Whose side is your financial adviser on, anyway?

Does your financial adviser have a legal duty to give advice that’s in your best interests? The chances are that you think the answer to this question is “yes.”

Chances are, you’re wrong.

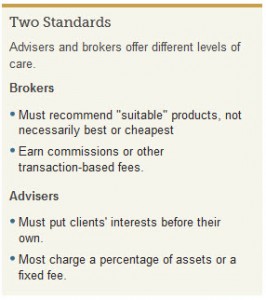

Not everyone who gives you financial advice has a duty to actually help you. The technical term for the true helpers is ‘fiduciaries.’ That means it’s their legal duty to always put their client’s best interests ahead of their own.

There are some financial helpers who are fiduciaries. That includes certified financial planners and Registered Investment Advisors – usually known as RIAs. Their job description includes warning you away from any financial cliffs. Unfortunately, these people are a small part of the financial advice world – they make up less than 20% of the universe.

NorthStar Capital Advisors is a Registered Investment Advisor and has a fiduciary responsibility to its clients.

Read more about fiduciaries in this article.