Hedge Funds — Exceptional Complexity, Exceptional Underperformance

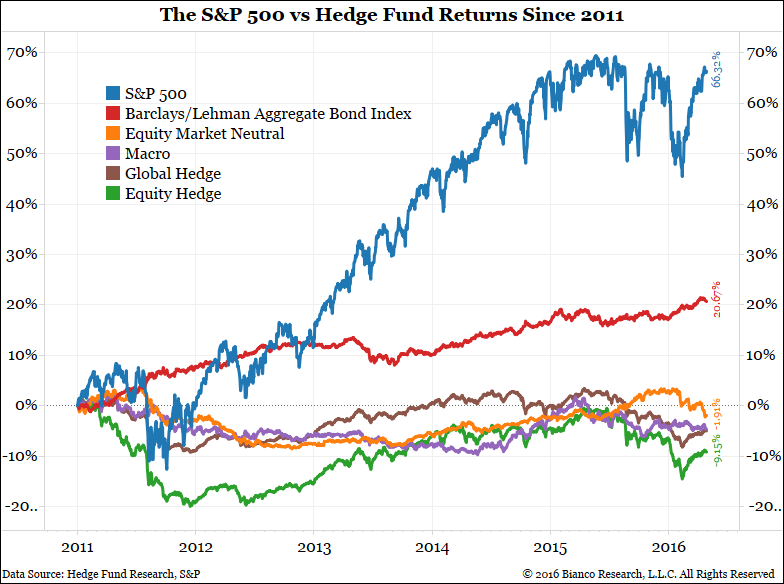

The chart above compares hedge fund returns to the S&P 500 Stock Index (blue) and the Barclays/Lehman Aggregate Bond Index (red) since 2011. Various popular hedge fund strategies are portrayed by the four colorful lines that occupy the zero-to-negative return space! In both an absolute and a relative sense, this is stunning underperformance. Moreover, those hedge fund returns are before fees, so the investor return is even worse. Hedge funds traditionally charge a management fee that’s 2% of assets, plus 20% on any profits.

Despite this dismal five-year run, complex and expensive hedge funds are more popular than ever. In the Internet era, interesting, persuasive, and money-losing commentary is just a click away!

At last Saturday’s annual meeting of Berkshire Hathaway, legendary investor Warren Buffett unloaded: “There’s been far, far, far more money made by people in Wall Street through salesmanship abilities than through investment abilities.” Buffet added that hedge funds operate with “a compensation scheme that is unbelievable to me.”

Our brains are naturally attracted to “shiny objects” and our intuition suggests success requires a complex solution. Nonetheless, empirical data such as the chart above demonstrate that wealth can be achieved through simple investments combined with simple discipline.