“You need to judge us over a full cycle”

The standard argument that active investment managers make when challenged by their clients on why their portfolios underperformed the market is, “you need to judge us over a full cycle.”

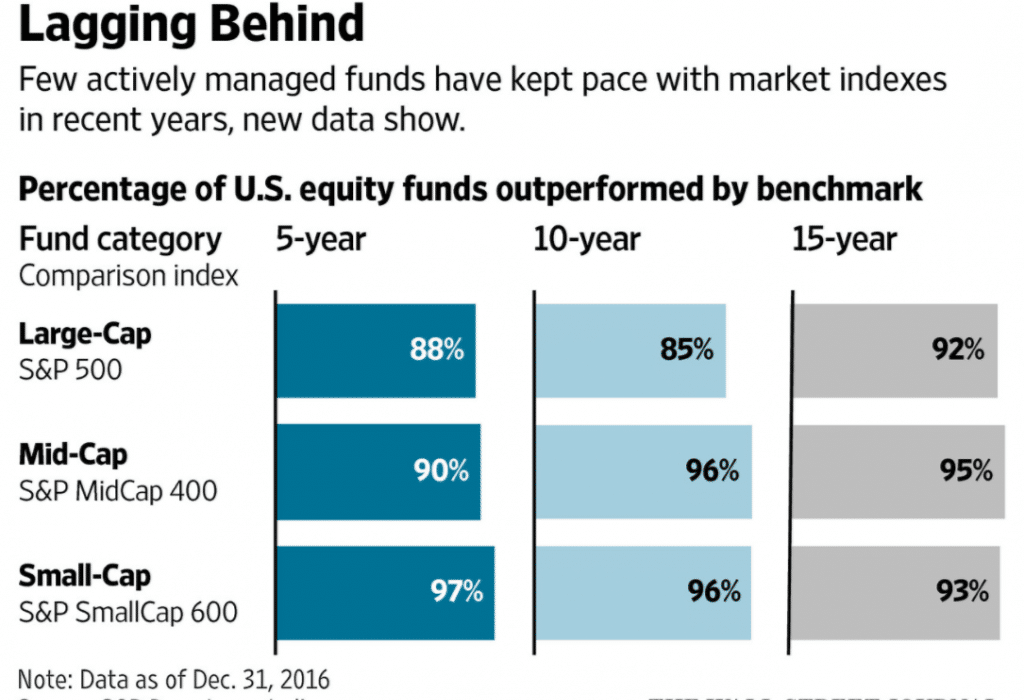

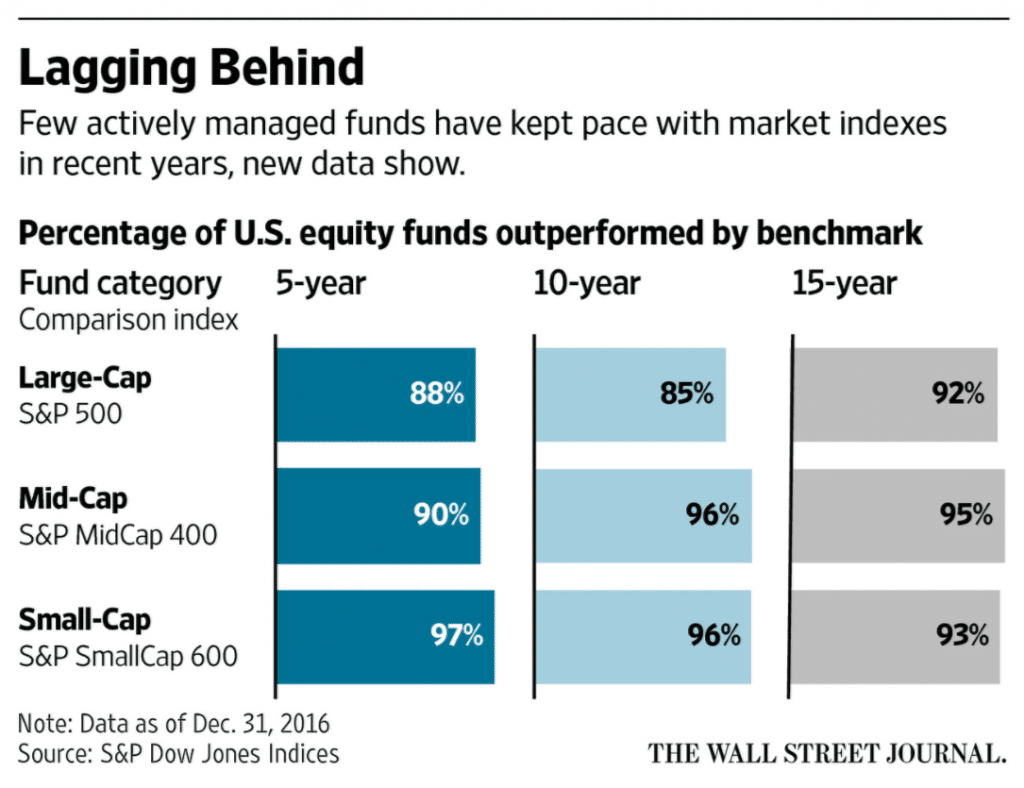

Robust results published in today’s Wall Street Journal blow a hole through active managers’ favorite defense. Over the 15 years that ended in December 2016, 82% of all U.S. funds trailed their respective benchmarks. That long time period is more than enough to encompass the active managers’ “full cycle”, boom-bust-boom argument. The findings are noteworthy because it’s the first time 15-year results have become available for this very comprehensive analysis.

The results are even worse when you looks at popular assets classes:

- 92.2% of U.S. large-cap active funds trailed their respective benchmarks

- 93.2% of U.S. small-cap active funds trailed their respective benchmarks

- 95.4% of U.S. mid-cap active funds trailed their respective benchmarks

That elusive 8% of all U.S. fund managers that did beat the market 2002-2016 is a slippery target for investors. Most of them did not persistently outperform throughout those 15 years. So you can’t just take today’s top performers and go with them. Said another way, the likelihood of you finding one of these funds ahead of time is very, very small.

You have a key decision — a choice that will materially impact your future life. How will you choose to invest the bulk of your portfolio? Will you go with the 92% odds in your favor (passive management), or the 8% odds in your favor (active management)?