Weekly Market Review ~ Friday, 03/30/12

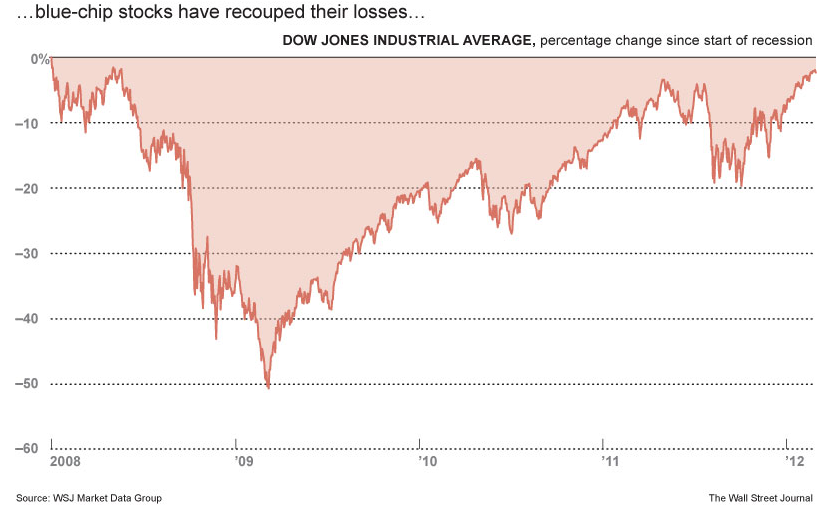

The major indexes gained more than one percent on Monday following remarks by Fed Chair Ben Bernanke that low interest rates will most likely remain for the foreseeable future to combat high unemployment. The S&P 500 hit a 4-year high. On Tuesday, the upward momentum could not be maintained despite expected consumer confidence and home price reports, as stock prices slid moderately. The slide continued on Wednesday as a US durable goods report failed to live up to expectations that the US economy is recovering. On Thursday, the indexes finished mixed as a revised US GDP report for the fourth quarter of 2011 failed to inspire buyers. Stocks closed the week and the first quarter of 2012 on Friday on another upnote, as the Dow finished Q1 with an 8.1% gain, its largest first quarter gain of a year since 1998. The tech-heavy NASDAQ recorded a 19% first quarter gain, its highest since 1991. The S&P 500 logged a 12% gain.

The major indexes gained more than one percent on Monday following remarks by Fed Chair Ben Bernanke that low interest rates will most likely remain for the foreseeable future to combat high unemployment. The S&P 500 hit a 4-year high. On Tuesday, the upward momentum could not be maintained despite expected consumer confidence and home price reports, as stock prices slid moderately. The slide continued on Wednesday as a US durable goods report failed to live up to expectations that the US economy is recovering. On Thursday, the indexes finished mixed as a revised US GDP report for the fourth quarter of 2011 failed to inspire buyers. Stocks closed the week and the first quarter of 2012 on Friday on another upnote, as the Dow finished Q1 with an 8.1% gain, its largest first quarter gain of a year since 1998. The tech-heavy NASDAQ recorded a 19% first quarter gain, its highest since 1991. The S&P 500 logged a 12% gain.

[table id=56 /]