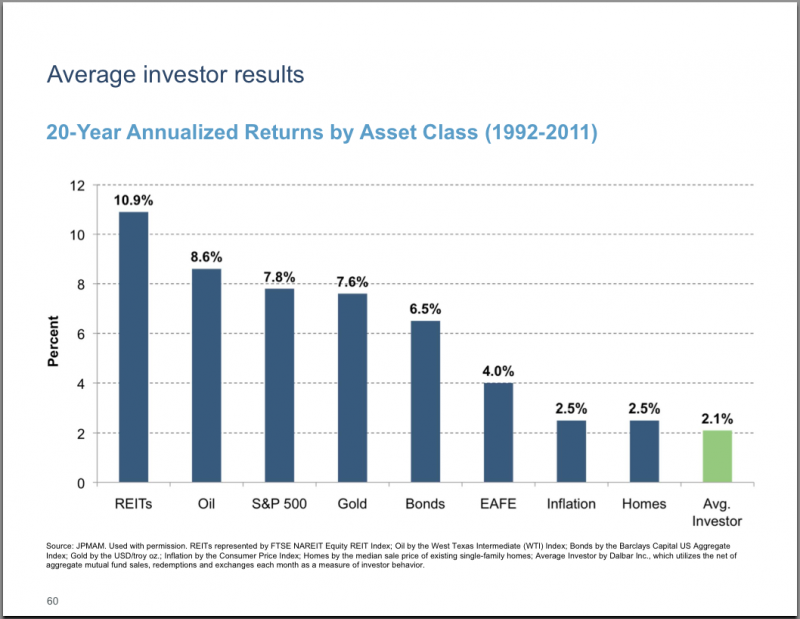

Market Timing & Emotions ~ Afflictions of the Average Investor

This chart of 20 years of market data vividly demonstrates a painful lesson. The average investor* badly trails all classes of investment assets.

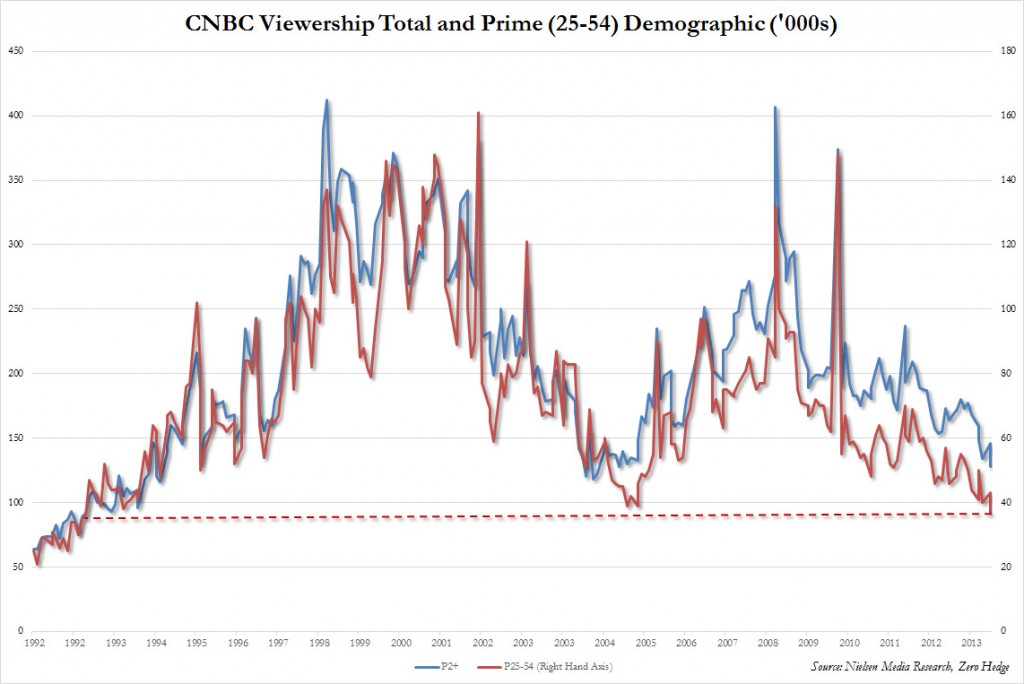

The primary culprit for this deficit is ill-fated attempts to time the market and emotionally driven decisions to move in and out of the markets.

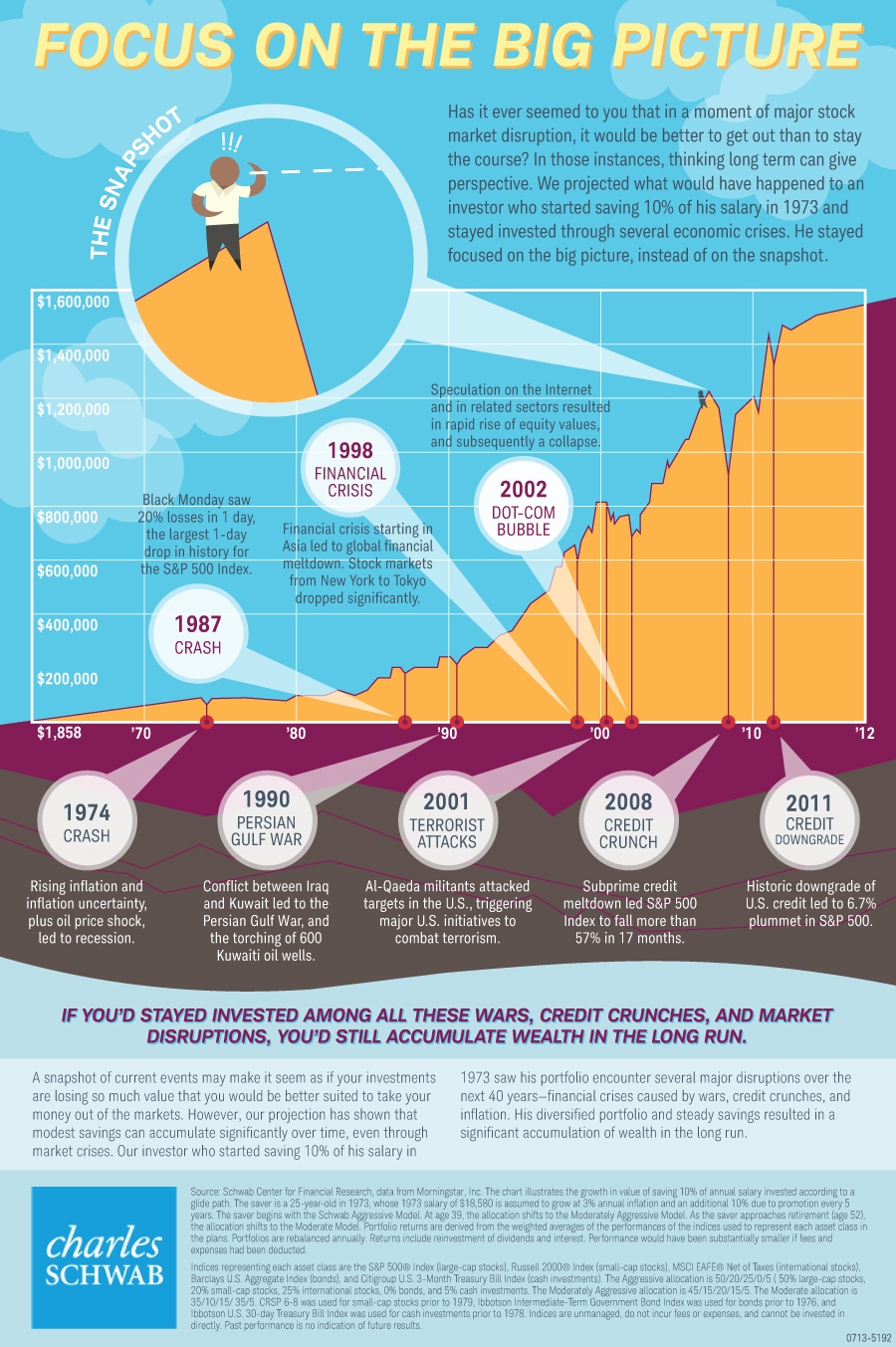

Most individuals claim to be long-term investor until their portfolio drops 10% and suddenly there’s panic.

Our primary role as an investment advisor is to help our clients have the discipline to ignore the gyrations of the markets and keep the long view when it comes to their investments.

* Average investor refers to individual investors across the United States