Fiscal Cliff’s Jagged Edge

If Washington can’t end the budget dilemma by year-end, most households will be impacted by the “fiscal cliff”.

If Washington can’t end the budget dilemma by year-end, most households will be impacted by the “fiscal cliff”.

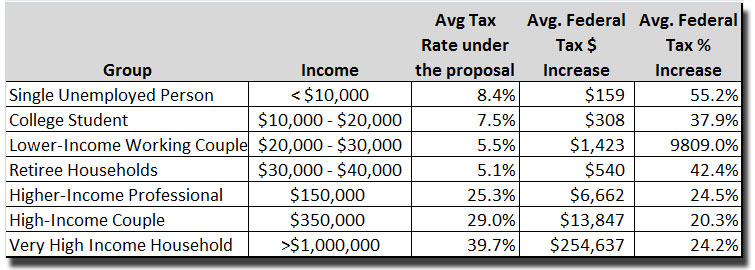

As the table below shows, lower-income people would see the steepest tax increases in percentage terms. For example, an average married couple making $20,000 to $30,000 would see their tax go up $1,423, from receiving a $15 refund to paying $1,408.

Here are the key drivers behind the tax increase broken out by group:

- Single unemployed person: loss of benefits

- College student: loss of education breaks as well as the payroll tax holiday

- Lower-income working couple: loss of Bush-era 10% bracket, loss of relief from so-called marriage penalty and the reduction of the child credit

- Retiree households: loss of Bush-era tax rates

- Higher income professional: loss of protection from the alternative minimum tax (AMT)

- High-income couple: disappearance of Bush-era tax cuts & AMT relief plus higher taxes on investments