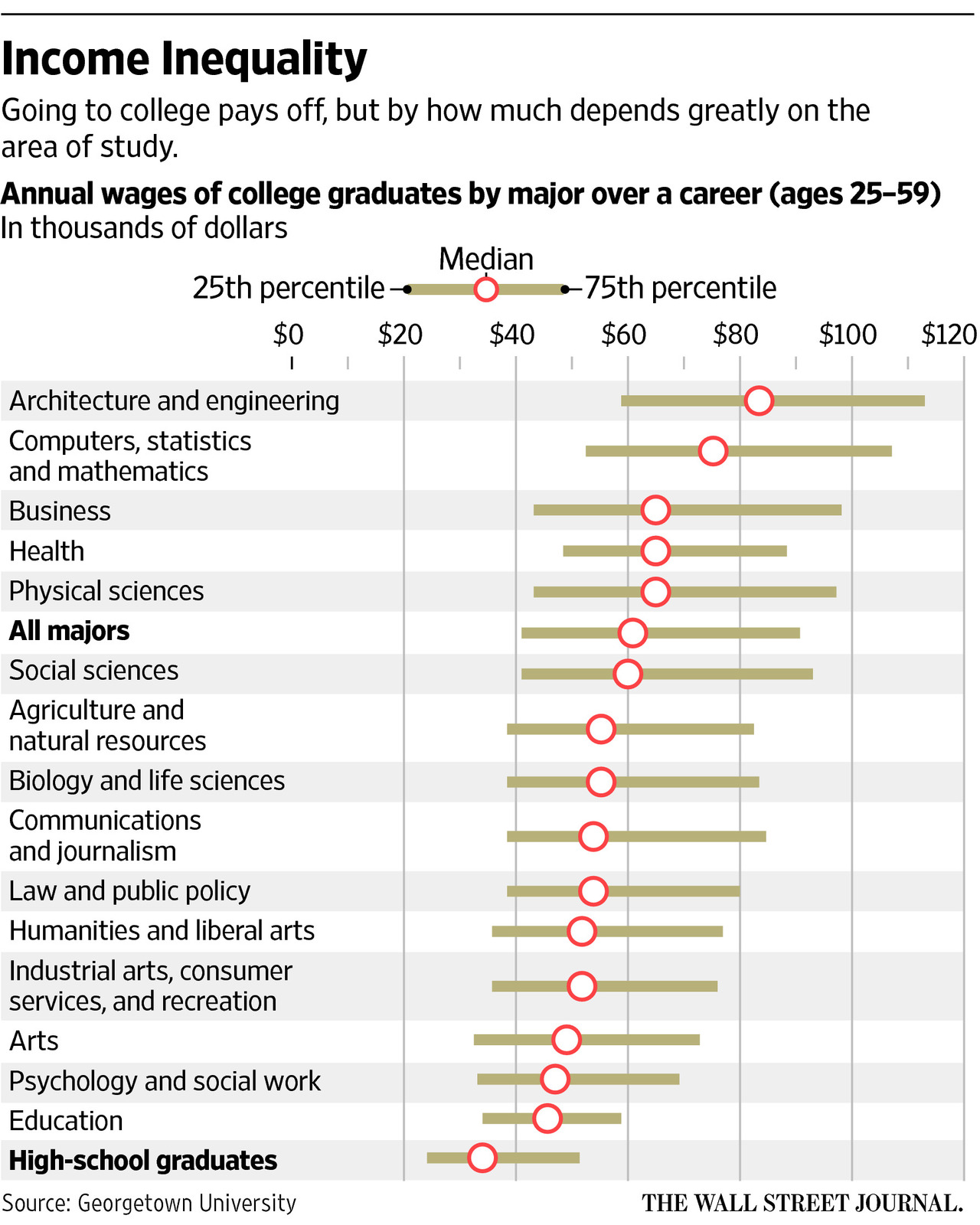

US Economic Performance by State

Wealth varies widely across the 50 states. The map below demonstrates just how widely.

States colored in dark green have highest gross state product (GSP) per capita; the lowest are in yellow. The size of each State is proportional to Real Gross Domestic Product for 2014. Real GDP is the US grew by 2.2% in 2014, higher than the 1.9% growth in 2013.

Again, state color shows the GDP per person while the state size reflects GDP overall.

Source: Fixr

3 Characteristics of Good Financial Advice

Searching for a good advisor? Here’s an insightful opinion on the 3 characteristics good financial advice should demonstrate:

Searching for a good advisor? Here’s an insightful opinion on the 3 characteristics good financial advice should demonstrate:

It should be given by someone you like who is qualified to be giving advice. This may seem so elementary, but it’s absolutely worth noting. Financial success is not typically something that happens in short periods of time. Most times it requires long stretches of behavioral adjustment. Therefore, the giver of advice is likely someone you will want to develop a relationship with. Relationships without chemistry are not usually very successful for any useful period of time. They should also be qualified to be giving the advice.

- It should only be given after arriving at a conclusion based on an exploration into your needs. Taking off the cuff financial advice should be avoided at most costs. If it is simply a fact or specific rule that applies to anyone – like IRA contribution limits at a certain age / income level, that’s fair. But if it has to do with how you should be allocating assets, how much you should be saving, what types of accounts you should have – these are all things that require developing a far deeper understanding than a brief conversation can offer.

- It should be simple for both the receiver and giver to understand. If the person giving the advice has your better interest in mind, they will have a deep grasp whatever it is they are recommending you do or invest in. If they truly do, it will be conveyed with ease. It may require some detective work on your part, but it shouldn’t be too difficult to figure out if you are listening to someone who doesn’t deeply understand the stuff they are talking about.

Source: TCP

Ten Harsh Financial Commandments

I) You will not buy low or sell high.

II) You will cut your winners and let your losers run.

III) You will wish you owned more of what’s going up and less of what’s going down.

IV) You will be fearful when others are fearful.

V) You will fight the trend.

VI) You will not buy when there is blood in the streets.

VII) You will spend too much time worrying about low probability outcomes.

VII) You will invest for the long-term, or until we get a ten percent correction, whichever comes first.

IX) You will go broke taking small profits.

X) You will not just sit there, you’ll do something.

Source: II

Recent Posts

-

Inflation relief June 3,2024

-

Why are markets volatile? May 3,2024

-

Can stocks go higher? April 3,2024

-

Does the Fed really matter? March 2,2024

Archives

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- October 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- November 2010

- October 2010

- September 2010

- August 2010

Categories

- 401(k)

- Annuities

- Behavior

- Best Practices

- Bonds

- Charitable Donations

- Economy

- Fees

- Fiduciary

- Financial Planning

- Investing 101

- Live Well

- Market Outlook

- Mutual Funds

- NorthStar

- Performance

- Personal Finance

- Planning

- Retirement

- Saving Money

- Scams & Schemes

- Seeking Prudent Advice

- Tax Planning

- Uncategorised

- Uncategorized

- Weekly Market Review