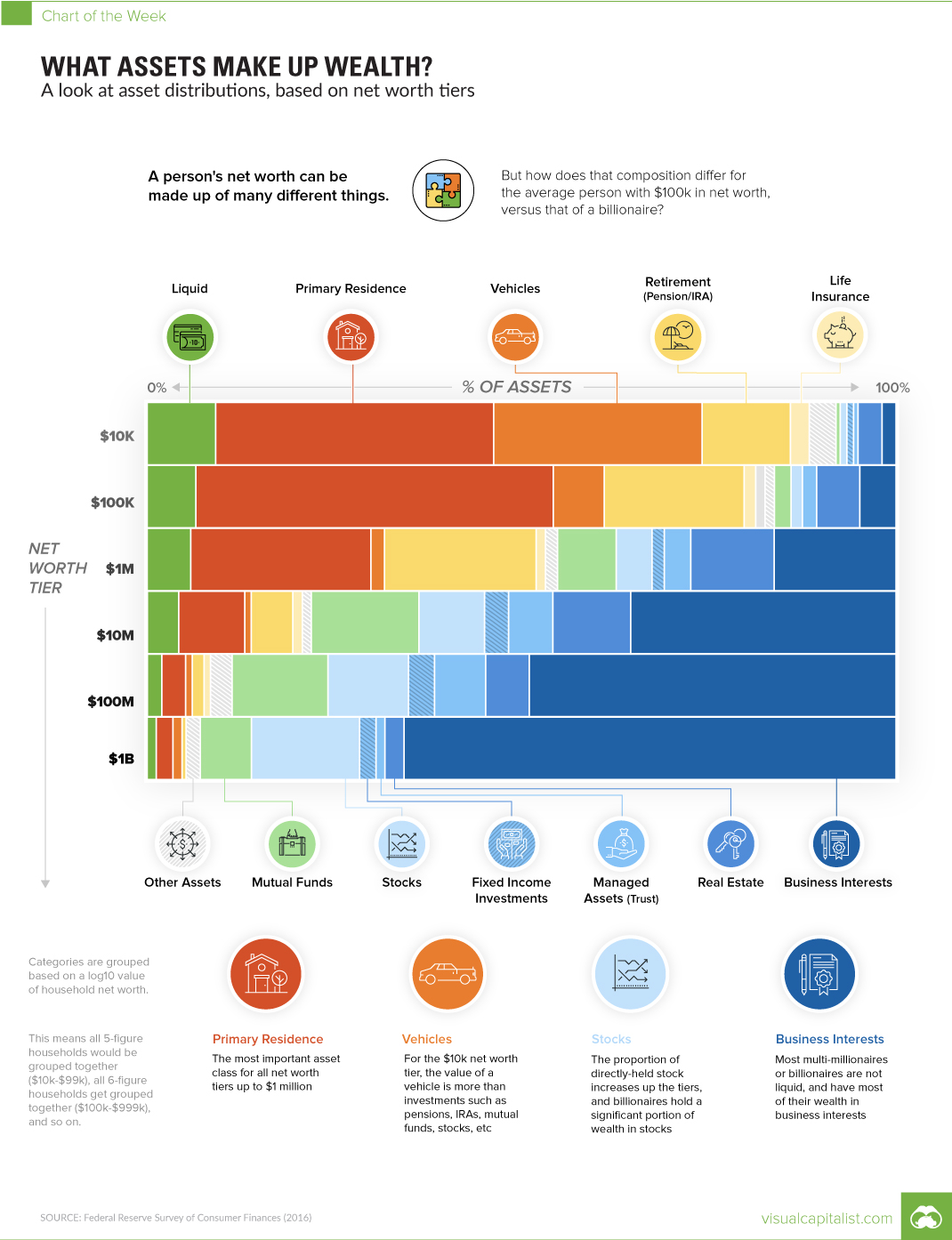

What Assets Make Up Wealth?

This is the time of year where our office is busily updating our clients’ net worth statements. Net worth is the best measure of both your current financial health and the financial progress you’re making over time. Remember that your net worth, simply put, is the sum of all the financial assets you own minus all of the debts that you owe. Almost every good financial decision you can make serves to either grow or protect your net worth. For example, saving and investing increase your the financial assets you own, while paying off debt decreases the amount you owe.

The Visual Capitalist recently published the fascinating chart below that examines how the composition of assets varies by net worth.

It’s readily apparent that the asset mix changes greatly between lower and higher net worths:

Primary Residence:

This is by far the most important asset class for all net worth tiers up to $1 million.

Vehicle:

For the $10k net worth tier, the value of a vehicle is more than investments such as pensions, IRAs, mutual funds, stocks, etc.

Stocks:

The proportion of directly-held stock increases up the tiers, and billionaires hold a significant portion of wealth in stocks.

Business Interests:

Most multi-millionaires or billionaires are not liquid, and have most of their wealth in business interests.