Happens All The Time

The New Year selloff in stocks has captured a lot of attention because,

- We’re not used to this since the market has been unusually quiescent the past few years

- The decline is global

- The speed of descent is significant

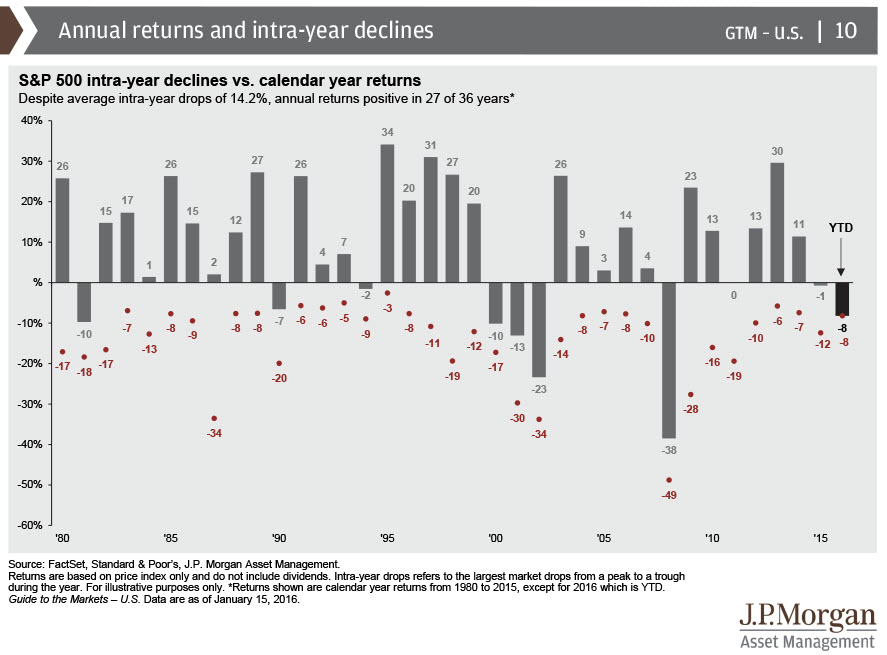

But despite perception, double-digit declines from prior highs are the norm, not an anomaly. It happens two out of every three years.

Here are great points of reference to put this market event into context:

-

The average intra-year decline is 16.4%. This current decline might feels worse due to the speed at which it’s happening, and because it’s occurring right out of the gate.

-

Double digit declines are to be expected, 64% of all years experienced them.

-

It’s not unusual for those double digit declines to be of little importance. 57% of the years with 10% drawdowns finished positive.

-

Stated differently, 36% of all years saw a double digit decline and still finished positive.

-

Drawdowns of 20% or more have happened 23 times, or 26% of all years. On five of those 23 occasions, stocks still ended up positive on the year.

The following chart provides a great visual on how intra-year drawdowns are normal.

Source: TII