Medicare changes retirees need to know about

New laws are here!

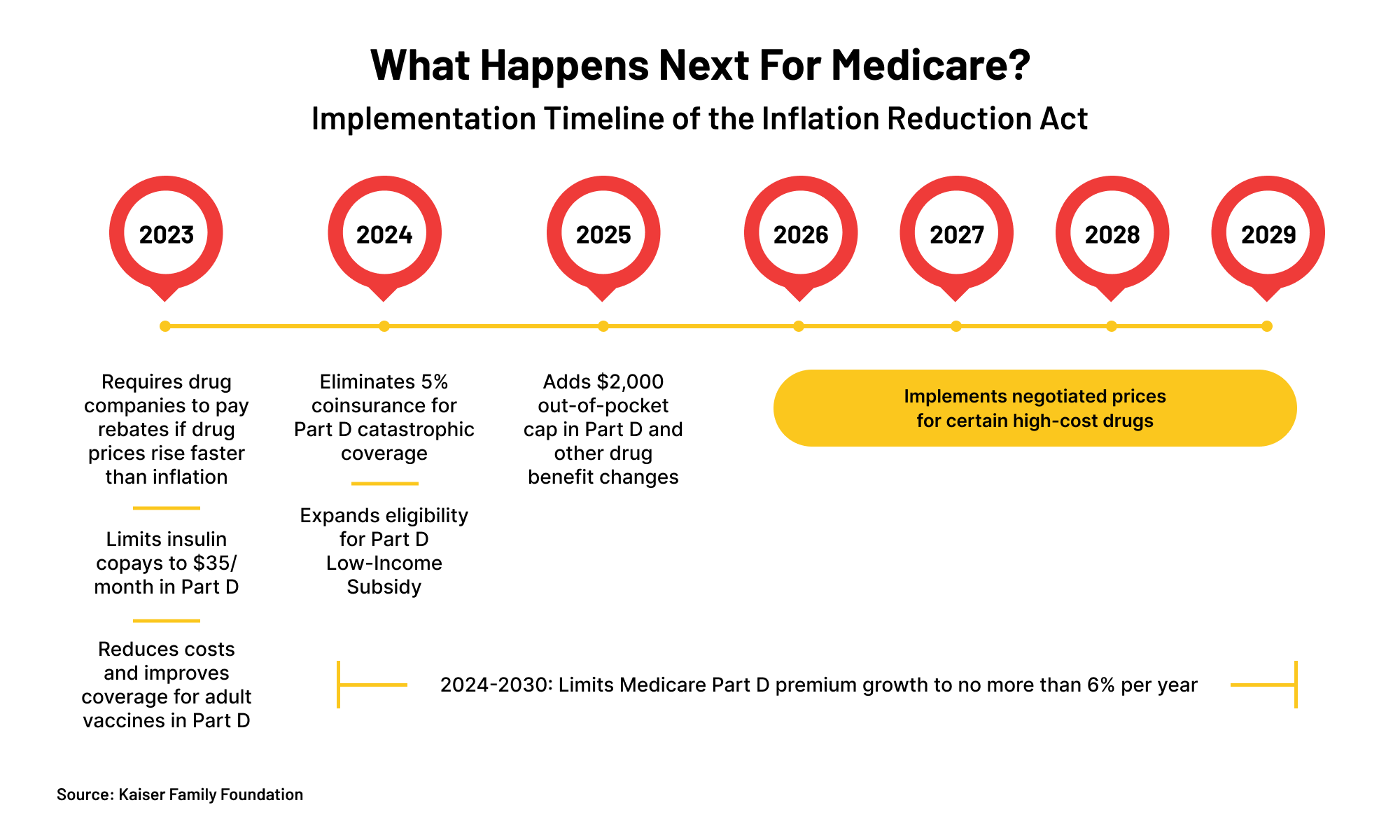

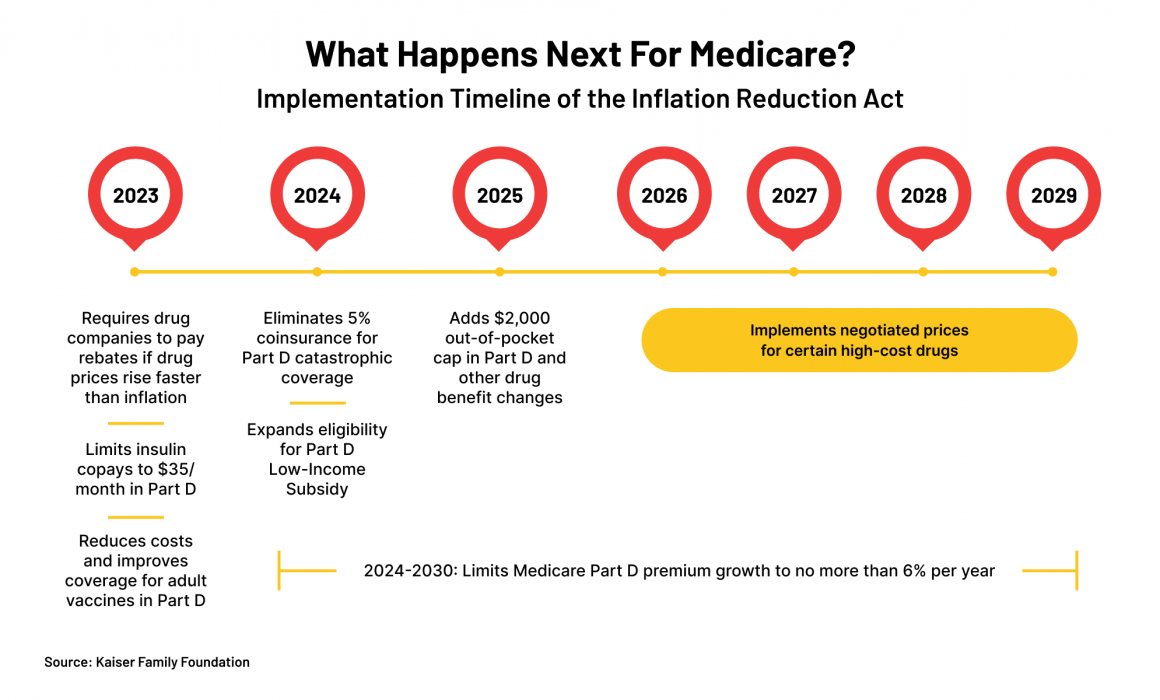

The new Inflation Reduction Act is a big enchilada of green energy spending, corporate taxes, and some pretty major changes to Medicare.

Is this deal a big deal? Could be. I’ll wrap it up for you at the end.

First, here are some Medicare changes you might want to know about:1

Medicare will be able to negotiate drug prices (starting in 2026)

For the first time, the Medicare program will have the power to negotiate the cost of (some) drugs.

Before price negotiations kick off, new rules will also force manufacturers to pay “rebates” to the government if they increase covered drug prices higher than general inflation (starting in 2023) and limit Medicare Part D premium increases each year (starting in 2024).1

Why does this matter? Drug price inflation is crazy high, outpacing general inflation for thousands of medications.2

The power to negotiate drug prices with manufacturers could end up lowering costs. For example, a budget study found that Medicare was paying 32% more for the same drugs as Medicaid (which already has the power to negotiate prices).1

Lower prices could lead to overall program savings (and possibly lower Medicare premiums), plus save money for retirees who depend on those specific drugs.

Out-of-pocket drug costs on Part D will be capped at $2,000/year (starting in 2025)

Under current laws, there’s no cap on how much people have to spend out-of-pocket for their medications, which can really add up under cost-sharing requirements.

Starting in 2024, folks who spend enough out-of-pocket on medications to surpass the “catastrophic threshold” will no longer have to pay coinsurance for their expensive drugs.1

And, starting in 2025, the maximum out-of-pocket medicine cost for folks on Part D will be a flat $2,000.

Why does this matter? Many drugs (especially new ones) can be devastatingly expensive.

Capping annual drug costs will hopefully not only save folks money, but also lead to more predictability in their yearly health care costs.

Out-of-pocket insulin costs will be capped at $35/month for Medicare participants (starting in 2023)

Starting in 2023, enrollees won’t have to spend more than $35 per month on their insulin copays.1

Folks on private health insurance won’t see a change.

Why does this matter? As anyone who needs insulin will tell you, it can get pricey, costing over $500 per year on average.3 Much more if you need one of the more expensive versions.

Capping costs could help the millions who need this life-saving medication.

All vaccines will be free under Part D (starting in 2023)

While flu and COVID-19 shots might be covered for many, most vaccines are not.

Starting in 2023, cost-sharing under Part D will end, making ALL covered adult vaccines free.1

Why does this matter? Many adult vaccines can cost quite a few bucks. For example, the shingles vaccine can cost upwards of $150 a pop and other recommended jabs can also be very pricey.4

Making vaccines free could not only lower the financial impact of immunizations, but also increase their availability to lower-income folks.

Will these new laws help retirees?

This is where the future gets hazy. Legal challenges or post-election changes could end up altering much of what’s in the Inflation Reduction Act. And much depends on the actual execution of the new rules.

The new rules could also mean premium changes as insurance companies figure out their models.

Since health care is one of the biggest unknown costs in retirement, lowering drug costs and making spending more predictable for Medicare recipients could absolutely have a positive impact on millions of people.

Will the Inflation Reduction Act help the economy?

Whether the overall bill will live up to its name, lower inflation, and have a net positive impact on the economy also remains to be seen.

Some economists project that the bill will end up modestly reducing inflation and trimming the federal budget over the next decade.5

Others are concerned about the impact of the new corporate tax rules written into the legislation.

As is usually the case, time will tell.

To your health,

Dr. Chris

1 – https://www.morningstar.com/articles/1109390/the-inflation-reduction-acts-impact-on-retirees

3 – https://www.kff.org/medicare/issue-brief/insulin-out-of-pocket-costs-in-medicare-part-d/

4 – https://www.cdc.gov/vaccines/programs/vfc/awardees/vaccine-management/price-list/index.html

Growing your wealth is a combination of making money and saving money. Today we’re focused on the latter half of that equation. Current trends in the debt market could save thousands of dollars per year for mortgage borrowers.

Growing your wealth is a combination of making money and saving money. Today we’re focused on the latter half of that equation. Current trends in the debt market could save thousands of dollars per year for mortgage borrowers.