WCCB TV Interviews Dr. Chris Mullis

Source: WCCB TV / Local Financial Advisors Say “Stay the Course” Following Historic Market Drop

Dr. Chris Mullis, NorthStar’s Founding Partner, did an on-air interview with WCCB TV news anchor Drew Bollea discussing how people should think about their investments in the midst of a global panic induced by the coronavirus. (click image to watch video)

Ironically, this interview was recorded on March 9, 2020 — exactly 11 years to the day since the crescendo of global panic that marked the bottom of the 2007-09 bear market.

Here’s the memo that we sent clients and friends ahead of this interview that elaborates on the points made during the news report:

March 9, 2020

At this morning’s opening level of 2,764, the S&P 500 is down over 18% from its all-time high, recorded on February 19. Declines of that magnitude are fairly common occurrences — indeed the average annual drawdown from a peak to a trough since 1980 is close to 14%. But such a decline in barely a month is noteworthy, not for its depth but for its suddenness.

As we all know by now, the precipitants of this decline have been (a) the outbreak of a new strain of virus, the extent of which can’t be predicted, (b) the economic impact of that outbreak, which is equally unknown, and (c) most recently, the onset of a price war in oil. (That last one is surely a problem for everyone involved in the production of oil, but it’s a boon to those of us who consume it.)

The common thread here is unknowability: we simply don’t know where, when or how these phenomena will play out. And in my experience, the thing in this world that markets hate and fear the most is uncertainty. We have no control over the uncertainty; we can and should have perfect control over how we respond to it.

Or, ideally, how we don’t respond. Because the last thing in the world that long-term, goal-focused investors like us do when the whole world is selling is — you guessed it again — sell. Indeed, I welcome your inquiries around the issue of putting cash to work along in here.

On March 3, the erudite billionaire investor Howard Marks wrote, “It would be a lot to accept that the US business world — and the cash flows it will produce in the future — are worth 13% less today than they were on February 19.” How much more true this observation must be a week later, when they’re down 18%.

Be of good cheer. This too shall pass.

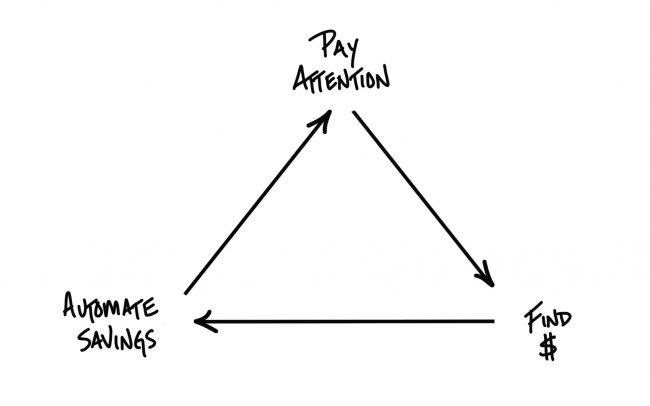

Growing your wealth is a combination of making money and saving money. Today we’re focused on the latter half of that equation. Current trends in the debt market could save thousands of dollars per year for mortgage borrowers.

Growing your wealth is a combination of making money and saving money. Today we’re focused on the latter half of that equation. Current trends in the debt market could save thousands of dollars per year for mortgage borrowers.