on maintaining your current lifestyle?

- INSURANCE: Why do we make such bad decisions when it comes to insurance?

- SHOPPING: Why do we invest in extended warranties?

- MORTGAGES: Why do we buy mortgages from the same old suspects?

Read Dr. Ariely’s article here and learn how to avoid these bad decisions.