Understanding Your Role and Responsibilities as a Power of Attorney

We wanted to provide you with some essential information regarding the role and responsibilities associated with being named a Power of Attorney (POA).

We wanted to provide you with some essential information regarding the role and responsibilities associated with being named a Power of Attorney (POA).

This is a critical aspect of estate planning and can have significant implications for both you and the principal (the person who has granted you this authority).

What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that grants a person (referred to as the agent or attorney-in-fact) the authority to act on behalf of another person (the principal). The extent of this authority is explicitly outlined in the document. It can range from very broad, sweeping powers to limited authority for specific circumstances.

There are different types of POAs:

-

Immediate POA: Goes into effect as soon as it is signed.

-

Springing POA: Only becomes effective if the principal loses capacity. However, the Springing POA is less favored in estate planning because proving incapacitation can be challenging.

It’s crucial to understand the specific terms outlined in the POA document you hold, as this will dictate the scope of your responsibilities and powers.

Your Responsibilities as a POA

Being named as a POA means you have the legal authority to act on someone else’s behalf. This role is often utilized when the principal becomes ill, disabled, or is otherwise unable to manage their affairs. Here are some common responsibilities you may be expected to undertake:

-

Financial Management: Oversee and manage the principal’s financial affairs.

-

Bank Accounts: Have direct access to and manage the principal’s bank accounts.

-

Insurance Decisions: Make decisions regarding the principal’s insurance policies.

-

Estate Documents: Maintain possession of and manage estate documents.

-

Tax Returns: File the principal’s tax returns.

-

Safe Deposit Box: Access and manage items in the principal’s safe deposit box.

-

Real Estate Transactions: Sign documents related to the sale or purchase of real estate.

-

Detailed Record-Keeping: Keep meticulous records of all financial transactions, including bills paid, assets sold or traded, and income collected. It’s also important to document your own expenditures if you seek compensation for your efforts (e.g., saving gas receipts, mileage, etc.).

What a POA Cannot Do

While the POA grants significant authority, there are limits to what you can do:

-

Write, Amend, or Revoke Estate Plans: In most states, you cannot write, amend, or revoke a will, trust, or other estate planning documents.

-

Vote on Behalf of the Principal: You cannot vote in public elections on behalf of the principal.

-

Make Decisions Beyond the Document: You cannot make decisions that are not explicitly stated in the POA document.

-

Transfer Assets to Yourself: You cannot transfer the principal’s assets into your own name unless explicitly authorized.

-

Borrow or Lend Money: You cannot borrow or lend money on behalf of the principal unless the POA document specifically grants this authority.

Durable Power of Attorney

One important aspect to understand is the concept of a “Durable” Power of Attorney. A Durable POA remains in effect even if the principal becomes physically or mentally incapacitated. This means your responsibilities and authority will continue regardless of the principal’s health status. Without this durable component, your role as POA would cease if the principal becomes incapacitated.

Final Thoughts

Being named a POA is a significant responsibility and a powerful tool in estate planning.

It is essential to fully understand the scope of your authority and the duties you are expected to perform.

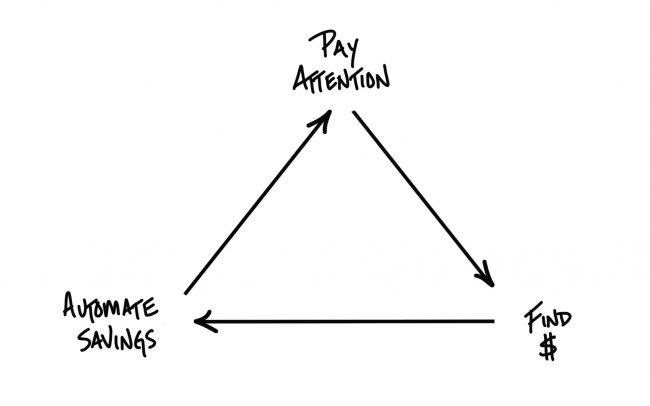

Growing your wealth is a combination of making money and saving money. Today we’re focused on the latter half of that equation. Current trends in the debt market could save thousands of dollars per year for mortgage borrowers.

Growing your wealth is a combination of making money and saving money. Today we’re focused on the latter half of that equation. Current trends in the debt market could save thousands of dollars per year for mortgage borrowers.