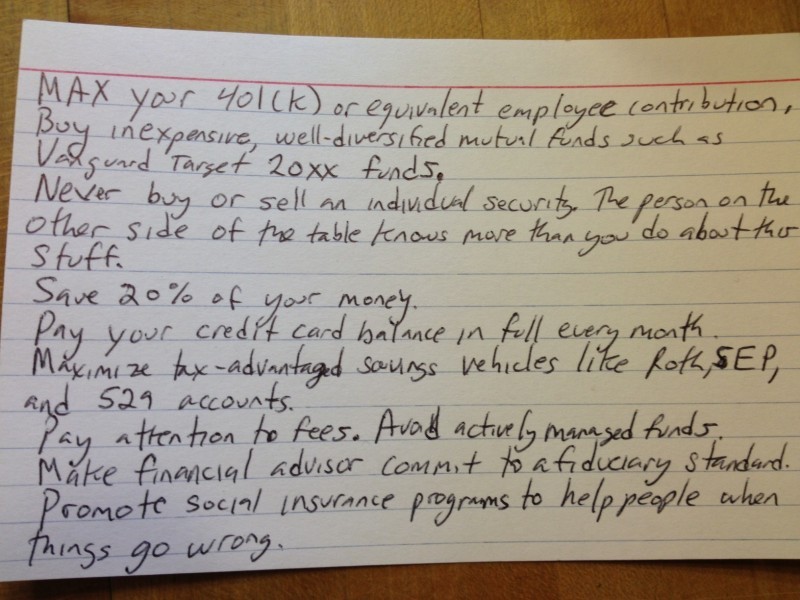

Index Card of Personal Finance Essentials

Simplicity is a great foundation and powerful foil to unnecessary complexity. University of Chicago professor Harold Pollack champions this approach to personal finance and dashed out this index card to make his point.

We work with our clients to go above and beyond the common sense, but it’s built upon a strong foundation of essentials similar to Dr. Pollack’s.