Weekly Market Review ~ Friday, 05/18/12

Last week’s slide continued on Monday with a 1% loss on concern that Greece may disconnect itself from the Euro currency. On Tuesday the Dow fell to a 4-month low, once again on worries about Greece. It was much of the same on Wednesday, although the Dow managed to keep its losses small. The losses continued on Thursday, as the small-cap Russell 2000 index has dropped 10% since its recent high in March. Stocks finished off the week on Friday with yet another loss. Even Facebook’s IPO could not energize the markets, as the Dow finished with a loss in 12 of the last 13 trading sessions, including every day this week.

Last week’s slide continued on Monday with a 1% loss on concern that Greece may disconnect itself from the Euro currency. On Tuesday the Dow fell to a 4-month low, once again on worries about Greece. It was much of the same on Wednesday, although the Dow managed to keep its losses small. The losses continued on Thursday, as the small-cap Russell 2000 index has dropped 10% since its recent high in March. Stocks finished off the week on Friday with yet another loss. Even Facebook’s IPO could not energize the markets, as the Dow finished with a loss in 12 of the last 13 trading sessions, including every day this week.

![]()

[table id=63 /]

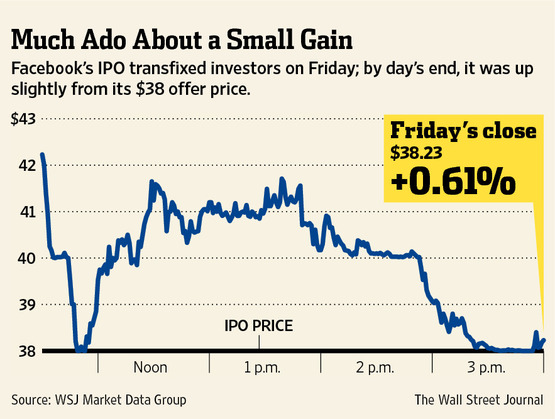

Facebook — How Not To Invest in the Stock Market

Despite predictions that its stock would soar on its first day of trading, Facebook was a big fizzle. In fact, Facebook’s underwriters struggled to keep the price from plunging through the initial offering price of $38 to avoid a huge embarrassment (note how the price flat lined at $38 starting at ~3:30pm on Friday, 5/18/12).

Despite predictions that its stock would soar on its first day of trading, Facebook was a big fizzle. In fact, Facebook’s underwriters struggled to keep the price from plunging through the initial offering price of $38 to avoid a huge embarrassment (note how the price flat lined at $38 starting at ~3:30pm on Friday, 5/18/12).

Despite widespread belief to contrary, buying a stock because you know the company or “feel good about the company” is no way to invest. This kind of thinking can be very dangerous to one’s financial health. Moreover, this approach is usually coupled with a strong emotional attachment that causes investors to hold onto that company much too long once the share price begins to deteriorate.

Warren Buffet once said, “You may have all these feelings about a stock, but a stock doesn’t know you own it. It doesn’t care what you paid for a stock.” It’s wise to use your head, not your heart, to keep emotions from corroding your investment discipline.

![]()

Weekly Market Review ~ Friday, 05/11/12

Major political upheaval in France and Greece over the weekend failed to have much of an impact on the markets on Monday, as initial trepidation in the morning faded, and the major indexes finished near the unchanged mark. On Tuesday, the Dow lost ground for the fifth straight session on concerns over the fallout from the recent Greek elections. The slide continued on Wednesday, with Spanish stocks falling to to their lowest levels since 2003 as Eurozone unrest continues. On Thursday the Dow finally managed a gain after six consecutive losses, although the gain was quite modest, following a mildly encouraging US labor report. Stocks finished the week on Friday down once again after J.P. Morgan announced a $2 billion loss that temporarily roiled banking stocks.

Major political upheaval in France and Greece over the weekend failed to have much of an impact on the markets on Monday, as initial trepidation in the morning faded, and the major indexes finished near the unchanged mark. On Tuesday, the Dow lost ground for the fifth straight session on concerns over the fallout from the recent Greek elections. The slide continued on Wednesday, with Spanish stocks falling to to their lowest levels since 2003 as Eurozone unrest continues. On Thursday the Dow finally managed a gain after six consecutive losses, although the gain was quite modest, following a mildly encouraging US labor report. Stocks finished the week on Friday down once again after J.P. Morgan announced a $2 billion loss that temporarily roiled banking stocks.

[table id=61 /]

Weekly Market Review ~ Friday, 05/04/12

On Monday, stocks finished off the month with a loss following news that Spain’s economy shrunk again for a second consecutive quarter. Still, the Dow managed to end the month with its seventh consecutive monthly gain. May started on an up note on Tuesday, with the Dow once again hitting a four-year high on good manufacturing news. On Wednesday the major indexes finished mixed, as a report indicating that private-sector job growth seems to be slowing dampened buyers’ enthusiasm. On Thursday, stocks fell once again in anticipation of Friday’s US employment report. The selling accelerated on Friday, as the employment report failed to meet expectations. While the unemployment rate slipped down to 8.1%, this decline was mainly due to workers leaving the work force rather than an increase in the number of new jobs.

On Monday, stocks finished off the month with a loss following news that Spain’s economy shrunk again for a second consecutive quarter. Still, the Dow managed to end the month with its seventh consecutive monthly gain. May started on an up note on Tuesday, with the Dow once again hitting a four-year high on good manufacturing news. On Wednesday the major indexes finished mixed, as a report indicating that private-sector job growth seems to be slowing dampened buyers’ enthusiasm. On Thursday, stocks fell once again in anticipation of Friday’s US employment report. The selling accelerated on Friday, as the employment report failed to meet expectations. While the unemployment rate slipped down to 8.1%, this decline was mainly due to workers leaving the work force rather than an increase in the number of new jobs.

[table id=60 /]

Leveraged and Inverse ETFs — Most Investors Should Avoid Them

Leveraged and inverse ETFs are difficult to understand and are not a good fit for long-term investors.

Leveraged and inverse ETFs are difficult to understand and are not a good fit for long-term investors.

Exchange-traded funds (ETFs) trade daily on exchanges like stocks. Leveraged versions use complex futures and derivatives to amplify the daily returns of an index, often times trying to double or triple the return. Inverse ETFs strive to return the opposite of the index.

When ETFs are held for longer than a day, the effects of compounding can produce results that vary significantly from the one-day outcome. This makes leveraged and inverse ETFs unpredictable and risky to hold for longer periods.

Citi, Morgan Stanley, UBS and Wells Fargo are paying $9.1M to settle allegations on leveraged ETFs. These banks were fined $7.3 million and they agreed to pay $1.8 million in restitution to some customers who were sold leveraged and inverse ETFs. Industry regulators allege the banks sold billions of dollars of these volatile investments without properly assessing their risks and whether they were suitable for retail customers. (“Retail” customers are individual investors versus “institutional” investors like pensions and hedge funds).

The Financial Industry Regulatory Authority (FINRA) and the Security & Exchange Commission (SEC) have previously warned the investing public about the risks of leveraged and inverse ETFs, particularly for those investing for the long term.

Weekly Market Review ~ Friday, 04/27/12

Stocks kicked off the week on Monday with renewed fear on European debt and the state of Europe’s economy, as the Dow dropped 100 points. Tuesday was a good day for blue chip stocks, but a poor day for tech stocks, as Apple weighed down the NASDAQ index to give that index its fifth consecutive loss. This downturn in Apple and the NASDAQ was quickly reversed on Wednesday, with an encouraging earnings report by Apple. A reassuring statement by Fed chief Ben Bernanke that interest rates will remain low also gave a boost to the market in general. On Thursday, stocks rose again despite a disappointing US jobs report. Stocks closed the week on Friday with another gain following several solid earnings reports, most notably by Amazon.

Stocks kicked off the week on Monday with renewed fear on European debt and the state of Europe’s economy, as the Dow dropped 100 points. Tuesday was a good day for blue chip stocks, but a poor day for tech stocks, as Apple weighed down the NASDAQ index to give that index its fifth consecutive loss. This downturn in Apple and the NASDAQ was quickly reversed on Wednesday, with an encouraging earnings report by Apple. A reassuring statement by Fed chief Ben Bernanke that interest rates will remain low also gave a boost to the market in general. On Thursday, stocks rose again despite a disappointing US jobs report. Stocks closed the week on Friday with another gain following several solid earnings reports, most notably by Amazon.

[table id=60 /]

“Stock-Picking Robot” — Really?

A pair of 21-year-old twin brothers (Alexander and Thomas Hunter) from the UK duped thousands of investors in the US into believing that a fictitious “stock-picking robot” could find penny stocks set to surge in price.

A pair of 21-year-old twin brothers (Alexander and Thomas Hunter) from the UK duped thousands of investors in the US into believing that a fictitious “stock-picking robot” could find penny stocks set to surge in price.

According to a lawsuit from the SEC, approximately 75,000 investors paid a total of $1.2 million for a newsletter subscription and home “robot software”. The Hunter twins used the newsletter and fake software to feed spurious stock tips to unwitting investors in a “pump and dump” scheme. The Hunters were also paid by companies to tout specific stocks.

The lessons here should be obvious. Lots of people

- Want to get rich quick

- Think investing has some magic bullet or secret formula for success

- Are essentially and critically uninformed about the markets

- Desperately need help with their investing and financial planning

If it sounds too good to be true, it probably is. If in doubt, seek the expert opinion of a competent, professional, and ethical investment advisor.

Weekly Market Review ~ Friday, 04/20/12

The Dow, NASDAQ, and S&P 500 finished with an unusual 1.4% spread on Monday, as the Dow reacted well to a positive retail sales report, while Apple dragged down tech stocks. On Tuesday all the major indexes soared following a successful Spanish bond sale that indicates that the beleaguered European country will not need a bailout. The market gave back some of these gains on Wednesday after earnings reports from tech giants IBM and Intel disappointed investors. On Thursday the downturn continued when US labor, housing, and manufacturing reports did not meet expectations. Stocks wrapped up the week on Friday with another split decision as good earnings reports from GE and Microsoft propelled the Dow upward, while the NASDAQ and S&P 500 lagged.

The Dow, NASDAQ, and S&P 500 finished with an unusual 1.4% spread on Monday, as the Dow reacted well to a positive retail sales report, while Apple dragged down tech stocks. On Tuesday all the major indexes soared following a successful Spanish bond sale that indicates that the beleaguered European country will not need a bailout. The market gave back some of these gains on Wednesday after earnings reports from tech giants IBM and Intel disappointed investors. On Thursday the downturn continued when US labor, housing, and manufacturing reports did not meet expectations. Stocks wrapped up the week on Friday with another split decision as good earnings reports from GE and Microsoft propelled the Dow upward, while the NASDAQ and S&P 500 lagged.

[table id=59 /]

Recent Posts

-

Estimated Taxes, Marriage 2.0 and Cosmic Bumper Cars January 8,2026

-

Hidden Insurance Gaps That Threaten Your Wealth December 11,2025

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- November 2019

- October 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- November 2010

- October 2010

- September 2010

- August 2010

Categories

- 401(k)

- Annuities

- Behavior

- Best Practices

- Bonds

- Charitable Donations

- Economy

- Fees

- Fiduciary

- Financial Planning

- Investing 101

- Live Well

- Market Outlook

- Mutual Funds

- NorthStar

- Performance

- Personal Finance

- Planning

- Retirement

- Saving Money

- Scams & Schemes

- Seeking Prudent Advice

- Tax Planning

- Uncategorised

- Uncategorized

- Weekly Market Review