What does 2024 have in store?

How did 2023 go for you?

Before the year ends, I like to sit down and review, thinking through what went well and what didn’t.

I try to mentally put the old year to bed before the new year kicks off.

Do you have a similar ritual you follow?

As we enter the final weeks of 2023, let’s take a moment to review some of the year’s major market and economic trends.

(Before I sign off, I’ll also pass along a few thoughts about what 2024 could have in store.)

AI became a major tech trend1

After ChatGPT launched in late 2022, the AI space race took off, with major updates and models hitting the headlines nearly every month.

AI will likely continue to play a major role next year as the tech matures and more companies find ways to use it in their operations.

Though major banks failed in Q1, we survived the crisis2

Markets reeled in the spring when several banks, including big leaguer Credit Suisse, failed in rapid succession due to exposure to risky assets.

Though many worried the financial contagion would spread and kick off a bigger crisis, regulators moved quickly and were able to resolve the situation, protecting the overall financial system.

Washington’s financial squabbles just kept coming

The federal government teetered on the brink of shutdown multiple times this year as lawmakers used financial deadlines to play at brinkmanship.

Fortunately, a shutdown was averted each time.

However, the political games affected U.S. credibility, leading ratings agencies to downgrade U.S. credit and financial outlook, which could increase consumer borrowing costs.3,4

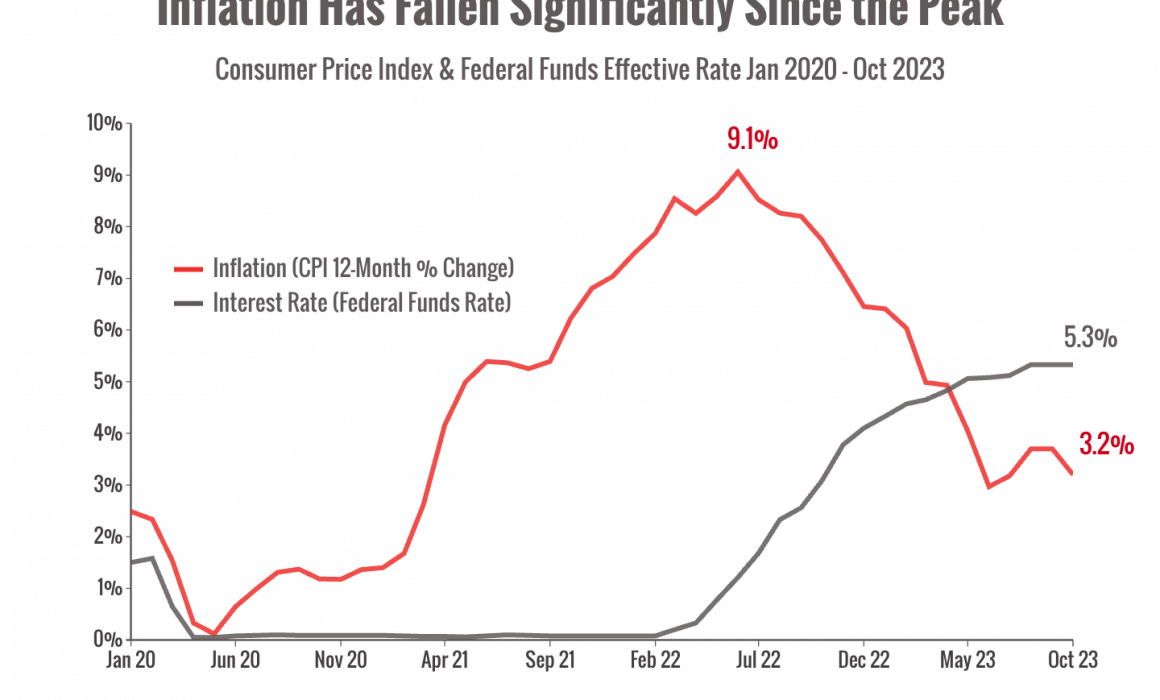

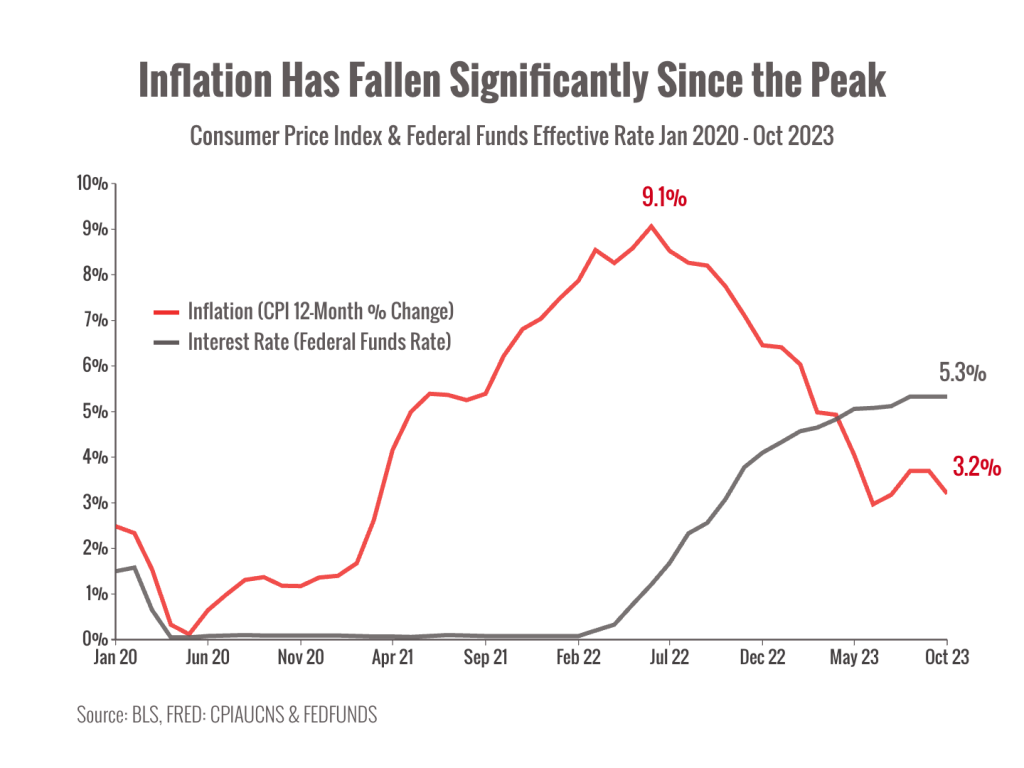

Interest rates may have (finally) peaked5

The push-pull between high inflation and high interest rates continued to be a major trend this year.

However, now that inflation looks to be on a strong downward trend, the Fed might be done hiking and pivot to cutting rates in 2024.

The economy shrugged off recession fears and grew6

Despite a lot of worrying headlines, we didn’t actually see a recession in 2023.

In fact, the economy turned out three straight quarters of growth, powered by strong U.S. consumers.

Will the economy continue to grow? Or will high interest rates knock it off track?

We’ll see in 2024.

Markets gained ground despite a bumpy road7

Despite many struggles along the way, the stock market rallied in 2023, regaining a lot of lost ground since the market bottom in 2022.

Some analysts say we’re already in a bull market, while others won’t officially call it until we regain the previous market peak.8

What does 2024 have in store for us?

We’re watching a lot of trends.

With a contentious election season ahead, markets will likely find plenty of volatility.

A serious correction may be in store, especially if recession fears return.

However, despite what the overblown headlines will tell you, election cycles are just one of the variables that impact markets.

Economics, business performance, and plain old investor psychology all play a part in how markets perform.

Will that predicted recession show up in 2024?

Opinions are mixed, as always. Some economists see slowing growth next year with no recession, while others still believe a recession could happen.

Bottom line

We’re watching, preparing, and thinking ahead about how to position our clients for various scenarios.

Until then, I hope you have a relaxing and amazing end to your 2023.

Sincerely yours,

Dr. Chris