The Cost Of Sitting On Cash

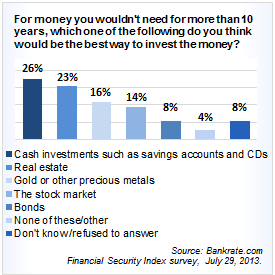

According to the latest financial security index by Bankrate.com, here’s how Americans prefer to invest money that they don’t need for more than 10 years:

26% say they prefer cash for long-term investments. Cash is arguably a great place to store your wealth briefly, however 80 years of data show cash is a horrible long-term investment.

26% say they prefer cash for long-term investments. Cash is arguably a great place to store your wealth briefly, however 80 years of data show cash is a horrible long-term investment.

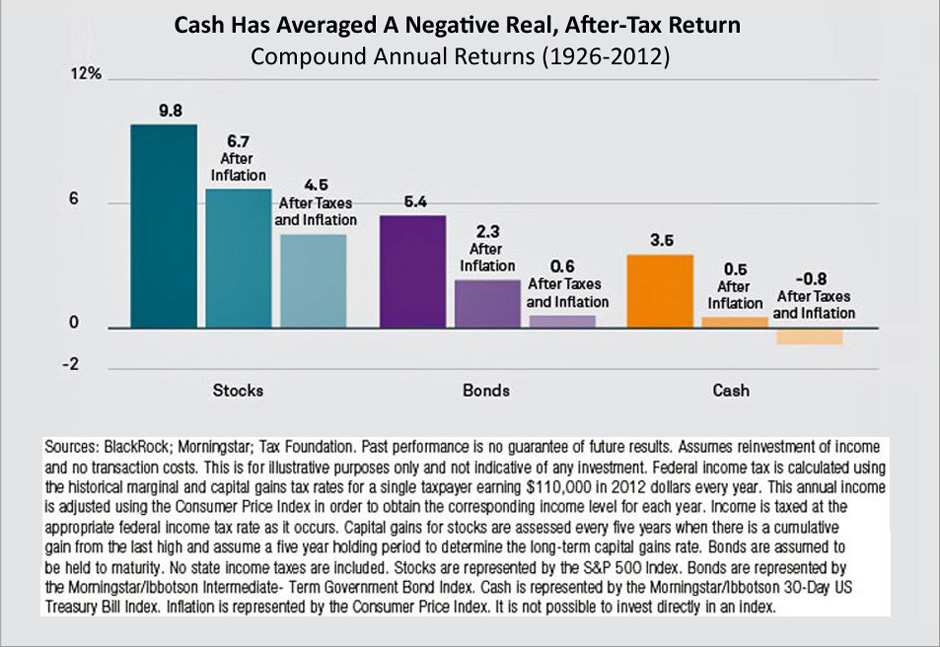

The following chart shows that cash has averaged a negative real, after-tax return (be sure to click on the chart for a closer look). Inflation and taxes are killers.

BankRate.com