10 Questions That Will Help Define Your Investment Philosophy

To define your investment philosophy, consider these key questions:

To define your investment philosophy, consider these key questions:

- What are your core investment beliefs?

- Do you understand your philosophy and why you believe in it?

- Do you know the potential risks?

- Does it suit your personality and individual circumstances?

- Will your philosophy help you follow whatever strategy you implement?

- What constraints are necessary for turning your philosophy into a portfolio?

- What will you own and why will you own it?

- What will cause you to buy or sell?

- What will cause you to make changes to your portfolio over time?

- What types of investments or strategies will you avoid?

Source: AAII

Financial Free Lunch?

Barry Ritholtz lays bare the myth…

Barry Ritholtz lays bare the myth…

Deep down inside, you already know this: There ain’t no such thing as a free lunch, financially or otherwise.

Of so many free lunches, this is the hard truth:

- You are not going to win the lottery.

- Hot stock tips are worthless (the only exceptions are those especially costly tips that will get you sent to federal prison).

- You are not going to buy an iPad from one of those deal sites for $3.

- No, you are not likely to buy in early to the next Apple or Netflix, and if you do, you are unlikely to hold it long enough.

- No, you are not going to make $10,000 gambling at fantasy sports.

- You (or your kid) are not going to be the next Michael Jordan or Adele.

- The odds are radically against you finding the mutual fund manager or stock broker who is going to make you fabulously rich.

- Indeed, the odds are against you stock picking, market timing or investing in a venture fund, private equity fund or hedge fund that, over the long haul, is going to outperform a simple index fund.

Source: BR

How to Succeed and have a Long and Happy Life

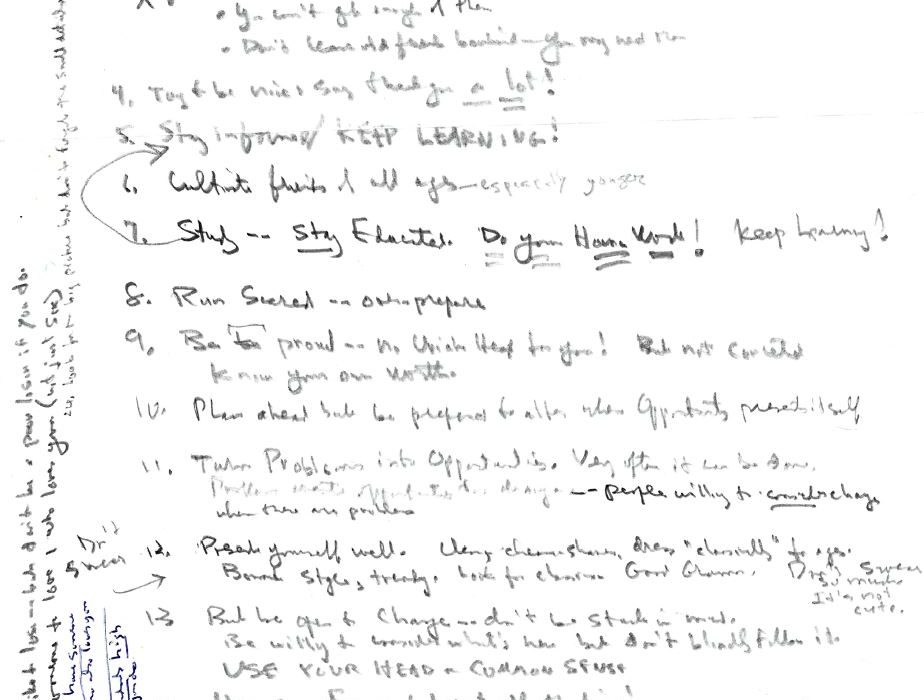

Legendary banker Richard Jenrette passed away last week at the age of 89. In his desk he left a hand-written note listing his 24 rules to succeed in finance and life. The note titled, “What I Learned (How to Succeed and have a Long and Happy Life),” was shared at his memorial service in Charleston, SC:

Legendary banker Richard Jenrette passed away last week at the age of 89. In his desk he left a hand-written note listing his 24 rules to succeed in finance and life. The note titled, “What I Learned (How to Succeed and have a Long and Happy Life),” was shared at his memorial service in Charleston, SC:

- Stay in the game. That’s often all you need to do – don’t quit. Stick around! Don’t be a quitter!

- Don’t burn bridges (behind you)

- Remember – Life has no blessing like a good friend!

- You can’t get enough of them

- Don’t leave old friends behind – you may need them

- Try to be nice and say “thank you” a lot!

- Stay informed/KEEP LEARNING!

- Study — Stay Educated. Do Your Home Work!! Keep learning!

- Cultivate friends of all ages – especially younger

- Run Scared — over-prepare

- Be proud — no Uriah Heep for you! But not conceited. Know your own worth.

- Plan ahead but be prepared to allow when opportunity presents itself.

- Turn Problems into Opportunities. Very often it can be done. Problems create opportunities for change — people willing to consider change when there are problems.

- Present yourself well. Clean, clean-shaven, dress “classically” to age. Beware style, trends. Look for charm. Good grammar. Don’t swear so much — it’s not cute.

- But be open to change — don’t be stuck in mud. Be willing to consider what’s new but don’t blindly follow it. USE YOUR HEAD – COMMON SENSE.

- Have some fun – but not all the time!

- Be on the side of the Angels. Wear the White Hat.

- Have a fall-back position. Heir and the spare. Don’t leave all your money in one place.

- Learn a foreign language.

- Travel a lot — around the world, if possible.

- Don’t criticize someone in front of others.

- Don’t forget to praise a job well done (but don’t praise a poor job)

- I don’t like to lose — but don’t be a poor loser if you do.

- It helps to have someone to love who loves you (not just sex).

- Keep your standards high in all you do.

- Look for the big picture but don’t forget the small details.

This is good advice for anyone!

Source: Bloomberg

Recent Posts

-

Inflation relief June 3,2024

-

Why are markets volatile? May 3,2024

-

Can stocks go higher? April 3,2024

-

Does the Fed really matter? March 2,2024

Archives

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- October 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- November 2010

- October 2010

- September 2010

- August 2010

Categories

- 401(k)

- Annuities

- Behavior

- Best Practices

- Bonds

- Charitable Donations

- Economy

- Fees

- Fiduciary

- Financial Planning

- Investing 101

- Live Well

- Market Outlook

- Mutual Funds

- NorthStar

- Performance

- Personal Finance

- Planning

- Retirement

- Saving Money

- Scams & Schemes

- Seeking Prudent Advice

- Tax Planning

- Uncategorised

- Uncategorized

- Weekly Market Review