NBC’s Chris Hansen Investigates Annuity Sales to Seniors

NBC’s Chris Hansen conducted an undercover investigation focused on the predatory sales tactics used in the sale of equity-indexed annuities to senior citizens.

Watch the video below or read the transcript to,

- go behind the scenes to uncover the sales tactics insurance agents use

- inside free-dinner seminars to catch the questionable pitches

- inside training sessions to reveal insurance agents being taught to scare seniors and puff their credential with deceptive books, magazines and radio shows

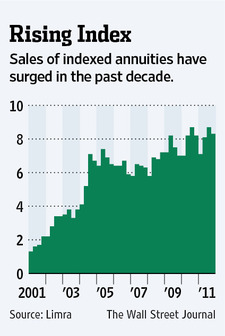

Prominent in the program is Annuity University which trains insurance agents. Annuity University has been sued for running a dishonest scheme to deceive, coerce, and frighten the elderly. Read more about Annuity University in this Wall Street Journal article.

Minnesota Attorney General Lori Swanson, who reviewed NBC’s footage, and who has filed several suits alleging fraud in the sale of annuities to seniors, tells Hansen: “…what is tragic about it is when those agents go into the seniors’ homes, it is literally the wolf among the lambs.”

“Treat’em like blind 12-year olds”

Commentary: Annuities are a suckers bet