Lessons of History

History provides a huge wealth of wisdom for helping us grow and protect our money. Trader-turned-educator-turned-financial planner Tony Isola provides an awesome analysis of the application of history lessons:

History provides a huge wealth of wisdom for helping us grow and protect our money. Trader-turned-educator-turned-financial planner Tony Isola provides an awesome analysis of the application of history lessons:

How can investors act as applied historians and use this skill set to create wealth?

There are several minefields that could easily be avoided with some knowledge of the past:

- Most market corrections don’t turn into bear markets.

- Using leverage to boost investment returns often ends badly.

- The president has very little control over the global economy.

- Buying new financial products at market peaks is a poor idea.

- Bull markets last much longer than bear markets.

- Stocks are six times more likely to be up 20% than down the same amount.

- Uncertainty is always present and it is not a wise choice to use it as an excuse not to invest.

- Stocks will do the best job of protecting future purchasing power over long periods of time.

- Investing in the fastest growing world economies will not guarantee higher investment returns.

- Most recessions haven’t turned into depressions.

- Investment costs, savings rates and time in the market are the biggest components in generating healthy investment returns.

- Factor investing won’t work for most people because of their cognitive deficiencies.

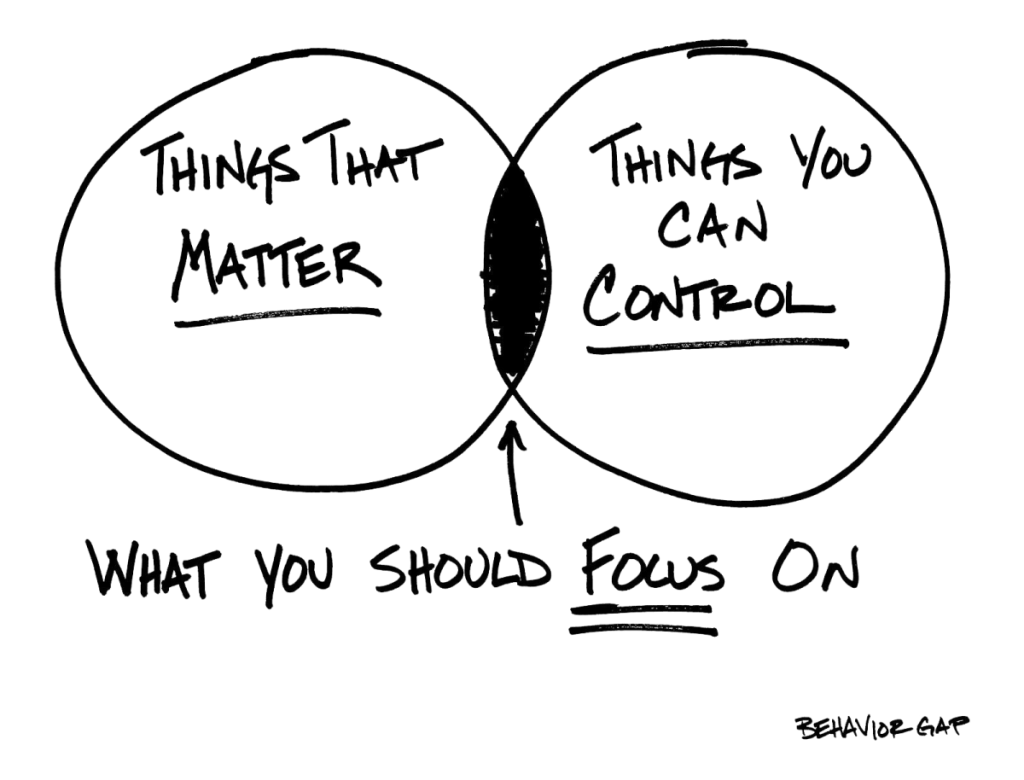

- There is a large behavior gap between total mutual fund returns and what investors actually receive.

- The great majority of mutual fund managers will underperform low-cost index funds because of costs.

- Diversification works, just not every year.

- Stocks can stay massively over- and undervalued for very long periods of time.

- Real returns after inflation are the only returns that matter.

- Stocks are in a bull market 85% of the time.

All of the following can be proven with applied historical analysis. This is a much better strategy than relying on your gut, or believing a compelling story, when allocating money.

Source: Teachable Moment