How Trump’s Tax Changes Will Impact You

“Reduce taxes across-the-board, especially for working and middle-income Americans” – that was Trump’s campaign pledge. And now he is about to move into the White House and is backed by Republican majorities in both House and Senate, he has a real shot at fulfilling that pledge to the letter. So, what are the specifics of his plan, and how would it affect you?

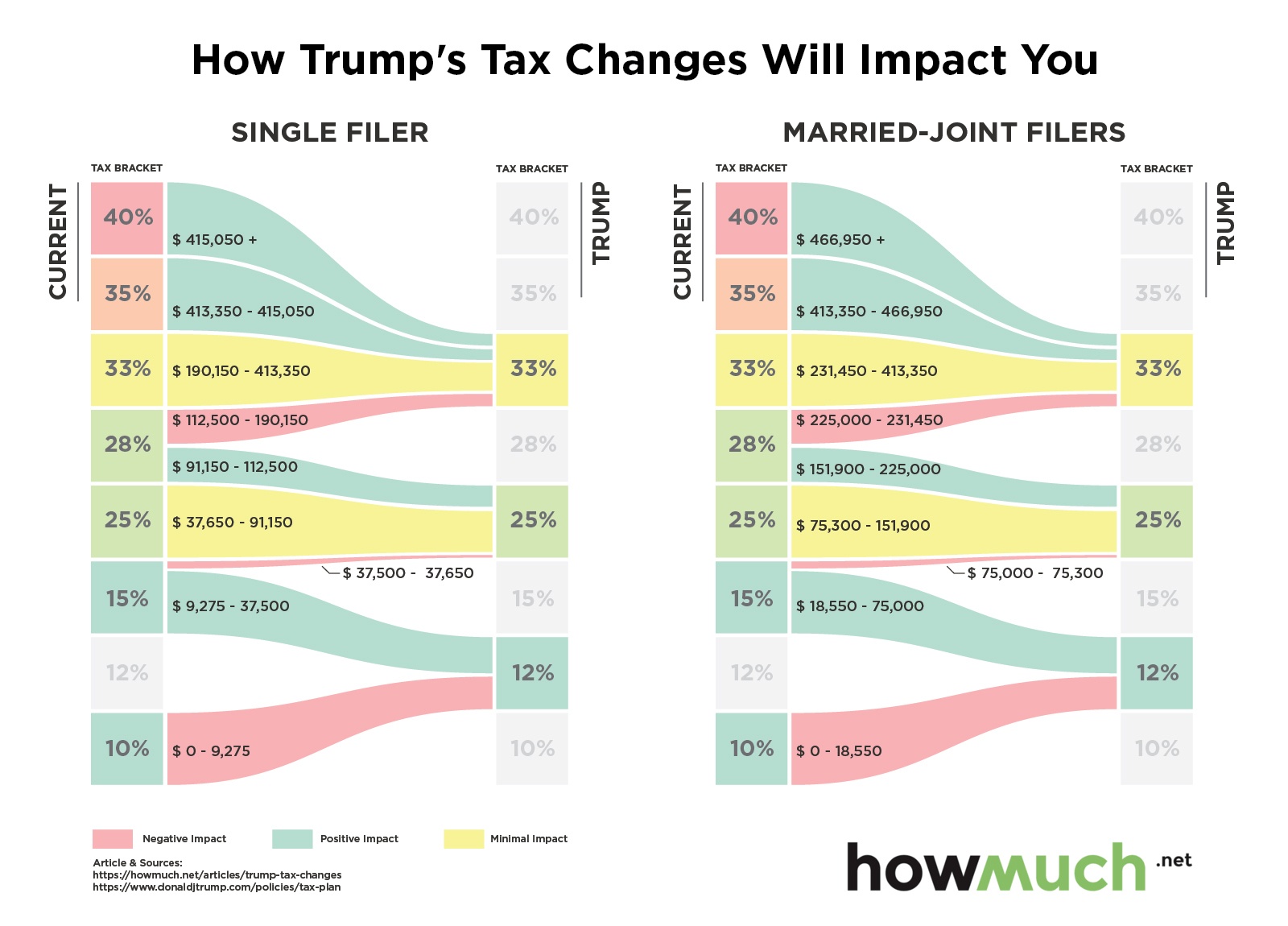

Source: How Much

Source: How Much