Thank You for Nine Years!

NorthStar Capital Advisors would like to take this special occasion to thank you, our loyal clients and friends, as tomorrow we celebrate 9 years of financial planning and investment management. We have come a long way since we rolled out our objective and disciplined approach to investing in 2006. Our success is attributable to clients and friends who faithfully support our business and receive great service and advice in return.

NorthStar Capital Advisors would like to take this special occasion to thank you, our loyal clients and friends, as tomorrow we celebrate 9 years of financial planning and investment management. We have come a long way since we rolled out our objective and disciplined approach to investing in 2006. Our success is attributable to clients and friends who faithfully support our business and receive great service and advice in return.

We deeply appreciate your loyalty and support over the past 9 years. We hope you and your family have a safe and happy holiday!

With heartfelt thanks,

Chris Mullis, Jimmy Irwin & David Berger

Thank You for Eight Years!

NorthStar Capital Advisors would like to take this special occasion to thank you, our loyal clients and friends, as today we celebrate 8 years of managing investment portfolios. We have come a long way since we rolled out our objective and disciplined approach to investing in 2006. Our success is attributable to clients and friends who faithfully support our business and receive great service and advice in return.

NorthStar Capital Advisors would like to take this special occasion to thank you, our loyal clients and friends, as today we celebrate 8 years of managing investment portfolios. We have come a long way since we rolled out our objective and disciplined approach to investing in 2006. Our success is attributable to clients and friends who faithfully support our business and receive great service and advice in return.

We deeply appreciate your loyalty and support over the past 8 years. We hope you and your family have a safe and happy holiday!

With heartfelt thanks,

Chris Mullis, Jimmy Irwin & David Berger

Thank You for Seven Years!

NorthStar would like to take this special occasion to thank you, our loyal clients and friends, as today we celebrate 7 years of managing investment portfolios. We have come a long way since we rolled out our objective and disciplined approach to investing in 2006. Our success is attributable to clients and friends who faithfully support our business and receive great service and advice in return.

NorthStar would like to take this special occasion to thank you, our loyal clients and friends, as today we celebrate 7 years of managing investment portfolios. We have come a long way since we rolled out our objective and disciplined approach to investing in 2006. Our success is attributable to clients and friends who faithfully support our business and receive great service and advice in return.

We deeply appreciate your loyalty and support over the past 7 years. We hope you and your family have a safe and happy holiday!

With heartfelt thanks,

Your NorthStar Team

Like Herding Cats?

Do you ever get the feeling that managing your finances is like herding cats? If you’re like the typical person with dozens of banking, credit card and investment accounts housed at an array of financial institutions, it sure can feel like it!

Do you ever get the feeling that managing your finances is like herding cats? If you’re like the typical person with dozens of banking, credit card and investment accounts housed at an array of financial institutions, it sure can feel like it!

Here are two great ways to corral your accounts and take control of that herd!

#1 Use Mint.com to get a comprehensive, “live” view of your accounts

Mint.com is a free web-based personal financial management service. Mint’s primary service allows users to track bank, credit card, investment, and loan transactions and balances through a single user interface. Users can also make budgets and goals.

It takes less than five minutes to set up an account and start loading your accounts. Each time you log in, Mint automatically polls your financial service providers for the most up-to-date balances for all your accounts.

#2 Consolidate your retirement accounts

It’s not uncommon for people to have four or more investment accounts (e.g., 401(k)s, profit-sharing accounts, IRAs, etc) that they have accumulated from working at various companies or even inherited. You should consider rolling accounts that have the same tax deferred treatment into a single giant IRA.

Consolidating your accounts will make it easier for you to monitor performance, rebalance your portfolio, maintain your asset allocation, and manage required distributions.

NorthStar Capital Advisors has an article What to Do with Your Old 401(k) that walks through the options including creating a consolidated “Rollover IRA” that will help you see the big picture more easily and help you make more informed decisions.

Smart Money Newsletter ~ November 2012

The latest issue of Smart Money is hot off the press!

The latest issue of Smart Money is hot off the press!

Smart Money is a NorthStar publication that covers financial education, money management, and investment strategies.

Here’s what you’ll find in the latest issue:

Financial Readiness — As Critical As Fully Charged Batteries

In light of the incredible impact of Megastorm Sandy last month, we want to spotlight the importance of “financial readiness” when it comes to disaster preparedness. It’s just as critical as filling the gas tank in your car and making sure you’ve got plenty of batteries ahead of an emergency.

What to Do With Your Old 401(k)?

Be it from changing jobs or retiring, it’s very common to have at least one old 401(k) account accumulating cobwebs in a dark corner of your financial closet. Shine a light there and make sure you’re doing the right thing. Here’s a quick overview of how to make a savvy decision with managing your old retirement accounts. Want more details? Check out our in-depth companion article on 401(k) choices available here.

Click the cover image to view or click here to download it directly. You can always get the latest issue of Smart Money by visiting www.nstarcapital.com/newsletters.

Given the universal importance of financial readiness, please do your friends and family a favor by sharing this article with them.

![]()

Thank You for Six Years!

NorthStar would like to take a moment to thank you, our loyal clients and friends, as today we celebrate 6 years of managing investment portfolios. We have come a long way since we rolled out our objective and disciplined approach to investing in 2006.

NorthStar would like to take a moment to thank you, our loyal clients and friends, as today we celebrate 6 years of managing investment portfolios. We have come a long way since we rolled out our objective and disciplined approach to investing in 2006.

Our success is attributable to clients like you who faithfully support our business and receive great service and advice in return.

Thank you again for your loyalty and support over the past 6 years. We are excited about what the future holds and we are thankful to be a healthy organization, consistently updating and improving our abilities to serve you. We appreciate your trust, and we’ll continue to do our best to give you the kind of service you deserve. We remain ambitious and committed to making both your investments and NorthStar Capital Advisors even more successful!

Best regards,

The NorthStar Team

Smart Money Newsletter ~ December 2011

Searching for a unique holiday gift for your friends and family? Read the latest issue of NorthStar’s newsletter for two money-savvy recommendations for both young and old.

Here’s the December issue of Smart Money. This is a complimentary newsletter published by NorthStar Capital Advisors that covers financial education, money management, and investment strategies.

Click the cover image to view or click here to download it directly. You can always get the latest issue of Smart Money by visiting www.nstarcapital.com/newsletters.

The Investing 101 column defines “rebalancing” and describes why it’s important to optimize your portfolio. This quarter’s issue also covers the academic origins of NorthStar and words of wisdom from John Bogle, an investment giant of the 20th century.

We hope you find this information useful. Please feel free to share with family and friends if you find it valuable. Best wishes for the holiday season!

Thank you

Smart Money Newsletter ~ September 2011

Here’s the September issue of Smart Money. This is a complimentary newsletter published by NorthStar Capital Advisors that covers financial education, money management, and investment strategies.

Here’s the September issue of Smart Money. This is a complimentary newsletter published by NorthStar Capital Advisors that covers financial education, money management, and investment strategies.

Click the cover image to view or click here to download it directly. You can always get the latest issue of Smart Money by visiting www.nstarcapital.com/newsletters.

The lead article describes how financial fraudsters come in all guises and often scam people in their most intimate social circles. Please help protect yourself, your friends, and your family by learning to recognize these swindlers and sharing this article with others.

The Investing 101 column walks you through the asset allocation puzzle, the biggest decision you will make regarding your investments. The newsletter also covers college savings and advice from Warren Buffett.

We hope you find this information useful. Please feel free to share with family and friends if you find it valuable.

Thank you

$mart Money Newsletter ~ May 2011

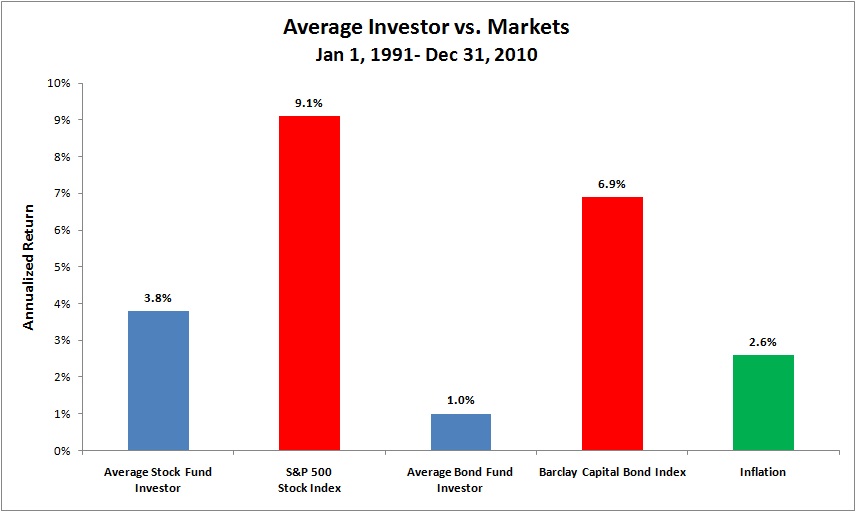

$mart Money is a quarterly newsletter published by our company. The lead article discusses how our natural instincts can seriously erode our investment returns and how to avoid these pitfalls. The Investing 101 column reviews the basics of stocks and bonds.

Download your free copy of the $mart Money Newsletter

Recent Posts

-

Inflation relief June 3,2024

-

Why are markets volatile? May 3,2024

-

Can stocks go higher? April 3,2024

-

Does the Fed really matter? March 2,2024

Archives

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- October 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- November 2010

- October 2010

- September 2010

- August 2010

Categories

- 401(k)

- Annuities

- Behavior

- Best Practices

- Bonds

- Charitable Donations

- Economy

- Fees

- Fiduciary

- Financial Planning

- Investing 101

- Live Well

- Market Outlook

- Mutual Funds

- NorthStar

- Performance

- Personal Finance

- Planning

- Retirement

- Saving Money

- Scams & Schemes

- Seeking Prudent Advice

- Tax Planning

- Uncategorised

- Uncategorized

- Weekly Market Review