Complex Annuities See Surging Sales ~ Investors Should Beware

An “indexed annuity” is a complex, high-cost, and illiquid financial product. They pay interest based on the performance of stock and bond market indexes. Insurers guarantee buyers will not lose their principal, but they require investors to lock-up their capital for long periods, often more than a decade.

An “indexed annuity” is a complex, high-cost, and illiquid financial product. They pay interest based on the performance of stock and bond market indexes. Insurers guarantee buyers will not lose their principal, but they require investors to lock-up their capital for long periods, often more than a decade.

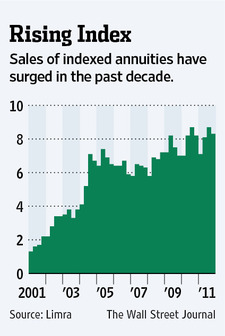

Indexed annuities are very popular with insurance salespeople because they are a high commission product. Insurance agents can get an up-front payoff of 12% or more of the invested amount simply by making the sale. The accompanying chart demonstrates the sales of indexed annuities have surged in the past decade.

Investor protection agencies and authorities are very concerned about abuse and fraudulent activity around annuities sales. Former California insurance commissioner Steve Pozner warned that agents “who steal from vulnerable seniors will not get away with their shameful tricks.”