Weekly Marker Review ~ Friday, 10/26/12

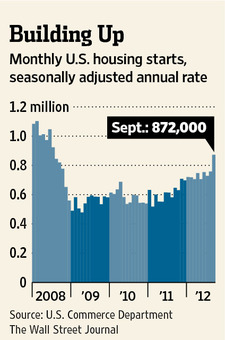

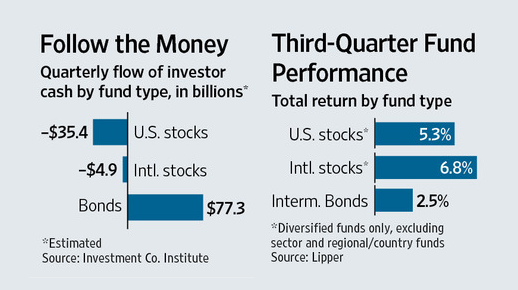

The downturn of last week continued into the early part of Monday, as the Dow dipped early by more than 100 points before recovering for a minimal gain by the end of the day. On Tuesday a plethora of weak earnings reports sent the market crashing again, with the Dow registering an almost 250 point loss. The major indexes failed to bounce back on Wednesday, experiencing yet another loss despite encouraging new home-building and home sales reports. On Thursday stocks earned back a small fraction of previous days’ losses after mixed economic and job-related reports. The major indexes finished the week on Friday with another tiny gain, despite the fact that the third quarter GDP rose by 2.0%, more than expected by analysts. However, investor excitement was tempered by yet more disappointing earnings reports.

The downturn of last week continued into the early part of Monday, as the Dow dipped early by more than 100 points before recovering for a minimal gain by the end of the day. On Tuesday a plethora of weak earnings reports sent the market crashing again, with the Dow registering an almost 250 point loss. The major indexes failed to bounce back on Wednesday, experiencing yet another loss despite encouraging new home-building and home sales reports. On Thursday stocks earned back a small fraction of previous days’ losses after mixed economic and job-related reports. The major indexes finished the week on Friday with another tiny gain, despite the fact that the third quarter GDP rose by 2.0%, more than expected by analysts. However, investor excitement was tempered by yet more disappointing earnings reports.

[table id=86 /]