Could the election tank the market? 3 things you need to know

The 2020 election is around the corner, adding another layer of uncertainty to an already volatile market.

This could be one of the most divisive races we’ve seen. We can’t predict its outcome or what it could mean for the economy.

So how can we keep a level head and make informed decisions amid so much chaos?

We made a quick video discussing three things you need to know to help protect your investments in the face of the unknown.

Video Transcript:

This is the FOURTH presidential election that we’ve navigated in our 15 years of helping our clients reduce taxes, invest smarter, and live better.

And we’re here to help you stay level-headed — even in times of chaos. The 2020 election is coming up fast, and we’ve had worried folks ask us: Will it tank the market?

In this video, we’ll give you three things to keep in mind so you can plan for uncertainty.

2020 has been wild, to say the least. And the upcoming election could be one of the most divisive races we’ve ever seen. Add a pandemic, confusing market trends, and it’s no wonder people are worried.

But let’s trade panic for perspective. Here are three WAYS we can prepare for election uncertainty:

#1 — It’s normal for markets to be more volatile in election years. But remember, other factors are always at play, like business cycles, interest rates, corporate profits — and, of course, unpredictable events like the pandemic. So what can you do? Take a deep breath and focus on the post-election period. If you want, we can help you create a plan to pursue long-term success, no matter who wins in November.

#2 — Markets don’t like uncertainty, and they don’t like surprises. So we can expect things to be a bit bumpy in the short term, especially in the weeks before and after the vote.

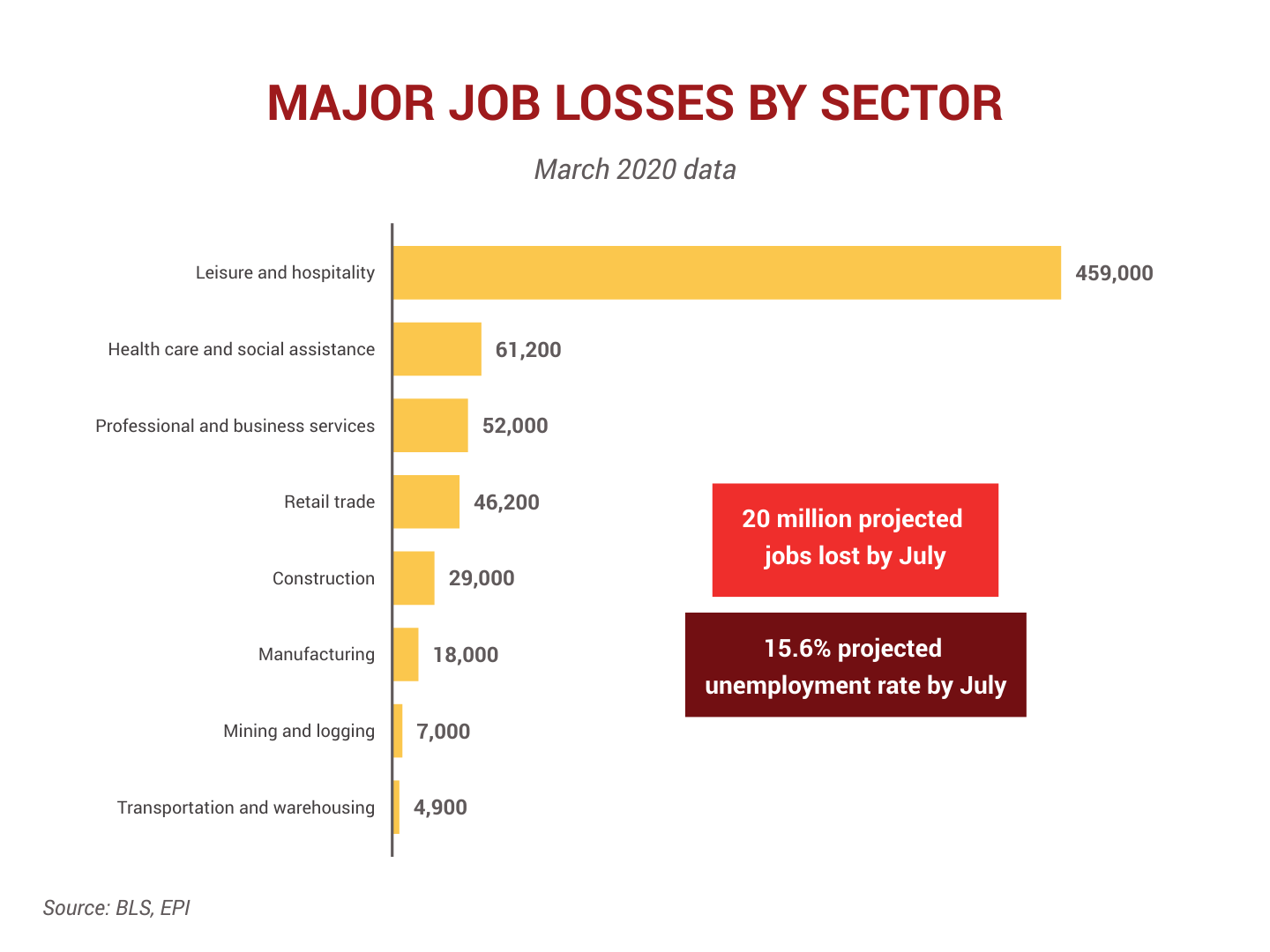

#3 — Regardless of who wins, the government will be focusing on the coronavirus and the country’s economic recovery. We don’t know what this will look like or how quickly things will happen. With some preparation now, we can help you create a financial plan that accounts for this uncertainty — and you can be less worried about your portfolio.

Listen, we don’t have a crystal ball. But we do have the advantage of knowing what’s happened in the past, and being able to prepare for what could happen in the future. While the past can’t predict the future, we can look to it for powerful perspective.

If you have questions about how the 2020 election might affect your portfolio or you’d like to talk one-on-one, please reach out.

As always — we thank you for your support, we appreciate your engagmement, and please be well.