Financial Advising Jedi?

Although the recently released “Solo” is losing money for Disney, the older Star Wars movies have some positive money perspective. Ryan Neal has a great piece on “Star Wars” lessons for financial planning. Here are some excerpts and adaptations to help you answer the perennial question, Is my financial advisor a Jedi Master?

The Power of Holistic Planning

The Power of Holistic Planning

As young Skywalker’s advisor, Obi Wan Kenobi teaches him that the Force, an energy field created by all living things that binds the galaxy together, is the source of his power. For financial advisors to truly unlock their potential, they need to have a holistic view of their clients’ financial lives, as well as a mastery of investment strategy. By understanding how various accounts, needs and goals all connect together, an advisor can be a truly powerful guide for their clients.

While Luke is a neophyte just learning the ways of the Force, Han Solo is a hardened skeptic, disregarding advisors like Obi Wan Kenobi and instead preferring the lifestyle of a risk taker, which has led him to real problems with debt. When Luke gets distracted by Solo’s taunts, Kenobi reminds him to trust in his plan instead of making knee-jerk reactions. While things get rocky along the way, Luke eventually reaches his goal of becoming a Jedi Knight. It’s a good reminder for when the markets get rough: Trust in the plan, mitigate short-term emotional reactions, and focus on long-term goals. Han may call it luck, but advisors know there’s no such thing.

The Quick and Easy Path Leads to the Dark Side

The Quick and Easy Path Leads to the Dark Side

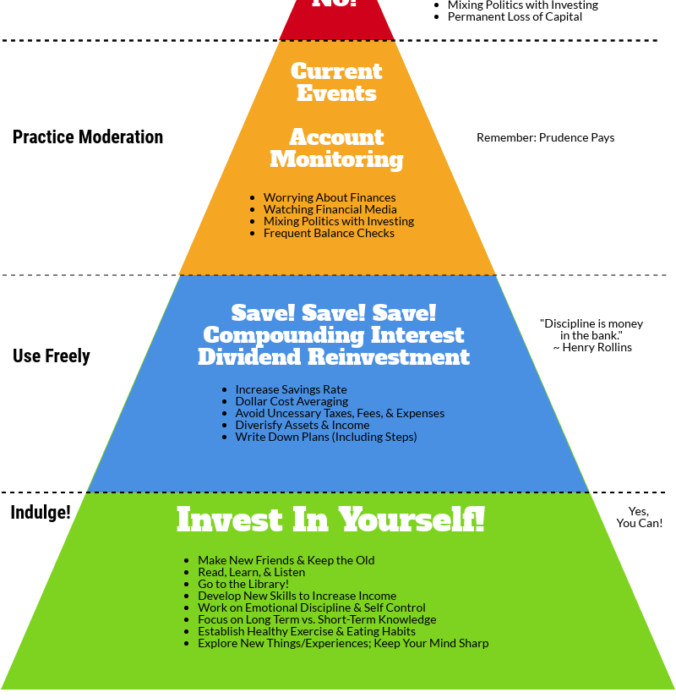

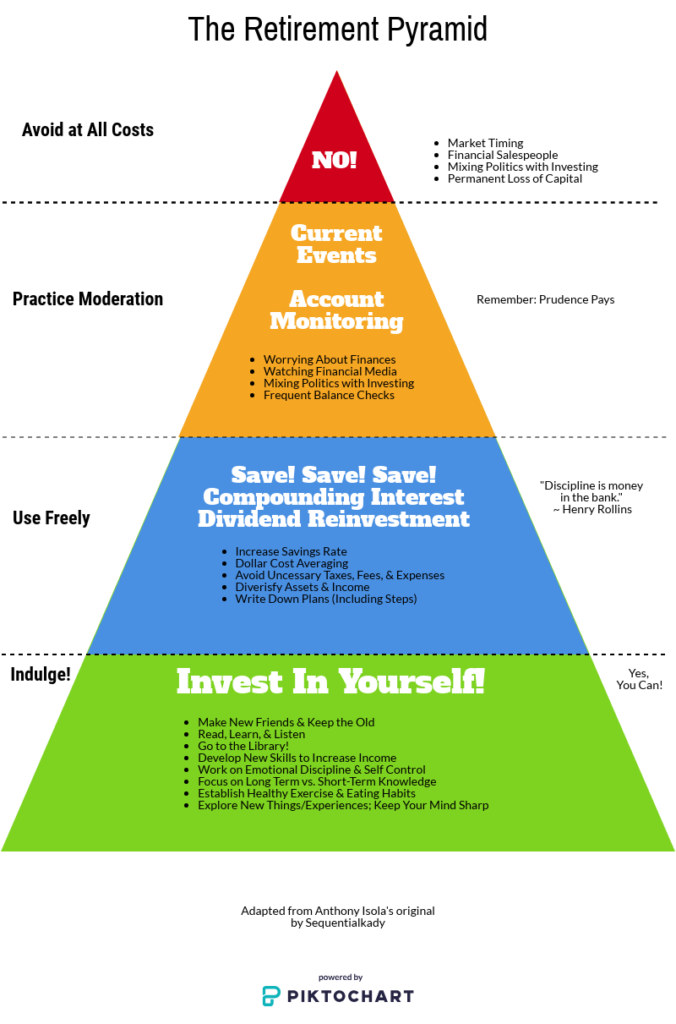

We learn more about the Force in the 1980s’ “Empire Strikes Back,” when Jedi master Yoda teaches Luke about the Dark Side. Like a good advisor, he tells Luke that chasing instant gratification, like investing heavily in a hot stock, can lead to ruin. When Luke ignores the advice, he’s almost defeated by Darth Vader. Yoda reminds us that patience is key with investing, not adventure or excitement.

Know Your Advisor’s True Value

Know Your Advisor’s True Value

Though his investment strategy might be questionable, Han Solo does understand value. Luke is shocked when Solo initially discloses his fees to pilot them across the galaxy in the Millennium Falcon. Luke says he could buy and pilot his own starship for less, but Obi Wan Kenobi knows expertise can command a fair price and even offers to spend more to ensure results. It turned out that Luke didn’t know flying through hyperspace from dusting crops, and Solo’s experience came in handy.

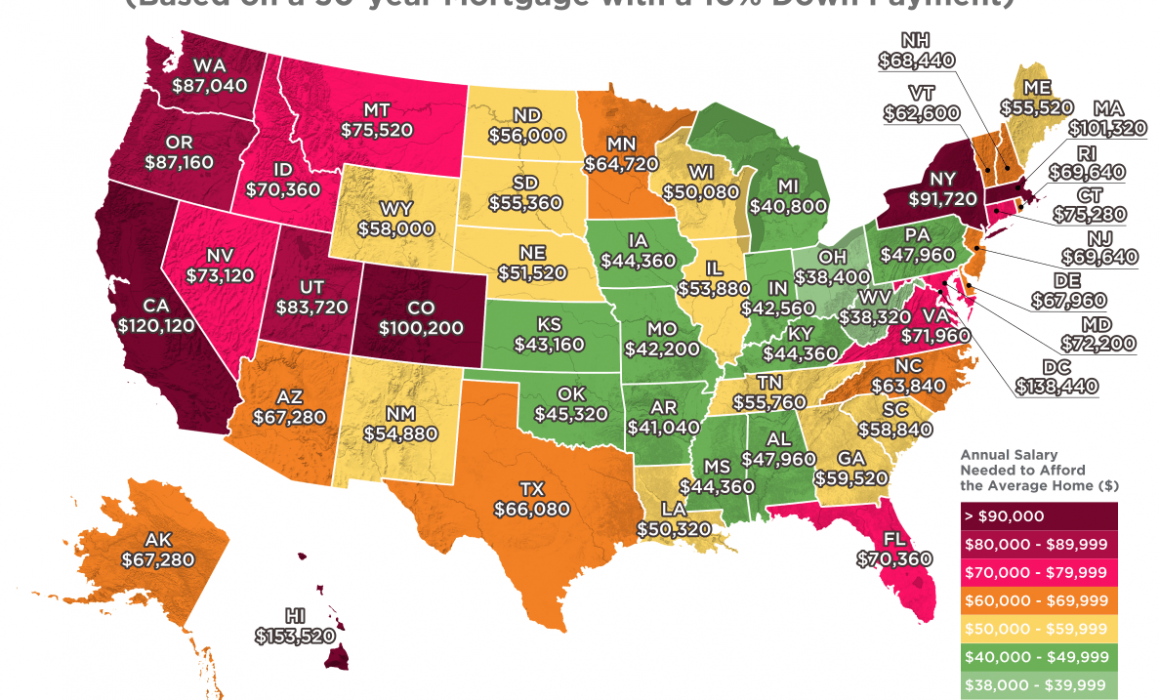

Though Han Solo told Princess Leia that he doesn’t care about her or the rebellion, he becomes a true hero after he realizes that there’s more to life than money. Advisors are worth more than just allocating assets and providing returns; they can be even more valuable to clients by helping them navigate important milestones in life, like buying a home, sending kids to college, and retiring comfortably. Remember what Leia told Han: “If money is all that you love, then that’s what you’ll receive.”

“Judge me by my size, do you?” Yoda may be small, but his power with the force is great. Similarly, many investors often think bigger is better and don’t realize that small boutique firms can provide superior guidance.

Source: WM