Weekly Market Review ~ Friday, 11/30/12

The Dow and S&P 500 experienced modest losses on Monday following last week’s huge upswing, as slightly disappointing Black Friday sales dampened the mood a bit. Still, the NASDAQ managed a small gain. On Tuesday selling accelerated as word sperad that Republican and Democrat leadership were not making any progress on fiscal cliff talks. Stocks bounced back on Wednesday following remarks by House Leader John Boehner and President Obama expressing optimism over a deal being reached. On Thursday stocks zigzagged with each sentence uttered by the leading politicians to settle somewhat higher. The market closed the week on Friday with little fanfare, as US consuner spending slipped for the first time in six months.

The Dow and S&P 500 experienced modest losses on Monday following last week’s huge upswing, as slightly disappointing Black Friday sales dampened the mood a bit. Still, the NASDAQ managed a small gain. On Tuesday selling accelerated as word sperad that Republican and Democrat leadership were not making any progress on fiscal cliff talks. Stocks bounced back on Wednesday following remarks by House Leader John Boehner and President Obama expressing optimism over a deal being reached. On Thursday stocks zigzagged with each sentence uttered by the leading politicians to settle somewhat higher. The market closed the week on Friday with little fanfare, as US consuner spending slipped for the first time in six months.

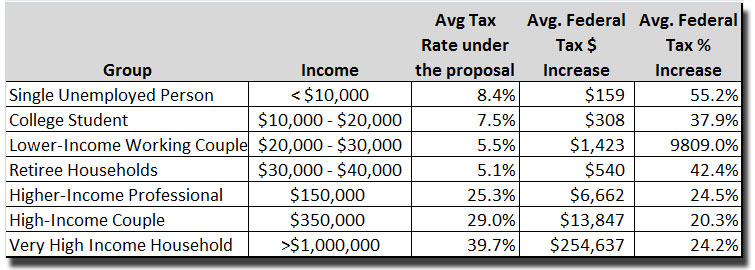

[table id=91 /]