Misconduct! 10 Worst & 10 Best Behaving Advisory Firms

New research shows the level of financial advisor misconduct is alarmingly high. “It’s everywhere, not just small firms. It is pervasive,” said Dr. Amit Seru, a finance professor at the University of Chicago’s Booth School of Business and a co-author of “The Market for Financial Adviser Misconduct” (Egan, Matvos, and Seru 2016).

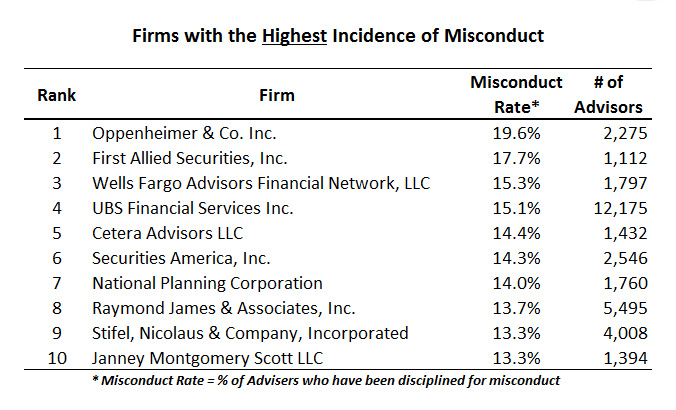

These researchers data mined the FINRA database to aggregate and measure the misconduct data for all U.S. firms with at least 1,000 advisors. The industry-wide average was 7% of all advisors have records of misconduct.

Oppenheimer ranked #1 in the “bad behavior” list. Nearly 20% of the advisors at Oppenheimer & Co. have been disciplined for misconduct that varies from placing clients in unsuitable investments to trading client accounts without permission. This rate is ~25 times higher than the “best behaving” firm, Morgan Stanley.

The following excerpt from Table 6 of this landmark study lists the 10 firms with the highest rate of “bad behavior”:

On the flip side, here is the list of the “best behaving” firms from the study:

On the flip side, here is the list of the “best behaving” firms from the study:

Here are some other key findings from this research:

Here are some other key findings from this research:

- Roughly 7% of advisors have misconduct records

- Prior offenders are 5 times as likely to engage in new misconduct as the average financial adivsor

- Approximately 50% of financial advisors lose their job after misconduct

- 44% of those advisors are re-employed in finance within a year (!)

- Misconduct is concentrated in firms with retail customers and in counties with low education, elderly populations, and high incomes

- Some firms “specialize” in misconduct and cater to unsophisticated consumers

Run, don’t walk, to the FINRA search page to immediately review your advisor’s regulatory disclosures!

Sources:

The Market for Financial Adviser Misconduct (Egan, Matvos & Seru, 2016)

Bloomberg