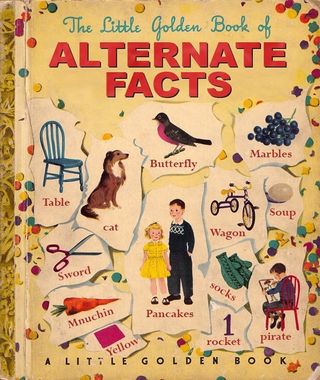

The (Alternative) Facts of Investing

How well do you know the “alternative facts” of investing? Phil Huber, CIO at Huber Financial, recently penned a great piece where he laid out what can appropriately be interpreted as the investing equivalent of FAKE NEWS:

How well do you know the “alternative facts” of investing? Phil Huber, CIO at Huber Financial, recently penned a great piece where he laid out what can appropriately be interpreted as the investing equivalent of FAKE NEWS:

Past performance is indicative of future results. Period!

Risk and return are NOT related. Period!

There is a direct correlation between how much a fund manager charges and how skilled they are. Period!

Standard deviation is risk. Period!

Nothing bad will happen if you mix your politics and your portfolio. Period!

Price is what you get, value is what you pay. Period!

The United States is the only capital market in the world and any attempts at investing in international stocks and bonds for diversification should be met with ridicule. Period!

Some investments are so great that they should be bought at any price. Period!

Three years is a statistically appropriate timeframe to judge the performance of an investment. Period!

Be greedy when others are greedy and fearful when others are fearful. Period!

Your calls for hyperinflation and currency debasement were not wrong, they were just early. Period!

If you can predict the outcome of an event, surely you can also predict how millions of other people will react to said outcome. Period!

The Dow is an accurate representation of the entire stock market. Period!

Price returns matter more than total returns. Period!

You can remain solvent longer than the market can remain irrational. Period!

The time to buy is when there’s a party in the street. Period!

Timing the market is more important than time in the market. Period!

Hedge Funds are an asset class. Period!

The perfect portfolio exists. Period!

It’s OK to let the tax tail wag the investment dog. Period!

It’s a stock picker’s market. Really, I mean it this time. Period!

Markets are perfectly efficient. Period!

Markets are wildly inefficient. Period!

This time is different. Period!

Phil goes on to point out that in many cases, the opposite is a closer approximation of reality and good behavior. He recommends the following ways to prevent “alternative facts” of investing from seeping into your portfolio:

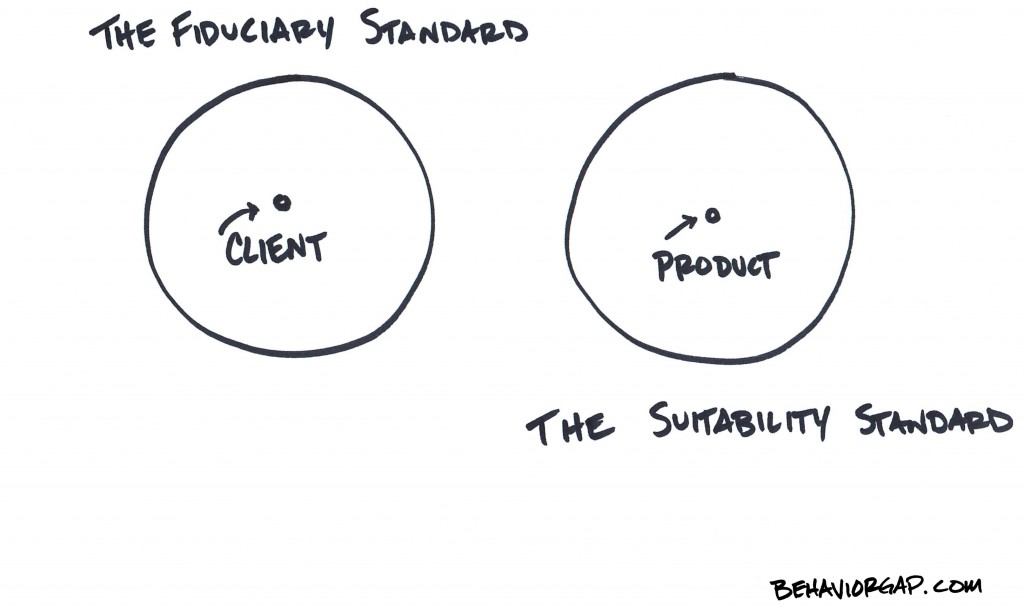

- Work with financial professionals that act as your fiduciary and put your interests ahead of their own.

- Implement an investment philosophy that isn’t predicated on forecasting an unknowable future.

- Have a written investment policy statement that governs how you or your advisor is going to manage your portfolio ahead of time. Refer back to that document when the going gets tough.

- Remember that the plural of anecdote isn’t data.

Source: B&P