What lessons will you take from this?

So much is unknown.

Do we reopen or wait?

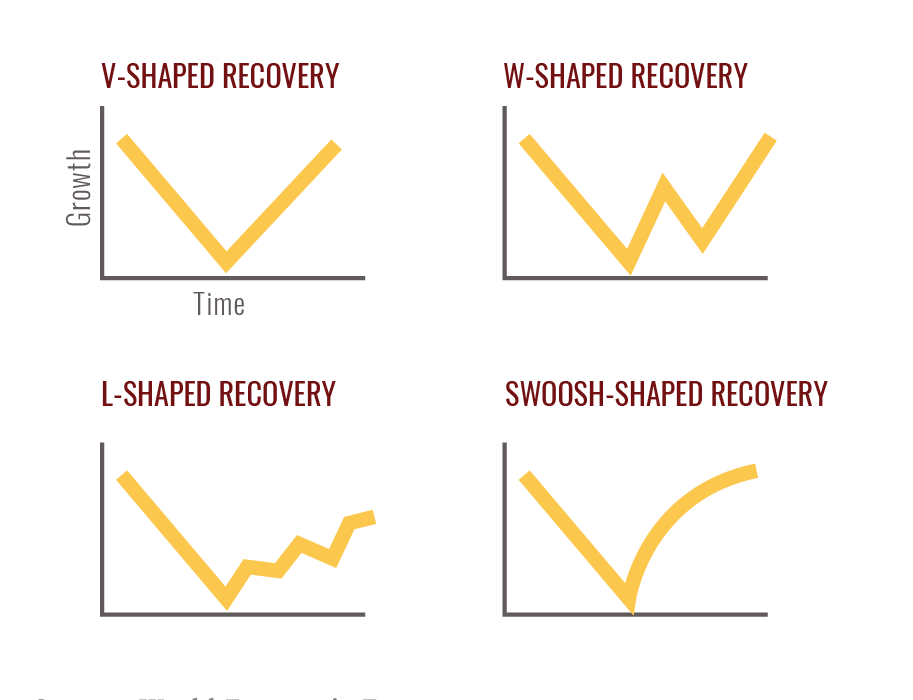

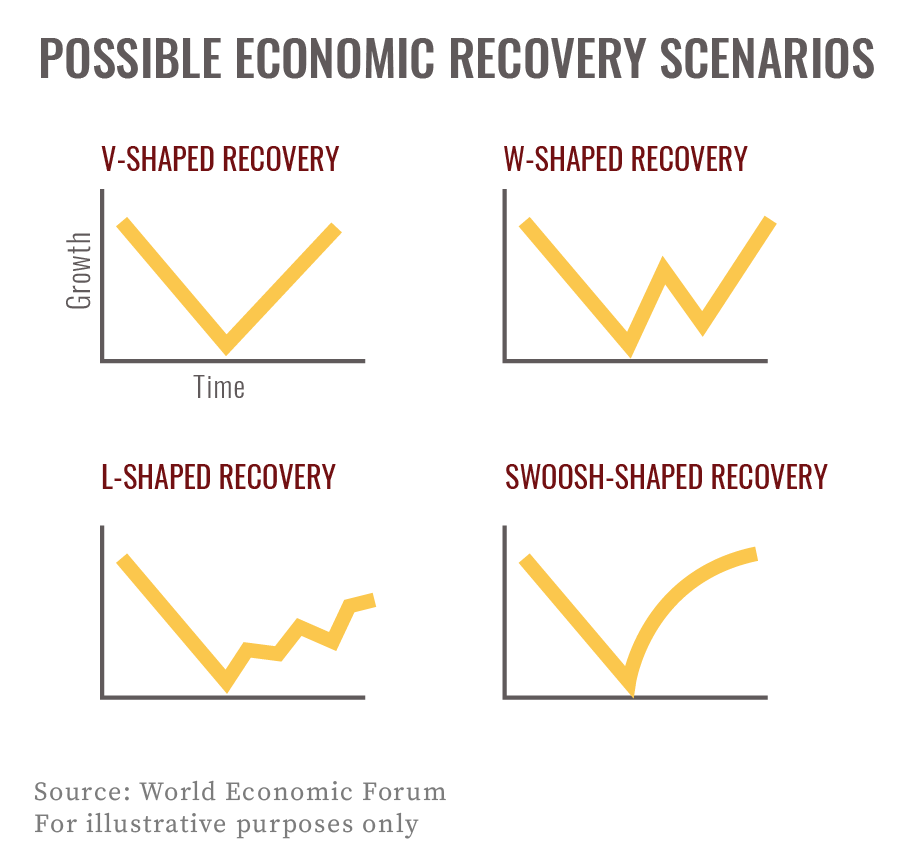

Are we past the peak? Or just over the first summit of a mountain range?

Are we safe yet?

After weeks of restrictions, it’s easy to feel that we’re swirling in a maelstrom of uncertainty, helpless to make decisions when so much remains unknown and out of our control.

The uncertainty, the personal losses many have experienced, and the everyday challenges of socially distant life can shake our foundation and cause us to lose touch with what’s most important.

I think that’s normal. We’ve traded a trip on the highway for an off-roading adventure. And we don’t know where it’s going to take us this year.

So let’s lean into the uncertainty. Let’s embrace it and use it as a wake-up call to explore and appreciate what really matters.

Our health. Our family, friends, and loved ones. Our home. Our community. Our compassion and creativity. Our resilience as human beings.

As for me, I have some moments of frustration, but I’m staying grounded by playing outside with our kids and working in the yard.

I’m also learning a lot about myself. I’ve learned that I really enjoy sitting face-to-face in the same room with clients, friends, and colleagues. I’ve learned that I’m not “camera ready” for Zoom meetings nor remote TV interviews, but I’m humbly trying to get better.

I’m working on gratitude and enjoying simple things like dinner-time conversations, our weekly visit with my parents, and fresh air.

I’m grateful to have a wonderful family, a comfortable home (aka The Bunker) and deeply meaningful work.

I’m grateful to have you.

On the professional side, I’m focused on what we can control on our clients’ behalf and staying abreast of what might come next. Our mantra right now is: “one day at a time.”

How are you? I’d love to hear how you are coping. What lessons are you learning about yourself? What have you had the courage to try for the first time? Hit “reply” and let me know.

This pandemic is scary. But it’s also a once-in-a-lifetime chance to hit the “reset” button and connect with the creativity, joy, and good old human ingenuity that can flourish within the limitations of pandemic life.

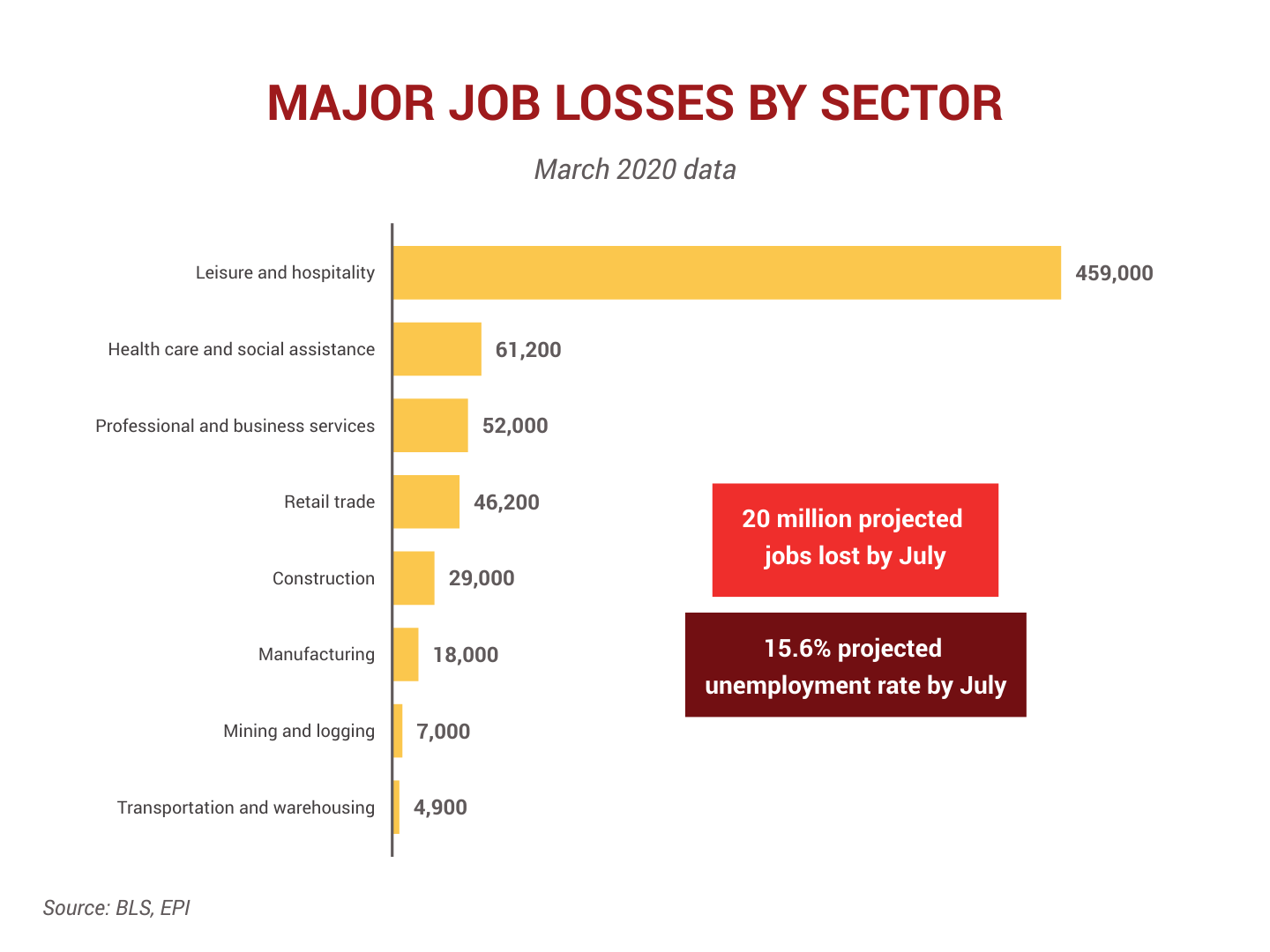

Eventually, we’ll recover from the pandemic. It’s not clear yet what that will look like, and we’ll likely see more hard days before we get there. Businesses will reopen, people will go back to work, the recession will pass, and the country will rebuild.

We will heal. But some marks will remain as reminders of our experience.

The Great Depression taught people to clip coupons and “make do or go without.” 9/11 upended our travel rituals and awareness of terrorism.

Some lessons from the pandemic will stay with us long after the immediate crisis fades. Some will be unconscious; maybe we’ll become a society of dutiful hand washers and social distancers.

Others will be lessons we consciously take with us about our values and ability to adapt to circumstances far beyond our control.

I’m hopeful and excited to see what we learn. Let’s make it good.

How has the pandemic changed your perspective? What new values and priorities will you bring out of your experiences? Email me at chrismullis@nstarcapital.com and let me know.

Be well,

Chris

|

Chris Mullis, Ph.D. Founding Partner NorthStar Capital AdvisorsFinancial Planning. Wealth Management. Since 2006 AskNorthStar.com |

P.S. Do you know someone who is having a hard time and could use some financial advice? We’re holding a few spots open for folks who could use a professional’s help. If you can think of someone, please reply to this email or call (704) 350-5028 to let me know.

P.P.S. And don’t forget about our special COVID-19 pro bono planning we created to support individuals and families who can’t afford fiduciary advice and financial planning.