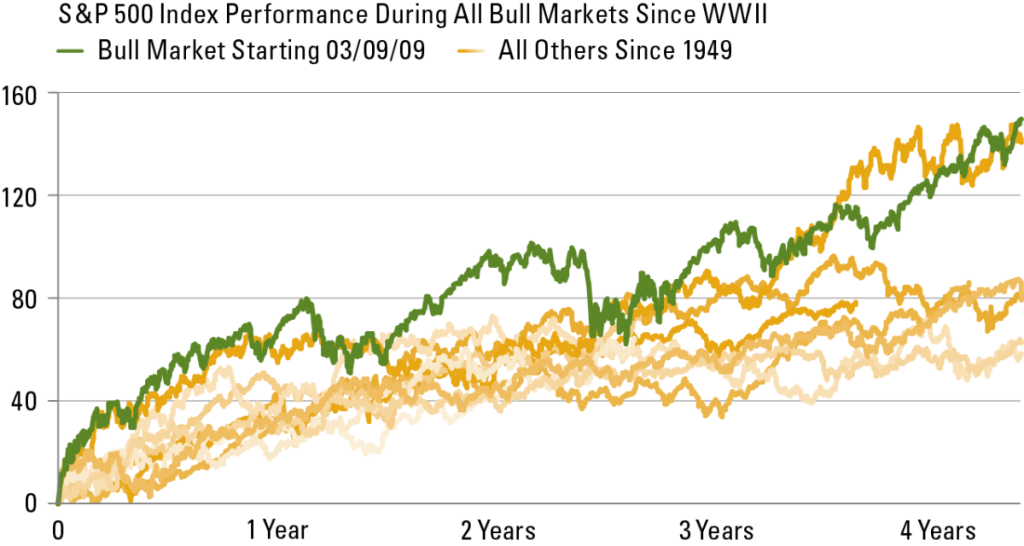

Strongest Bull Market Since WWII

The current bull market that began in March 2009 is the strongest bull market recorded by the S&P 500 since the end of World War II (see green line in chart above).

The current bull market that began in March 2009 is the strongest bull market recorded by the S&P 500 since the end of World War II (see green line in chart above).

The market has accomplished this achievement despite a litany of negatives,

- Fiscal cliff tax increases;

- Sequester spending cuts;

- High oil prices;

- Italian election debacle;

- Cyprus bank bailout;

- Weakening Chinese economic growth;

- Federal Reserve communicating the intention to end quantitative easing (QE);

- Downward revisions to earnings growth estimates;

- Rising interest rates;

- A rise in geopolitical risk from North Korea, Egypt, and Syria; and

- Bouts of defensive sector market leadership and weak trading volume.

Sources:

Chart o’ the Day: Strongest Bull Market In 65 Years

What’s Powering the Strongest Bull Market Since WWII?