10 Cognitive Biases That Affect Your Investment & Everyday Decisions

Research suggests that we make up to 35,000 decisions every single day. Emotions, experiences, and environment can strongly influence our decision making process. Enjoy the cartoons below and learn more about common cognitive biases that impact your everyday life and your investing behavior.

Bandwagon Effect: Believing or doing something because people around you believe or do it

Bandwagon Effect: Believing or doing something because people around you believe or do it

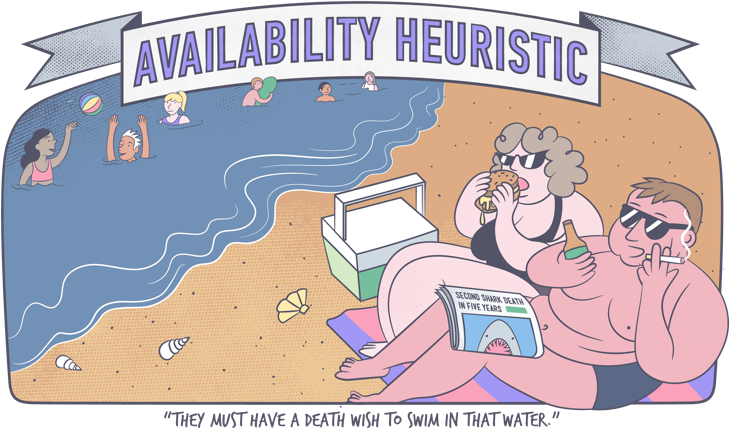

Availability Heuristic: Overestimating the importance of information that is easiest to recall

Availability Heuristic: Overestimating the importance of information that is easiest to recall

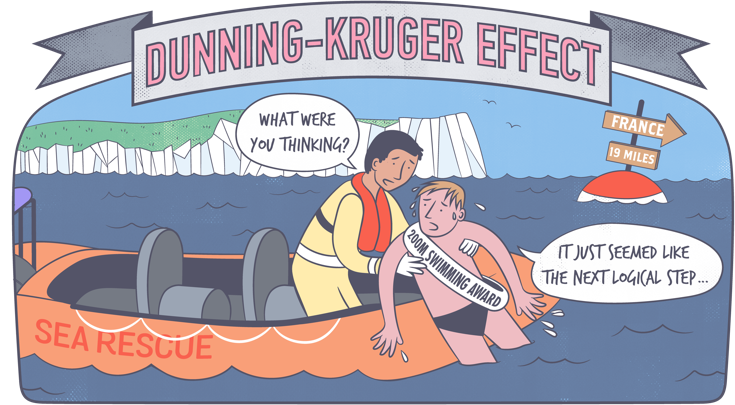

Dunning-Kruger Effect: Unskilled individuals overestimating their

abilities and experts underestimating theirs

Dunning-Kruger Effect: Unskilled individuals overestimating their

abilities and experts underestimating theirs

Framing Effect: Drawing different conclusions from the

same information presented differently

Framing Effect: Drawing different conclusions from the

same information presented differently

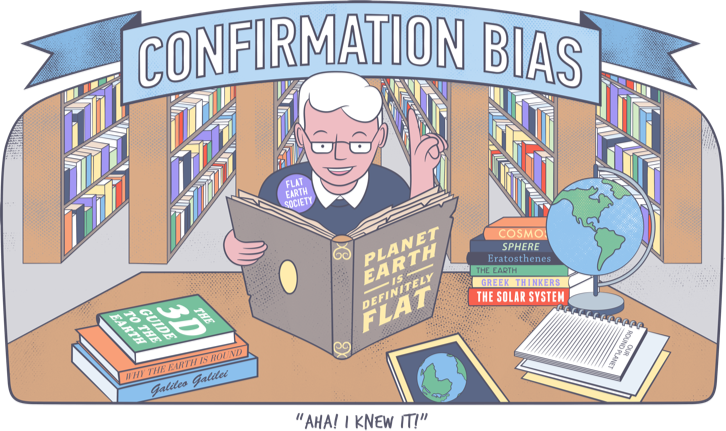

Confirmation Bias: Seeking and prioritizing information

that confirms your existing beliefs

Confirmation Bias: Seeking and prioritizing information

that confirms your existing beliefs

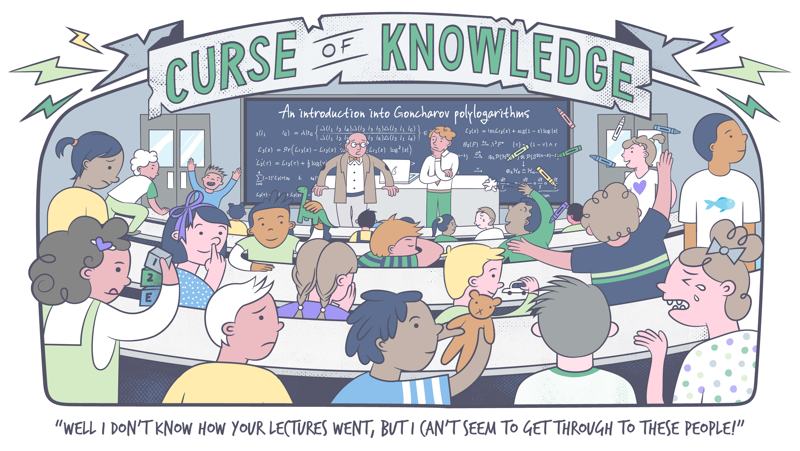

Curse of Knowledge: Struggling to see a problem from the perspective of someone with less knowledge than you

Curse of Knowledge: Struggling to see a problem from the perspective of someone with less knowledge than you

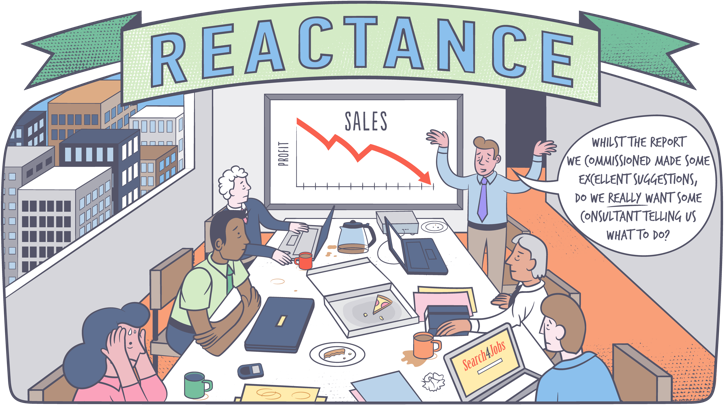

Reactance: The desire to do the opposite of what is requested or

advised, due to a perceived threat to freedom of choice

Reactance: The desire to do the opposite of what is requested or

advised, due to a perceived threat to freedom of choice

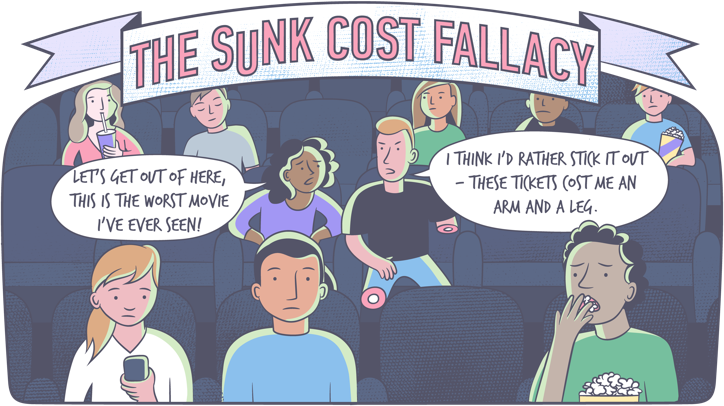

The Sunk Cost Fallacy: Refusing to abandon something unrewarding because you’ve already invested in it

The Sunk Cost Fallacy: Refusing to abandon something unrewarding because you’ve already invested in it

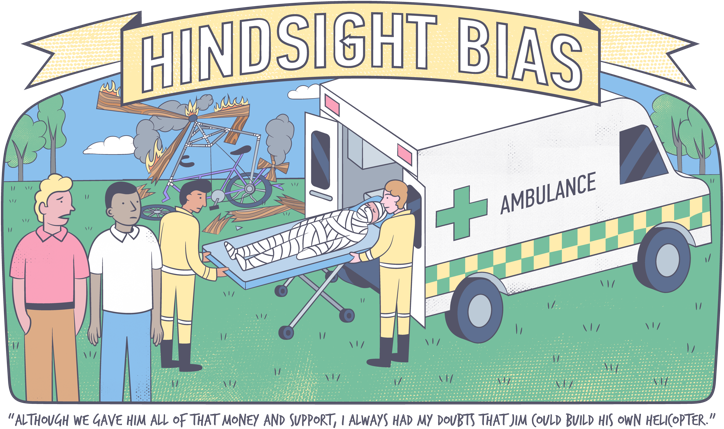

Hindsight Bias: Believing that you could have predicted an event after it has occurred

Hindsight Bias: Believing that you could have predicted an event after it has occurred

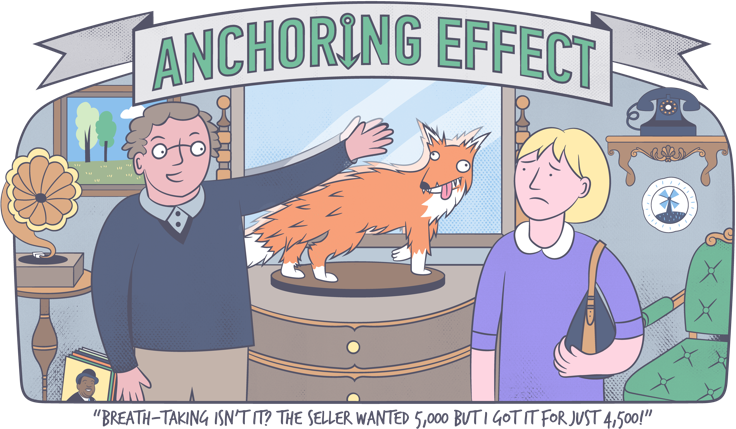

Anchoring Effect: Excessively focusing on the first piece of

information you receive when making a decision

Anchoring Effect: Excessively focusing on the first piece of

information you receive when making a decision

Source: Towergate