Know More, Make More

A new academic study finds that more financially knowledgeable people earn a higher return on their 401(k) retirement savings.

A new academic study finds that more financially knowledgeable people earn a higher return on their 401(k) retirement savings.

Dr Robert Clark (NC State University), Dr. Annamaria Lusardi (George Washington University), and Dr. Olivia Mitchell (University of Pennsylvania) analyzed a unique dataset that combined 401(k) performance data for 20,000 employees plus financial literacy data for the same workers.

Investors deemed to be more financially knowledgeable than peers enjoyed an estimated 1.3% higher annual return in their 401(k)s or other defined contribution plans than those with less knowledge.

According to the study’s authors:

“We show that more financially knowledgeable employees are also significantly more likely to hold stocks in their 401(k) plan portfolios. They can also anticipate significantly higher expected excess returns, which over a 30-year working career could build a retirement fund 25% larger than that of their less-knowledgeable peers.”

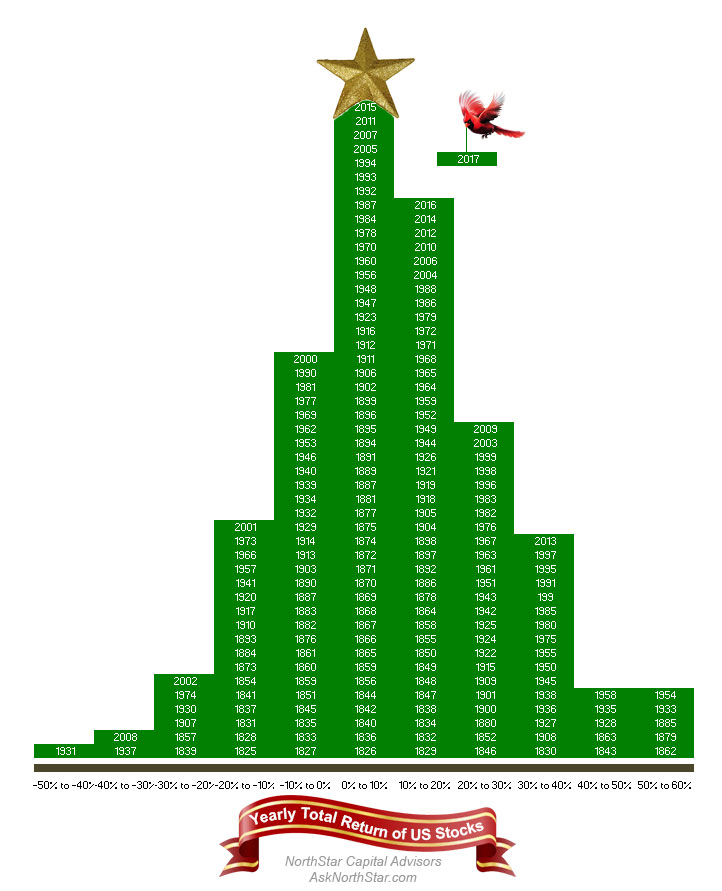

Financially savvy people tend to save more and are more likely to invest those savings in the stock market. But past studies haven’t clearly demonstrated that these people necessarily make better investment decisions. The authors look at patterns in 401(k) retirement accounts and find that more sophisticated investors do indeed get better returns on their savings.

Source: “Financial Knowledge and 401(k) Investment Performance”