What is financial planning?

Today I want to zoom out to talk about the principles and beliefs that underpin good financial planning.

On its own, “financial planning” is a very broad and nebulous term.

But let’s narrow and clarify this.

These are the core principles from my perspective as a CERTIFIED FINANCIAL PLANNER™, a retirement planning firm owner, and someone who has walked this path with successful & thriving families for the past 17 years.

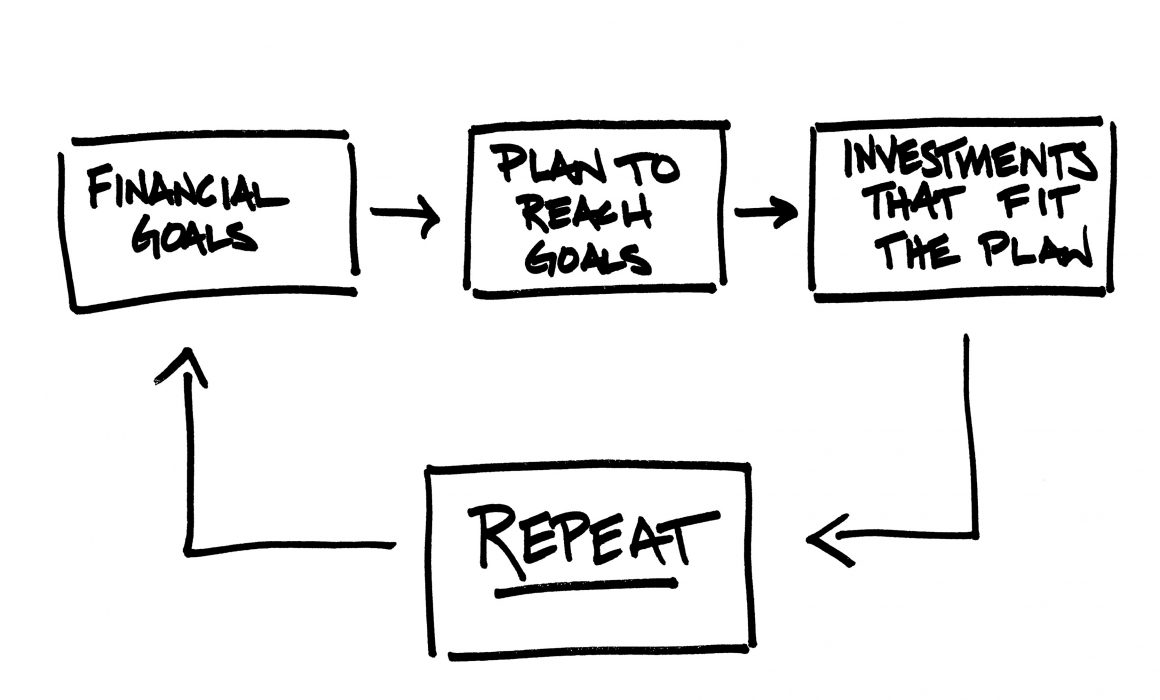

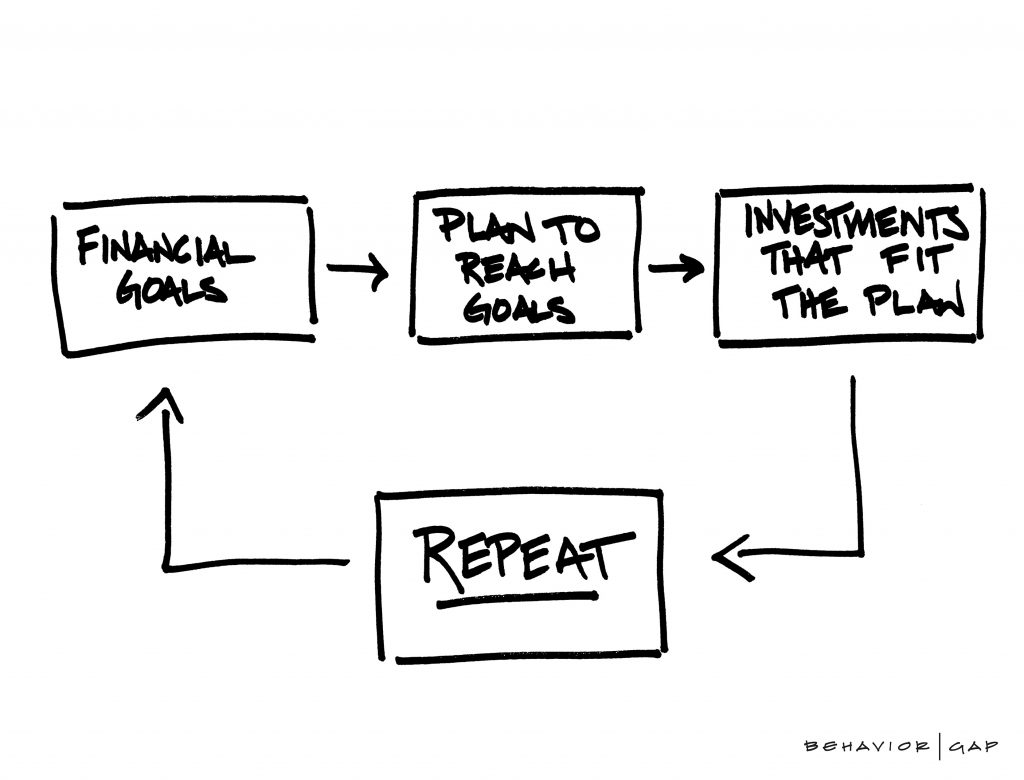

#1 — To Be Successful, You Must Have a Plan: Just like you don’t get into your car without a destination and an approximate route to get there in mind, financial planning is much the same. To be successful, we must first define what success means — that is the identification of your life’s purpose and the goals associated with that purpose. Then we can craft a financial strategy specifically designed to pursue those objectives.

#2 — We Are Planning Focused: Many firms are either primarily insurance or investment focused, whereas we are planning-focused. This is because we know that decisions made in one area will impact many others. Thus, we constantly keep your complete financial life in mind to ensure proper alignment between each of your life’s goals.

#3 — Financial Planning Is Not Precise; It Is Adaptive: We know that the world (markets, economy, tax law, etc.) and our personal lives (income, health, family) are ever-changing. A plan that sits on a shelf couldn’t possibly account for all that life will throw at you, so we meet regularly throughout the year to adjust your plan as needed to reflect the current reality.

#4 — We Control the Things We Can Control: We will not pretend to know which way the market will go next as there are no facts about the future. We believe in controlling what we can control. That is, the amount we save, how long we give our savings to grow, our asset allocation, our behavior, how we plan to minimize our lifetime tax bill, and how we plan for various risks. These are what will ultimately determine your success.

#5 — Prepare for What Can Go Wrong; Invest for What Can Go Right: Even the absolute best investment portfolio can be undone if you are not prepared for life’s what-ifs. A few examples might include an unexpected death, health issues, accidents, lawsuits, or becoming disabled. Planning for and insuring against these risks is what allows us to invest for all that can go right. We cannot control what happens to us, so it is imperative that we are prepared for each of these possibilities.

#6 — Good Planning Has a Long Time Horizon: We view every client relationship as a lifelong partnership. This is a significant advantage because our single objective is to provide advice that will (hopefully) result in the accomplishment of your multi-decade goals and we expect to walk with you every step of the way.

#7 — We Follow Our Own Advice: As the steward of our clients’ complete financial lives, we believe that we should plan for our own financial lives by using these same financial planning principles. So, that’s exactly what we do.

Whether you’re doing this work on your own or partnering with a professional, I strongly believe these concepts are critical to your process of success.

By the way, you will notice that much of the specifics in terms of HOW we do financial planning is purposefully omitted (click here if you’re curious about those technical details).

I’ve done this for a reason. It’s much more important that we agree on the core principles at a 30,000-foot level — versus specific tools & techniques — to achieve your best outcomes.

To your planning & continued success,

Dr. Chris