You Are Your #1 Threat

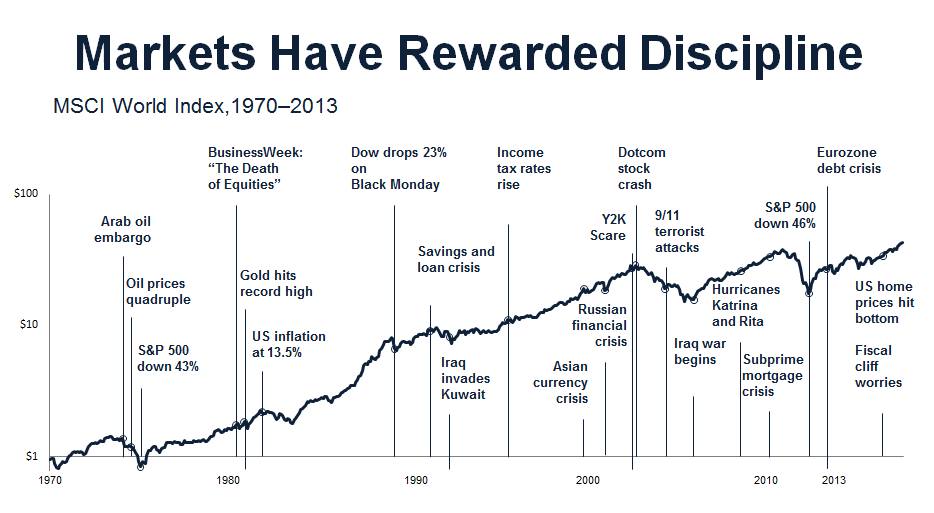

The chart above from Dimensional Fund Advisors is an excellent demonstration of the resilience of the market. Each event marked on the timeline was accompanied by thousands of articles and TV reports discussing at great length how bad things were going to get and what you supposedly needed to do. Despite all that noise, the market just keeps powering up over the long term.

The chart above from Dimensional Fund Advisors is an excellent demonstration of the resilience of the market. Each event marked on the timeline was accompanied by thousands of articles and TV reports discussing at great length how bad things were going to get and what you supposedly needed to do. Despite all that noise, the market just keeps powering up over the long term.

Individual investors (that’s you!) constitute the number one threat to their own portfolio. How’s that? In the face of market stress and volatility, they usual reaction is some combination of the following :

- Fleeing into the arms of a charlatan who purports to having predicted it

- Buying into Black Swan funds and protective products that cap all future upside and cost a fortune

- Obsessing over hedges after the fact

- Selling out with big (permanent) losses and sitting in cash

- Freezing 401(k) contributions or having retirement cash allocated to money market funds

- Excessive trading

- Planting a flag and being unwilling to publicly change our minds in the face of new evidence

- Throwing money at bizarre alternatives like coins, bars, bricks and bullion which have no proven ability to fund a retirement

- Conflating political views with investment expectations

According to adivsor Josh Brown, “every one of these things is extremely detrimental to our financial health. In some cases, the damage could be irreversible. Nothing kills the long-term returns of a portfolio like throwing away the playbook in the heat of a market crisis.”

Source: TRB

Simple, Bedrock Rules on Personal Finance

Financial columnist Brett Arends’ final piece for the Wall Street Journal is absolutely foundational!

Financial columnist Brett Arends’ final piece for the Wall Street Journal is absolutely foundational!

Ignore economic and financial forecasts. Their purpose is to keep forecasters employed. Most professional economists were blindsided in 2008 by the biggest financial collapse in 70 years—and by the stock market’s recovery.

Ignore “expert” stock picks. The stocks that Wall Street experts like most generally fare no better than those they like least—or stocks picked at random.

Keep it simple. Complicated financial strategies and investments are mostly designed to enrich managers and salesmen.

Buy individual stocks only as a gamble. Never buy fashionable investments.

Put most of your long-term portfolio into equities. While equities are volatile, they generally produce the best long-term returns—typically about 4% to 5% a year above inflation. But remember to hang on when they plummet.

Invest globally, not just in the U.S. Foreign stock markets, in the aggregate, are no riskier than U.S. markets and offer terrific diversification.

Buy Treasurys, too: In addition to stocks, own some long-term Treasury bonds and some Treasury inflation-protected securities. These are likely to hold their value, or even go up, when stocks crash.

Save early, save often. Time and patience are the investor’s best friends.

Use those free shelters. Contribute as much as possible to your company’s 401(k) plan or equivalent (such as 403(b) or 457), and at least enough to get the company match. If you can, contribute to individual retirement accounts for yourself, and a nonworking spouse, as well.

Plan for a long life. A third of your adult life could come after you’re 65. Try to pay off your mortgage, and save at least 10 times your annual salary, by the time you retire. Delay taking Social Security for as long as you can up to the age of 70, to maximize each monthly check.

Beware of buying your employer’s stock. Your job there is probably financial exposure enough.

Protect your nest egg. Don’t drain your retirement savings to pay for your child’s college education. Likewise, don’t empty your 401(k) or IRAs to start a business. You will be taxed and penalized on the withdrawals even if you lose the money.

Teach your children about money. Teach them early and often. No one else will, and they will have to make their own way.

Don’t Drop the Ball…on your New Year’s financial resolutions

It’s early February and “crunch time” for those of us trying to keep our New Year’s resolutions.

It’s early February and “crunch time” for those of us trying to keep our New Year’s resolutions.

If you made a financial resolution to ring in 2015 then you’re not alone! 31% of Americans set financial objectives this year. There are powerful reasons to make and keep such resolutions:

- For those who made a resolution in 2014, 74% say they succeeded in getting at least halfway to their goal

- 51% of people who made a financial resolution at the start of 2014 feel that they are now in a better financial situation

- 42% of those surveyed say sticking to financial resolution is easier than sticking to other popular resolutions

- For those who made a resolution for 2014, 29% say there were completely successful in reaching their goal

- 64% say being encouraged by the progress made is the #1 motivator to stick with financial resolutions

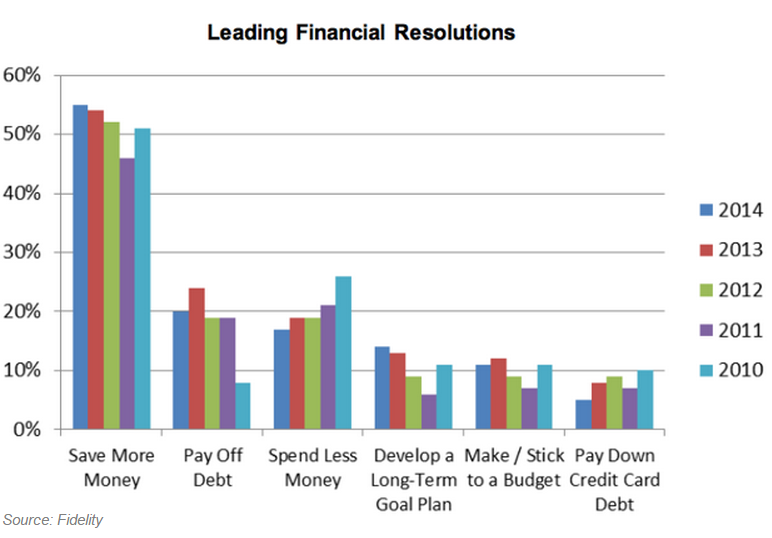

Mandi Woodruff posted the interesting chart below on the leading New Year’s financial resolutions for the past few years. Encouragingly, “develop a plan to reach longer-term goals” is a popular choice, increasing to 14 percent. This is a more than twofold increase since 2011, when it was at a single-digit low of 6 percent.

Need help keeping and tracking your resolutions? Contact us!

Don’t Drop the Ball on Your 2015 Financial Resolutions

Recent Posts

-

Inflation relief June 3,2024

-

Why are markets volatile? May 3,2024

-

Can stocks go higher? April 3,2024

-

Does the Fed really matter? March 2,2024

Archives

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- October 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- November 2010

- October 2010

- September 2010

- August 2010

Categories

- 401(k)

- Annuities

- Behavior

- Best Practices

- Bonds

- Charitable Donations

- Economy

- Fees

- Fiduciary

- Financial Planning

- Investing 101

- Live Well

- Market Outlook

- Mutual Funds

- NorthStar

- Performance

- Personal Finance

- Planning

- Retirement

- Saving Money

- Scams & Schemes

- Seeking Prudent Advice

- Tax Planning

- Uncategorised

- Uncategorized

- Weekly Market Review