Putting Clients Second (!?!)

Although the following makes reference to politicians and political decisions, it’s not meant to be political. The intent is to inform you and to help protect you and your family’s best interest.

Although the following makes reference to politicians and political decisions, it’s not meant to be political. The intent is to inform you and to help protect you and your family’s best interest.

Today the founder and former chief executive of Vanguard, John C. Bogle, penned an article in the New York Times. It starts off:

THE Trump administration recently announced that it intends to review, and presumably overturn, the Obama-era fiduciary duty rule that is scheduled to take effect in April. The administration’s case was articulated by Gary Cohn, the new director of the National Economic Council.

Mr. Cohn, most recently the president of Goldman Sachs, called it “a bad rule” and likened it to “putting only healthy food on the menu, because unhealthy food tastes good but you still shouldn’t eat it because you might die younger.” Comparing healthy and unhealthy food to healthy and unhealthy investments is an interesting analogy.

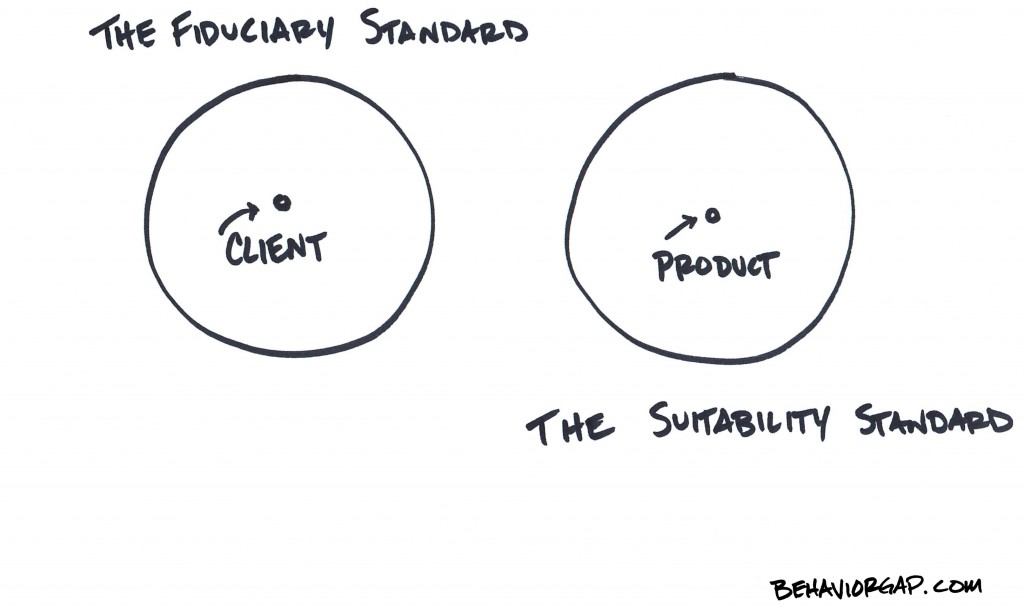

The now-endangered fiduciary rule is based on a simple — and seemingly unarguable — principle: that in giving advice to clients with retirement funds, stockbrokers, registered investment advisers and insurance agents must act in the best interests of their clients. Honestly, it seems counterproductive to go to war against such a fundamental principle. It simply doesn’t seem like a good business practice for Wall Street to tell its client-investors, “We put your interests second, after our firm’s, but it’s close.”

To learn more, see Mr. Bogle’s article and The Freedom To be Fleeced — How Donald Trump Made Financial Hustles Great Again

It’s easy to get lost in the details and let our minds glaze over, but what you should know is very simple:

- An advisor that is a fiduciary has a legal obligation to put your best interests first, always.

- Most people think that all or most advisors are fiduciaries (WRONG!).

- Most purveyors of financial products and services are NOT fiduciaries. They comply with a much lower “suitability standard.”

- To assure you and your family are getting the most trustworthy care, always ask your advisor or financial salesperson the following:

“Are you a fiduciary? Are you always acting in a fiduciary capacity when working with me?”

When we formed our advisory practice many years ago we purposefully chose to be a fiduciary because it’s the right thing to do. Incredibly that ethos is counter-cultural in financial services. It’s bemusing to watch the delicate public-relations dance and contortions that many big institutions are making around or in avoidance of doing the right thing.