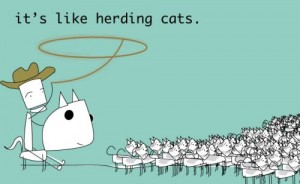

Like Herding Cats?

Do you ever get the feeling that managing your finances is like herding cats? If you’re like the typical person with dozens of banking, credit card and investment accounts housed at an array of financial institutions, it sure can feel like it!

Do you ever get the feeling that managing your finances is like herding cats? If you’re like the typical person with dozens of banking, credit card and investment accounts housed at an array of financial institutions, it sure can feel like it!

Here are two great ways to corral your accounts and take control of that herd!

#1 Use Mint.com to get a comprehensive, “live” view of your accounts

Mint.com is a free web-based personal financial management service. Mint’s primary service allows users to track bank, credit card, investment, and loan transactions and balances through a single user interface. Users can also make budgets and goals.

It takes less than five minutes to set up an account and start loading your accounts. Each time you log in, Mint automatically polls your financial service providers for the most up-to-date balances for all your accounts.

#2 Consolidate your retirement accounts

It’s not uncommon for people to have four or more investment accounts (e.g., 401(k)s, profit-sharing accounts, IRAs, etc) that they have accumulated from working at various companies or even inherited. You should consider rolling accounts that have the same tax deferred treatment into a single giant IRA.

Consolidating your accounts will make it easier for you to monitor performance, rebalance your portfolio, maintain your asset allocation, and manage required distributions.

NorthStar Capital Advisors has an article What to Do with Your Old 401(k) that walks through the options including creating a consolidated “Rollover IRA” that will help you see the big picture more easily and help you make more informed decisions.