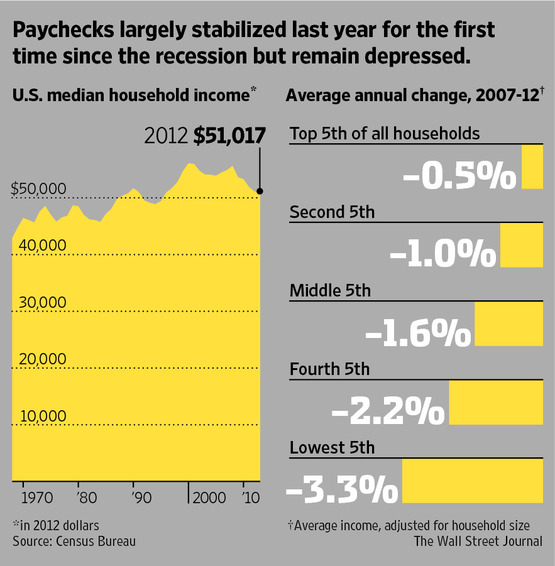

Household Income Levels Off After Hitting Two-Decade Low

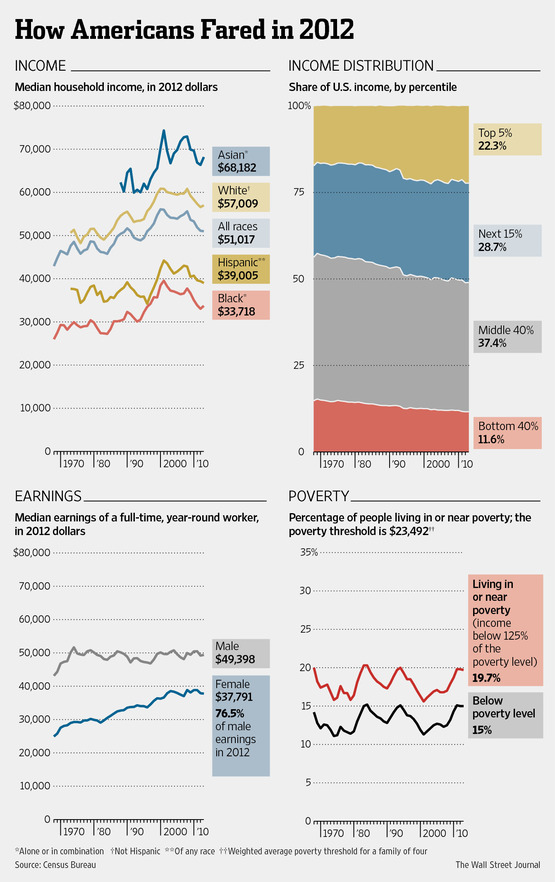

The Census Bureau released the latest snapshot of how U.S. living standards are evolving. The Census report, viewed as a gauge of American prosperity, could mark a turning point for the recovery. Here’s some takeaways:

- The income of the typical U.S. family stabilized last year for the first time since the recession.

- The bottoming-out follows four years of declines that pushed incomes to their lowest levels in nearly two decades.

- Consumers may soon feel the benefits of an improving job market that has seen unemployment drop from a peak of 10% to 7.3% this August.

- A rally in stocks also has boosted incomes for some Americans, along with rebounding real-estate prices.