20 People You Don’t Want to Invest With

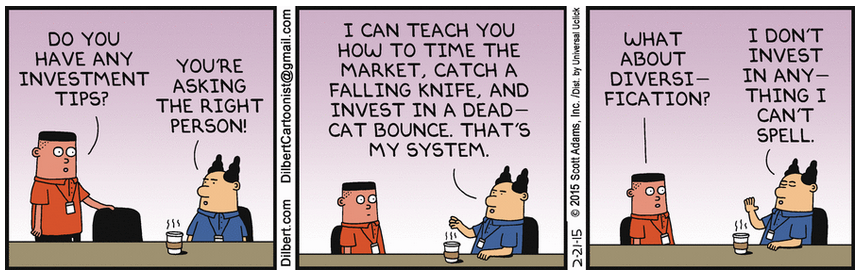

Identifying what does NOT work is often a great process for narrowing your list of options of what you should do. In that spirit, here’s Ben Carlson’s list of 20 people you wouldn’t want to invest with:

Identifying what does NOT work is often a great process for narrowing your list of options of what you should do. In that spirit, here’s Ben Carlson’s list of 20 people you wouldn’t want to invest with:

1. People that are unwilling or unable to admit their limitations.

2. People that are consumed by ideological or political beliefs when making investment decisions.

3. People that are unwilling to say “I don’t know.”

4. People that don’t learn from their mistakes.

5. People that blame external forces for their failures.

6. People that are unable to effectively communicate their process.

7. People that make guarantees about the markets in the future.

8. People that are more interested in selling you a product than creating a beneficial long-lasting client relationship.

9. People that try to invest in the markets as they “should be” instead of how they actually are.

10. People that are more worried about what others are doing instead of focusing on their own process and goals.

11. People that take the markets personally and let their emotions drive their decisions.

12. People that assume “trust me, I got this” is good enough in terms of explaining their strategy.

13. People that believe in conspiracy theories and think the system is out to get them.

14. People that are more worried about sounding intelligent than actually making money.

15. People that obsess over the market’s short-term movements.

16. People that would rather take you golfing than help you solve your problems.

17. People that make you feel like they’re doing you a favor by letting you invest your money with them.

18. People that try to dazzle you with 200 page pitch books.

19. People that are more worried about gathering future clients than taking care of their current ones.

20. People that tell you what you want to hear instead of what you need to hear.

Source: AWOCS