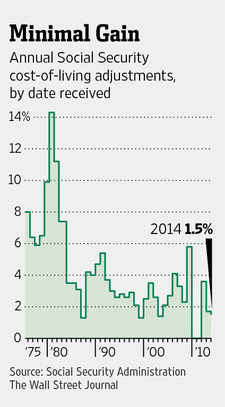

Social Security Benefits To Increase 1.5% in 2014

The federal government announced Wednesday that the social security benefits for almost 63 million retirees and disabled people will increase by 1.5% next year.

The federal government announced Wednesday that the social security benefits for almost 63 million retirees and disabled people will increase by 1.5% next year.

This will be one of the smallest annual increases since automatic cost-of-living adjustments (COLA) began in 1975. The sluggish U.S economic recovery has kept inflation in check and limited businesses’ ability to raise prices of goods and services.

Social Security pays retired workers an average of $1,272 a month. A 1.5% raise comes to about $19.