What’s Wrong with the Financial Services Industry?

According to Barry Ritholtz, the big problems that plague the financial service industry are the following:

According to Barry Ritholtz, the big problems that plague the financial service industry are the following:

• Simplicity does not pay well: Investing should be relatively simple: Buy broad asset classes, hold them over long periods of time, rebalance periodically, get off the tracks when the locomotive is bearing down on you. The problem is its easier in theory than is reality to execute. And, it is difficult to charge excessive fees for these services.

• Confusion is not a bug, its a feature: Thus, the massive choice, the nonstop noise, confusing claims, contradictory experts all work to make this much a more complex exercise than it need be. This is by design.

• Too much money attracts the wrong kinds of people: Let’s face it, the volume of cash that passes through the Financial Services Industry is enormous. Few who enters finance does so for altruistic reasons. There is a difference between normal greed (human nature) and outright criminality. This is why strong regulators and enforcement cops are required.

• Incentives are misaligned: Too many people lack the patience to get rich slowly. Hence, not only do the wrong people work in finance, and some of the right people exercise bad judgment.

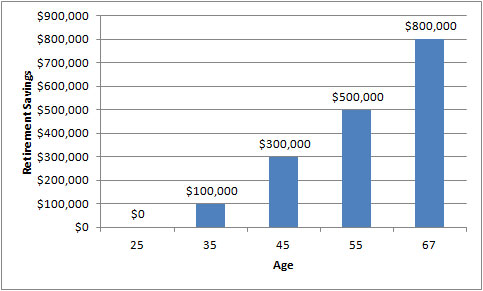

• Too many people have a hand in your pocket: The list of people nicking you as an investor is enormous. Insiders (CEO/CFO/Boards of Directors) transfer wealth from shareholders to themselves, with the blessing of corrupted Compensation Consultants. 401(k)s are disastrous. NYSE and NASDAQ Exchanges have been paid to allow a HFT tax on every other investor. FASB and Accountants have done an awful job, allowing corporations to mislead investors with junk balance statements. The Media’s job is to sell advertising, not provide you with intelligent advice. The Regulators have been captured.

Source: The Big Picture