Markets & Fiscal Drama

What’s going on with markets?

Why does the federal government keep getting into fiscal fights?

A lot is going on, so let’s discuss.

Why did markets melt down?

A combination of things.

Some negative news about home sales and consumer confidence created fresh concerns about the state of the economy. [1]

The reality of what high interest rates (that may go even higher this year) could mean for corporate profits is also setting in.

Companies that have to refinance corporate debt at higher rates could see much higher interest payments, cutting into their performance.

And on top of all that is the latest round of fiscal drama in Washington.

All that uncertainty pushed markets into fear and selling mode.

What are markets going to do next?

That’s hard to say.

Markets often bounce after a selloff as traders buy the dip.

We’re kicking off a new quarter and positive news could cause stocks to rally.

However, bearish selling pressure could continue as investors recalibrate their expectations about how long higher interest rates could linger.

So, what’s behind the ongoing budgetary drama in Washington?

Phew. It’s complicated.

Many economists and politicians agree that federal spending needs to be reined in.

The problem is that no one agrees on when and where to cut.

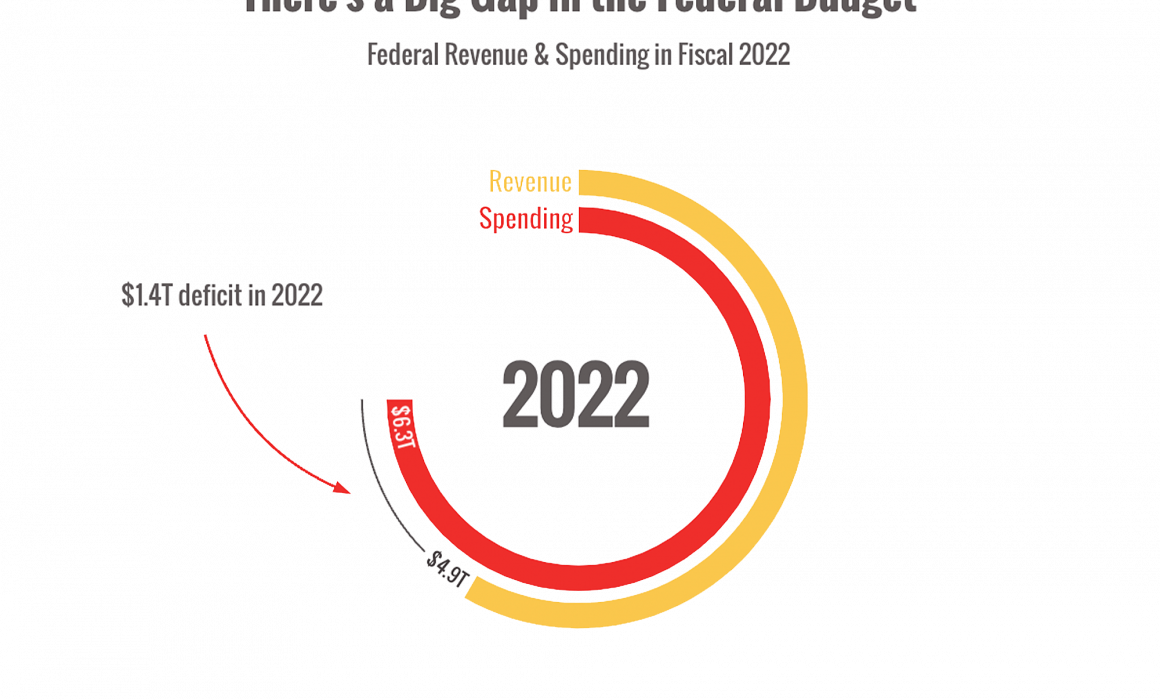

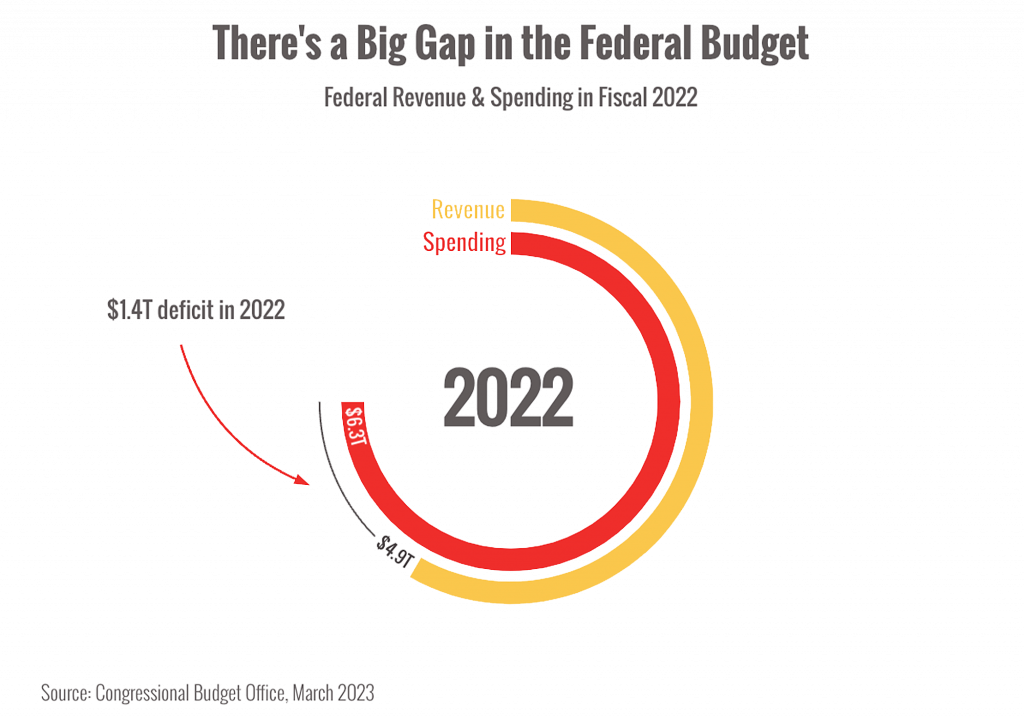

The U.S. has a pretty big deficit issue.

The Congressional Budget Office (CBO) projects that the federal deficit will rise to nearly $3 trillion per year in the 2030s, up from about $1.4 trillion in 2022. [2]

That large gap will continually add to the overall national debt (and interest payments) until it’s addressed.

Critical deadlines like the passage of spending bills (or raising the debt ceiling) offer an opportunity for politicians to force a standoff.

If federal spending needs to be cut, are budget showdowns actually that bad?

Fiscal crises aren’t good for the economy or markets.

Government shutdowns are disruptive as offices close down, troops and workers go without pay, and regular government processes stop.

Debt ceiling standoffs risk defaulting on sovereign debt, which would spill over into global financial markets.

The CBO estimated that the 2018-2019 shutdown cost the economy $11 billion, $3 billion of which was never regained by future spending. [3]

Even near-misses can be costly as they inject uncertainty and distrust about government processes.

In its August downgrade of U.S. credit, Fitch Ratings emphasized its concern about how political polarization affects regular government processes in Washington. [4]

Here’s the bottom line: the long-term effects of the latest crisis are likely to be muted.

There are a lot of factors (positive and negative) driving markets and this is just one of them.

However, we’re likely to see a lot of volatility ahead as investors digest economic data and judge recession risks.

Sources:

1. https://www.cnbc.com/2023/09/25/stock-market-today-live-updates.html

2. https://www.cbo.gov/publication/58946#_idTextAnchor004

3. https://www.reuters.com/world/us/shutdown-default-washingtons-risky-new-debt-ceiling-standoff-2023-01-24/

4. https://www.cnn.com/2023/09/25/economy/moodys-us-government-shutdown-credit-rating/index.html

Chart sources: https://www.cbo.gov/publication/58888